Cryptocurrency vs Traditional Money: Key Differences Explained

Here’s what nobody tells you about the cryptocurrency vs traditional money debate: it’s not really about which one is “better.”

It’s about understanding two fundamentally different systems for storing and transferring value. One relies on institutions you trust. The other relies on mathematics you can verify.

Most people argue about cryptocurrency without understanding how either system actually works. You’re about to get the complete breakdown of both – the real advantages, the honest limitations, and why this difference matters for your financial future.

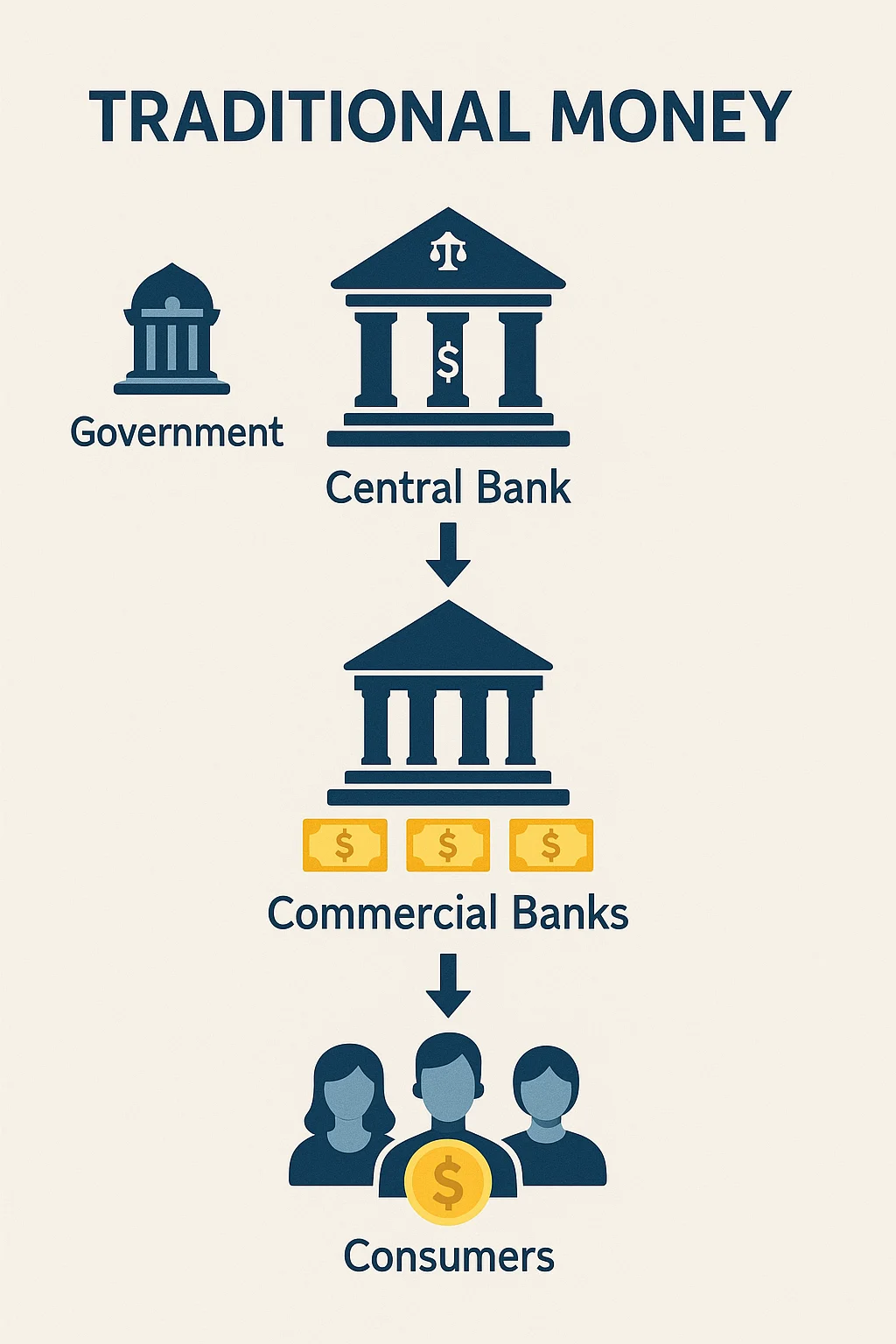

Traditional Money: How It Actually Works

Before we compare anything, let’s establish what traditional money actually is and how it functions.

The Three Types of Traditional Money

Physical Cash: Paper bills and metal coins issued by governments Bank Deposits: Digital numbers in bank computer systems

Central Bank Reserves: Digital money that banks use to settle with each other

Here’s the key point: Most of your “money” is already digital. When you check your bank balance, you’re looking at database entries, not physical cash.

How Traditional Money Gets Created

Government Printing: Central banks create physical cash (but this is less than 10% of total money supply) Bank Lending: Banks create new money when they issue loans (this is where most money comes from) Government Spending: Governments spend money into existence through fiscal policy

Understanding what cryptocurrency is helps you see why this centralized creation process matters.

Who Controls Traditional Money

Central Banks: Set interest rates and monetary policy Commercial Banks: Control access to your money Governments: Can freeze accounts, impose capital controls Regulators: Monitor and restrict transactions

This isn’t necessarily bad – it provides stability and consumer protection. But it means your money exists at the permission of institutions.

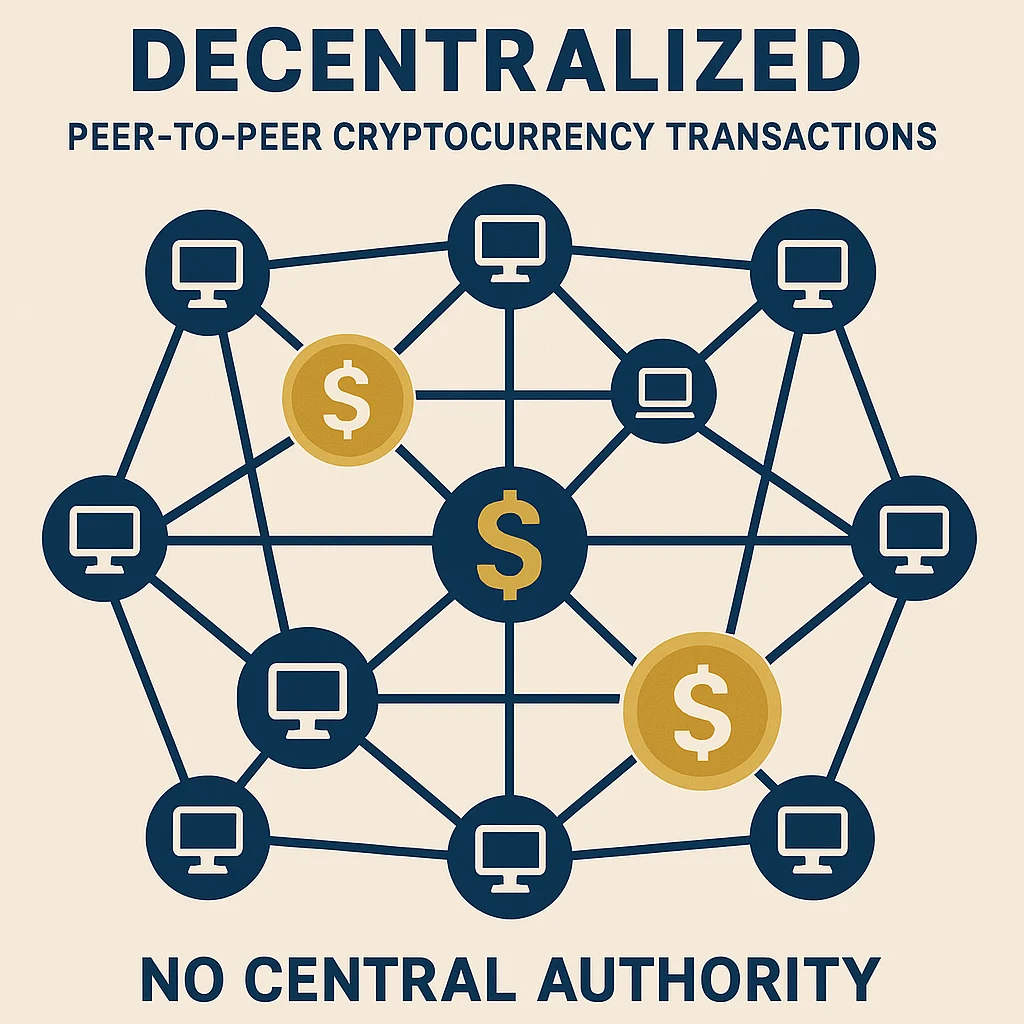

Cryptocurrency: A Different Approach to Money

Cryptocurrency takes a radically different approach to the same basic function: storing and transferring value.

How Cryptocurrency Money Supply Works

Fixed or Predictable Supply: Most cryptocurrencies have caps on total supply Algorithmic Creation: New coins created through mining or staking based on mathematical rules No Central Authority: No single entity can print more cryptocurrency

For example: Bitcoin will never have more than 21 million coins. Ever. This is enforced by mathematics, not institutions.

Who Controls Cryptocurrency

The Network: Thousands of computers worldwide maintain the system Mathematical Rules: Code determines how the system operates Users: You control your own money through private keys Consensus: Changes require agreement from network participants

Learning how cryptocurrency works reveals why this distributed control matters.

Speed and Availability: The Time Factor

Traditional Money Speed

Domestic transfers: Same-day to 3 business days International transfers: 3-5 business days (often longer) Check deposits: 1-5 business days to clear Weekend/holiday limitations: Banks closed, transfers delayed

Why it’s slow: Multiple intermediary banks, compliance checks, batch processing systems built decades ago.

Cryptocurrency Speed

Domestic and international: Same speed (minutes to hours) No geographic limitations: Send to anywhere with internet 24/7 availability: No business hours or bank holidays Near-instant confirmation: Transaction visible immediately, settled within hours

Real example: Sending $1,000 from New York to Tokyo takes 3-5 days through banks. The same transaction with cryptocurrency takes 10-60 minutes.

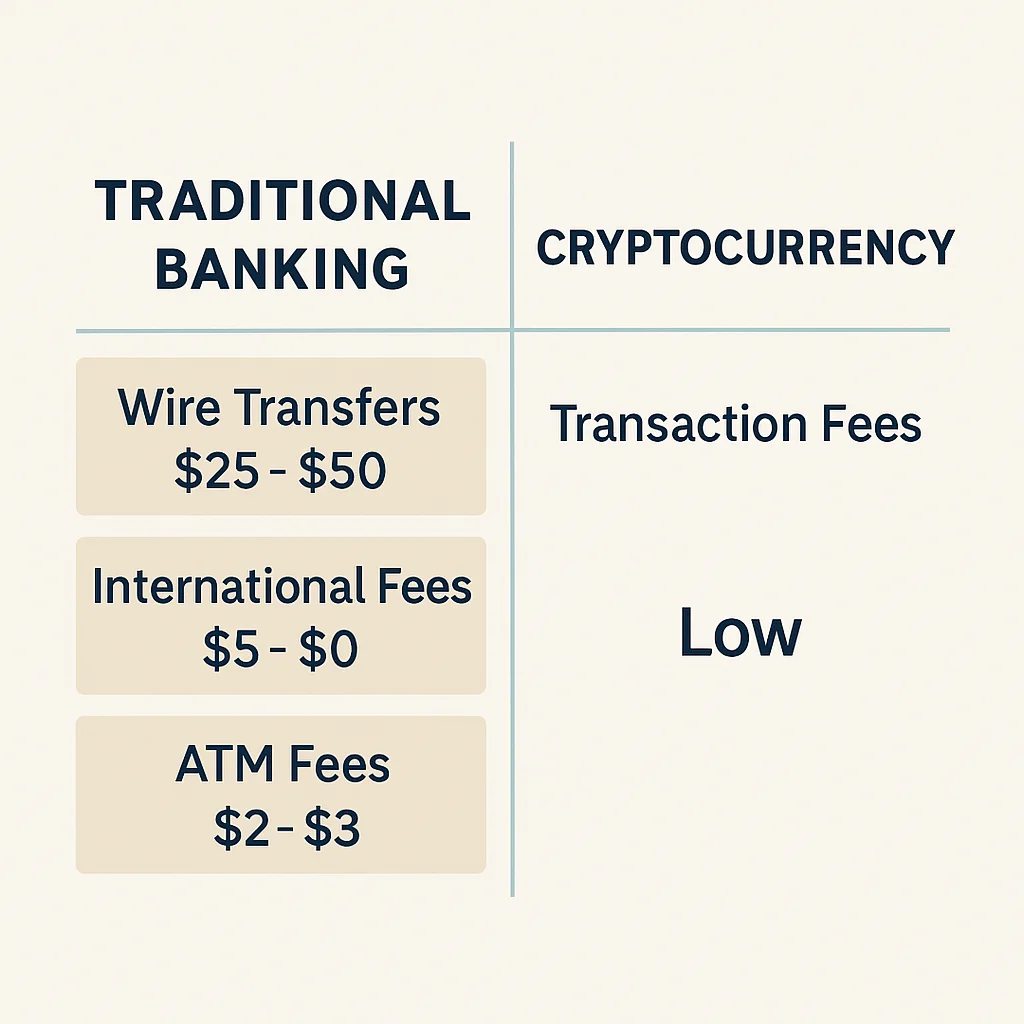

Cost Comparison: The Fee Reality

Traditional Money Costs

International wire transfers: $15-50 per transaction Currency exchange: 2-4% markup on exchange rates ATM fees: $2-5 per transaction (out-of-network) Monthly account fees: $5-25 per month Overdraft fees: $25-35 per incident

Hidden costs: Inflation reduces purchasing power when central banks print money.

Cryptocurrency Costs

Bitcoin transactions: $1-20 depending on network congestion Ethereum transactions: $5-50+ during peak usage

Newer cryptocurrencies: Often under $1 No monthly fees: No account maintenance costs No overdraft fees: You can only spend what you have

Important note: Different types of cryptocurrency have vastly different fee structures.

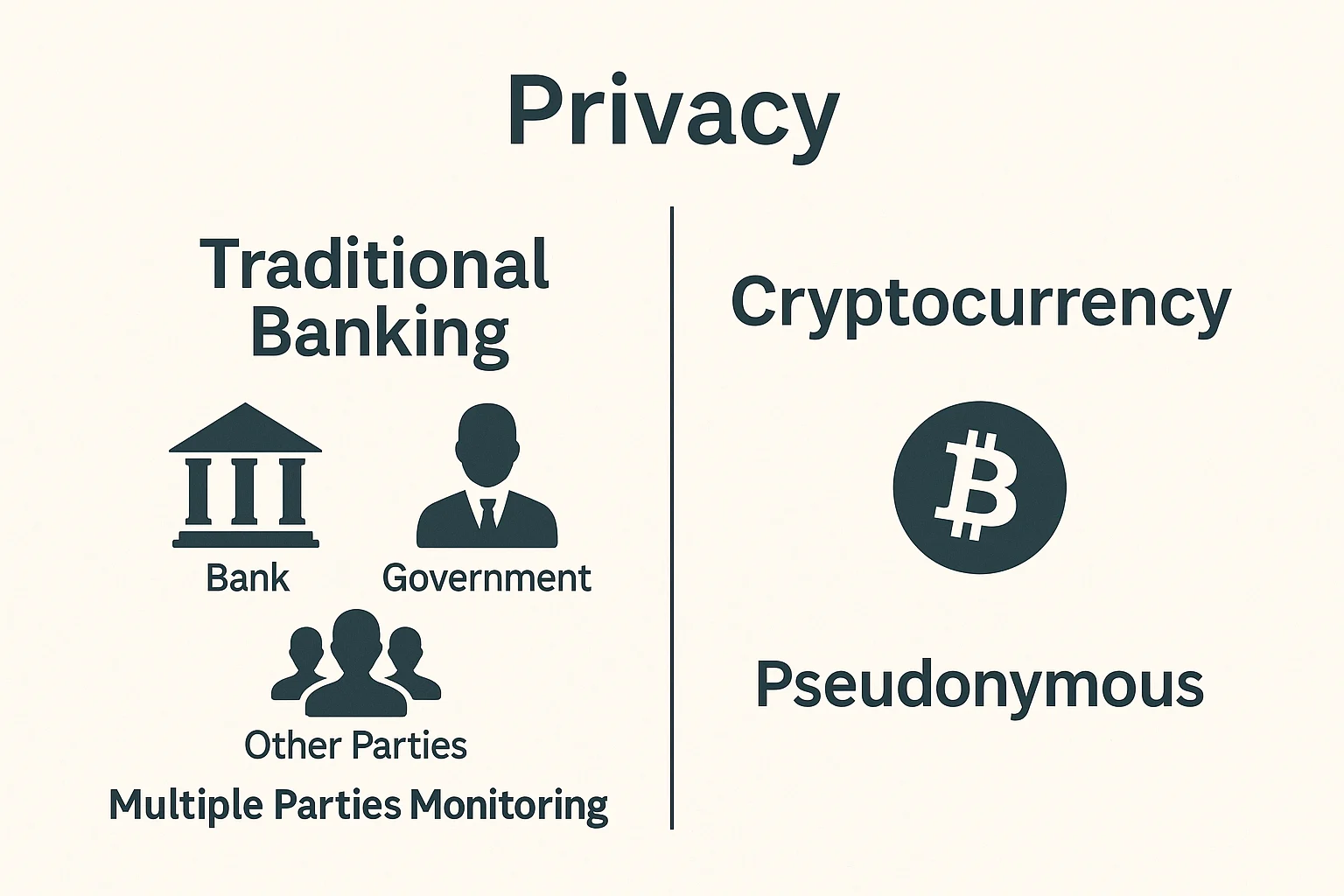

Privacy and Surveillance: Who Sees Your Money

Traditional Money Privacy

Bank monitoring: All transactions tracked and reported Government access: Authorities can view account details Third-party data sharing: Banks sell spending data to marketers Compliance reporting: Large transactions automatically reported to government Account freezing: Banks can freeze funds based on suspicious activity

Cryptocurrency Privacy

Pseudonymous: Transactions tied to wallet addresses, not directly to identities Public but private: Transaction amounts visible, but not who’s behind them No automatic reporting: Transactions don’t trigger government alerts Self-custody options: You can hold cryptocurrency without any institution knowing

Reality check: Cryptocurrency isn’t completely anonymous. Understanding cryptocurrency risks includes privacy considerations.

Inflation Protection: Store of Value Comparison

Traditional Money and Inflation

Unlimited supply: Central banks can print money whenever they want Inflation targeting: Most central banks aim for 2-3% annual inflation Historical reality: US dollar has lost 95% of purchasing power since 1913 Policy changes: Monetary policy can change based on political pressures

Cryptocurrency and Inflation

Limited supply: Most cryptocurrencies have maximum supply caps Predictable inflation: New coin creation follows predetermined rules Deflationary design: Some cryptocurrencies become scarcer over time Immune to policy changes: Supply rules can’t be changed easily

Bitcoin example: Only 21 million Bitcoin will ever exist. As demand increases but supply stays fixed, price tends to rise.

Understanding what makes cryptocurrency valuable helps explain this inflation protection.

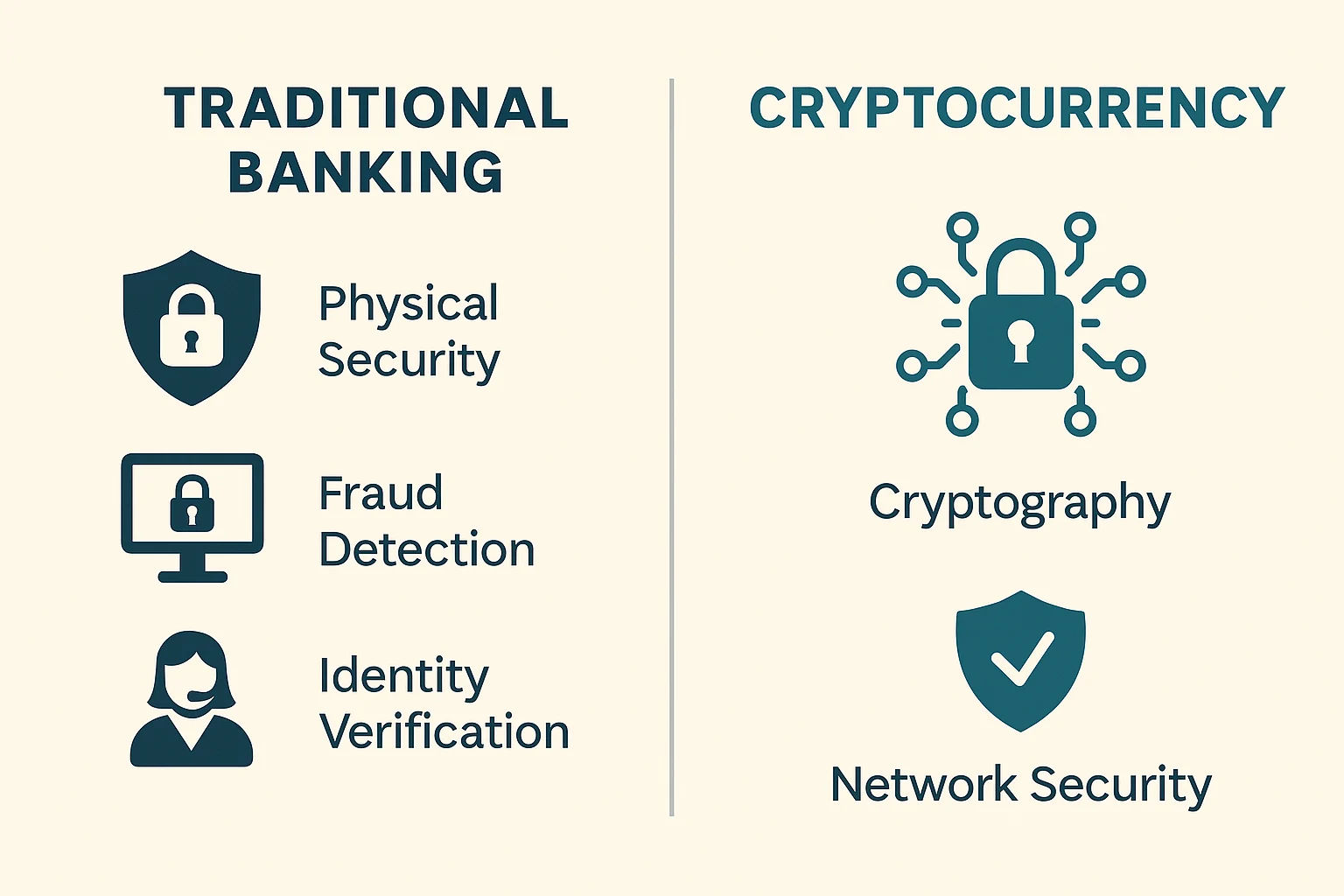

Security: Protection Mechanisms

Traditional Money Security

FDIC insurance: Bank deposits protected up to $250,000 (in US) Fraud protection: Credit card chargebacks and dispute resolution Professional management: Banks handle security infrastructure Recovery options: Lost cards can be replaced, passwords reset Regulatory oversight: Government agencies monitor bank security

Vulnerabilities: Single points of failure, insider fraud, government seizure.

Cryptocurrency Security

Cryptographic protection: Military-grade encryption secures transactions No single point of failure: Distributed across thousands of computers Self-custody options: You control your own security Immutable transactions: Once confirmed, cannot be reversed or frozen Transparent verification: Anyone can verify system integrity

Vulnerabilities: User error, lost private keys, no insurance or chargebacks.

Accessibility: Who Can Use Each System

Traditional Money Access Requirements

Bank account: Requires credit check, minimum deposits, proper documentation Physical location: Need access to bank branches or ATMs Credit history: Many services require established credit Government ID: Must provide official identification Stable address: Need permanent residence for account opening

Global reality: 1.7 billion adults worldwide don’t have bank accounts.

Cryptocurrency Access Requirements

Internet connection: Only requirement for basic access Smartphone or computer: Device to manage cryptocurrency wallet No credit check: Past financial history irrelevant No minimum deposits: Can start with any amount Pseudonymous: Don’t need government ID for basic use

Global potential: Anyone with internet can access cryptocurrency services.

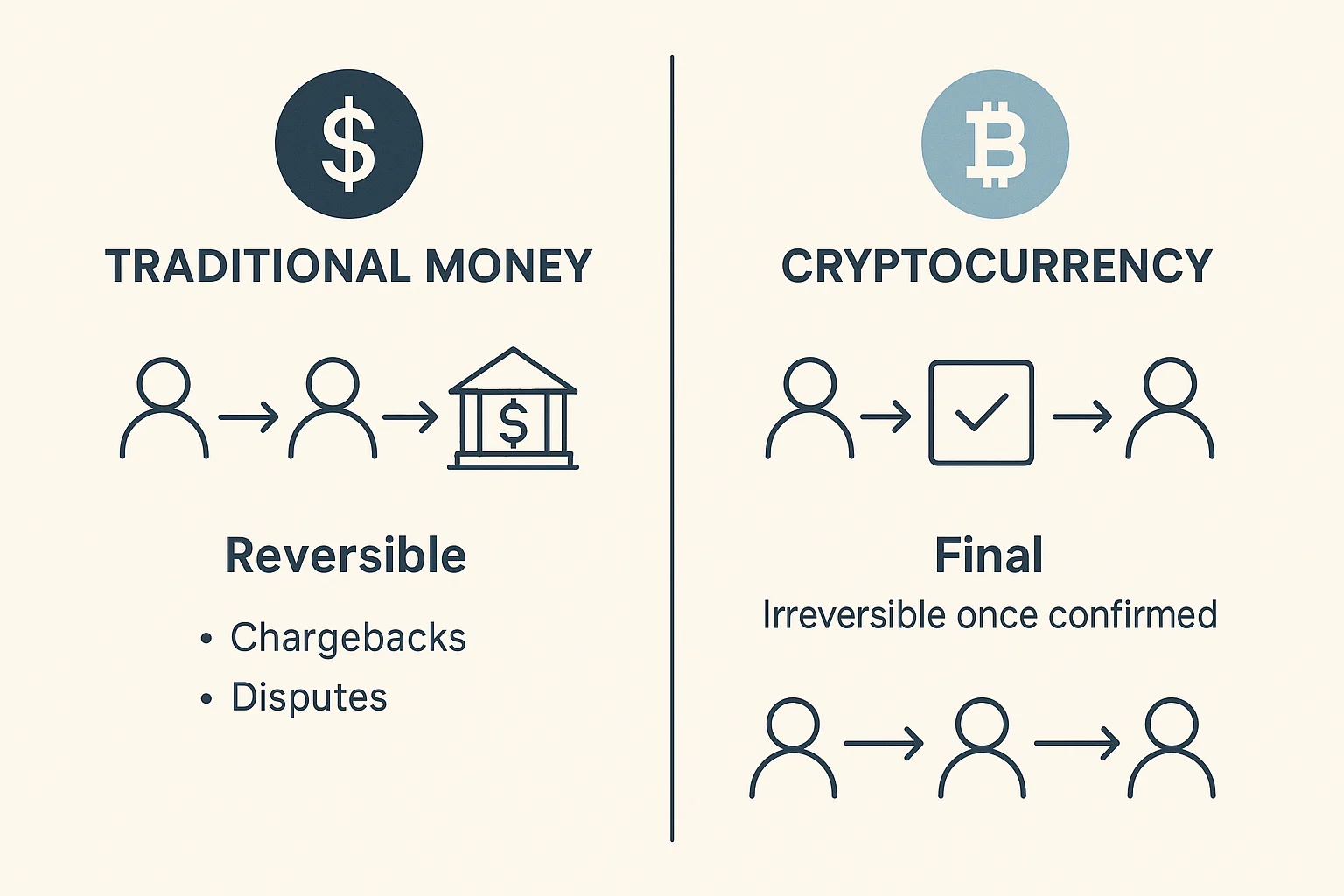

Reversibility: Transaction Finality

Traditional Money Reversibility

Credit card chargebacks: 60-120 days to dispute transactions Bank transfers: Can be reversed within certain timeframes Check payments: Can bounce days after deposit Fraud protection: Banks can reverse unauthorized transactions Dispute resolution: Third parties can mediate transaction problems

Business impact: Merchants face chargeback fraud and processing delays.

Cryptocurrency Irreversibility

Final settlement: Transactions cannot be reversed once confirmed No chargebacks: Send to wrong address? Money is gone forever Immediate settlement: No waiting periods for funds to clear Fraud elimination: Impossible to create fake cryptocurrency transactions Business benefits: Merchants get guaranteed payment

User responsibility: Understanding what happens when you buy cryptocurrency includes accepting this responsibility.

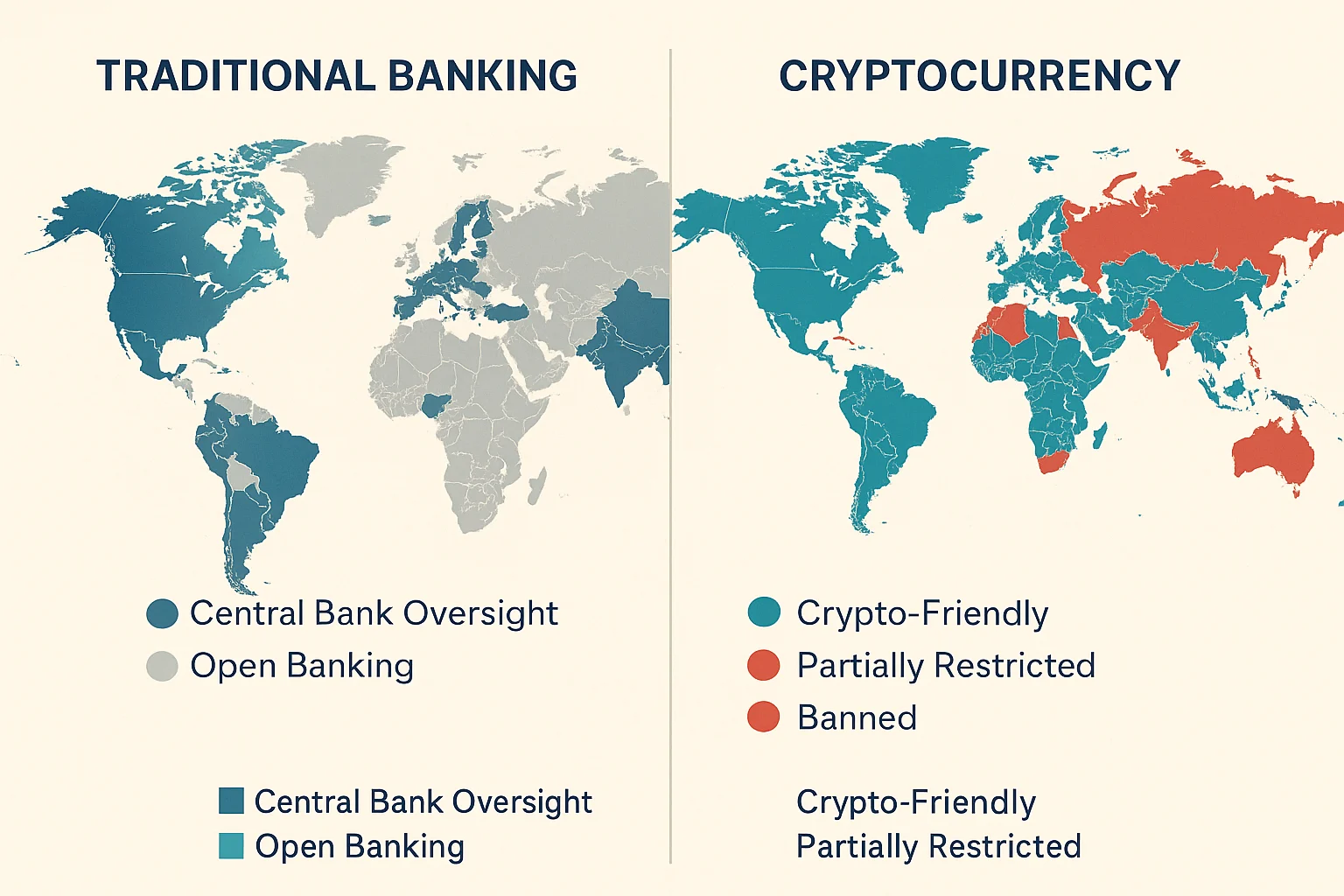

Regulatory Environment: Legal Framework

Traditional Money Regulation

Mature framework: Centuries of established law and precedent Consumer protection: Extensive regulations protecting users Standardized globally: Similar banking laws across developed countries Deposit insurance: Government-backed protection for bank deposits Clear tax treatment: Well-established rules for reporting and taxation

Cryptocurrency Regulation

Evolving framework: Laws still being written and tested Regulatory uncertainty: Rules vary significantly by country Innovation space: Less regulation allows for rapid development Personal responsibility: Fewer consumer protections Unclear tax treatment: Complex and changing tax requirements

Current cryptocurrency legal status varies dramatically by location.

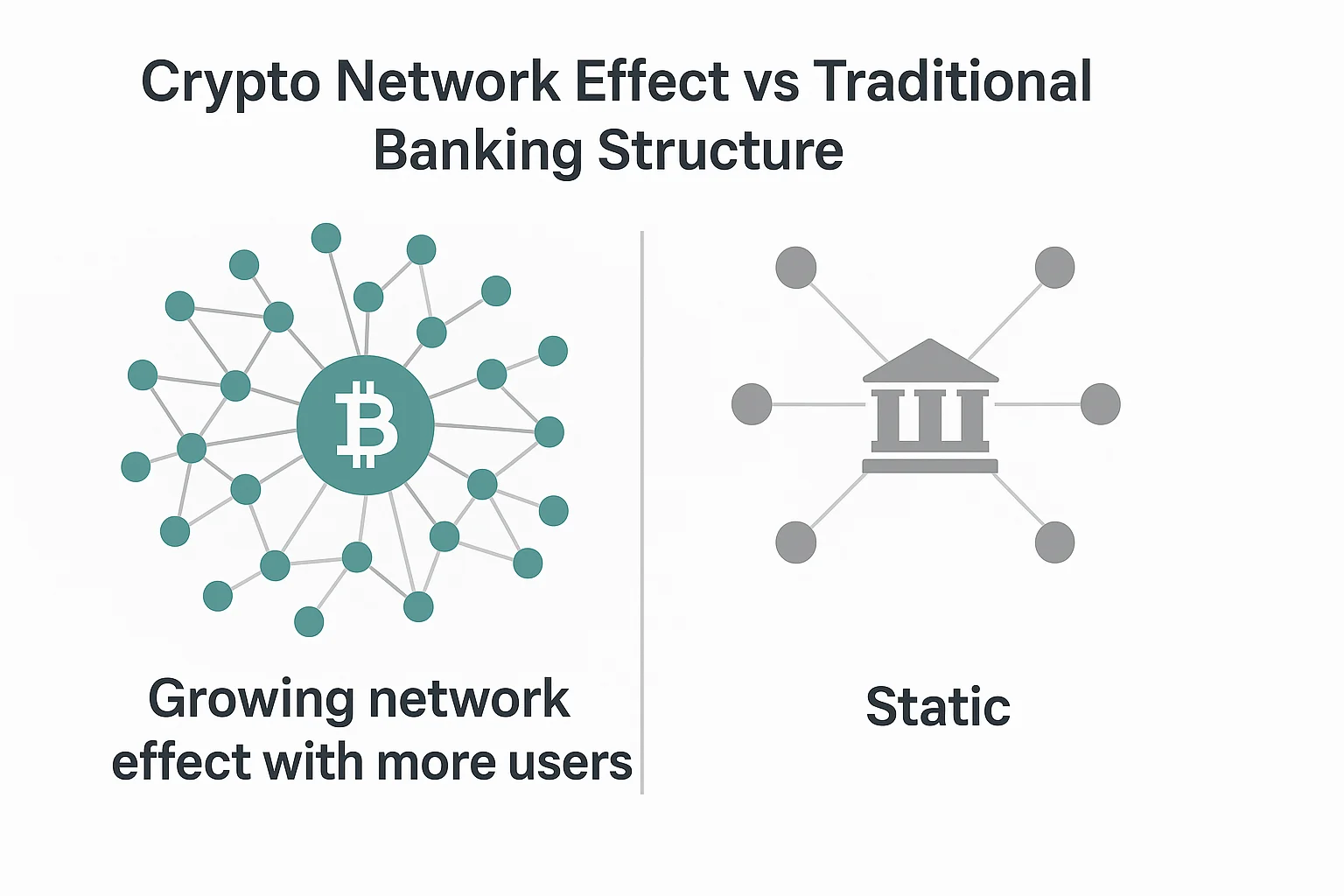

Network Effects: Getting Stronger vs Staying Static

Traditional Money Network Effects

Established infrastructure: Extensive existing network of banks, ATMs, merchants Slow innovation: Legacy systems difficult to upgrade Geographic limitations: Different systems in different countries Institutional barriers: High costs to build competing payment networks

Cryptocurrency Network Effects

Growing utility: More users make networks more valuable and secure Rapid innovation: New features and improvements deployed quickly Global by design: Same system works everywhere Open development: Anyone can build on cryptocurrency networks

Example: Bitcoin becomes more secure as more miners join. Ethereum becomes more useful as more applications are built on it.

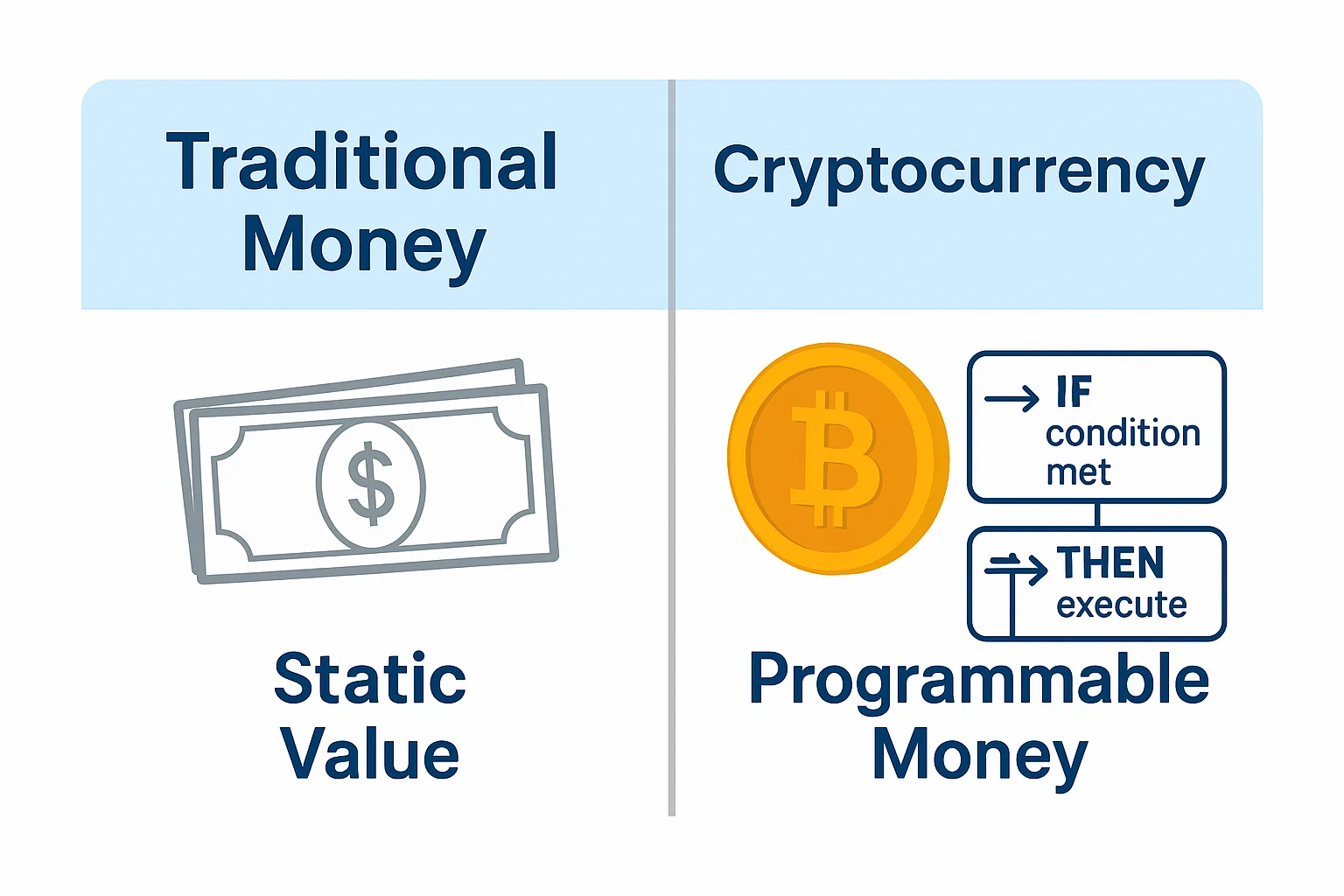

Programmability: Smart Money vs Dumb Money

Traditional Money Limitations

Static value: Money just sits there until manually moved Manual processes: Humans required for most complex transactions Intermediaries needed: Lawyers, escrow services, banks for complex agreements Geographic restrictions: Different rules and systems in different places

Cryptocurrency Programmability

Smart contracts: Money that executes agreements automatically Automated processes: Transactions trigger based on predefined conditions No intermediaries: Code executes agreements without human intervention Global standards: Same smart contract works anywhere

Real applications: Automatic insurance payouts, decentralized lending, self-executing wills.

Different types of cryptocurrency offer varying levels of programmability.

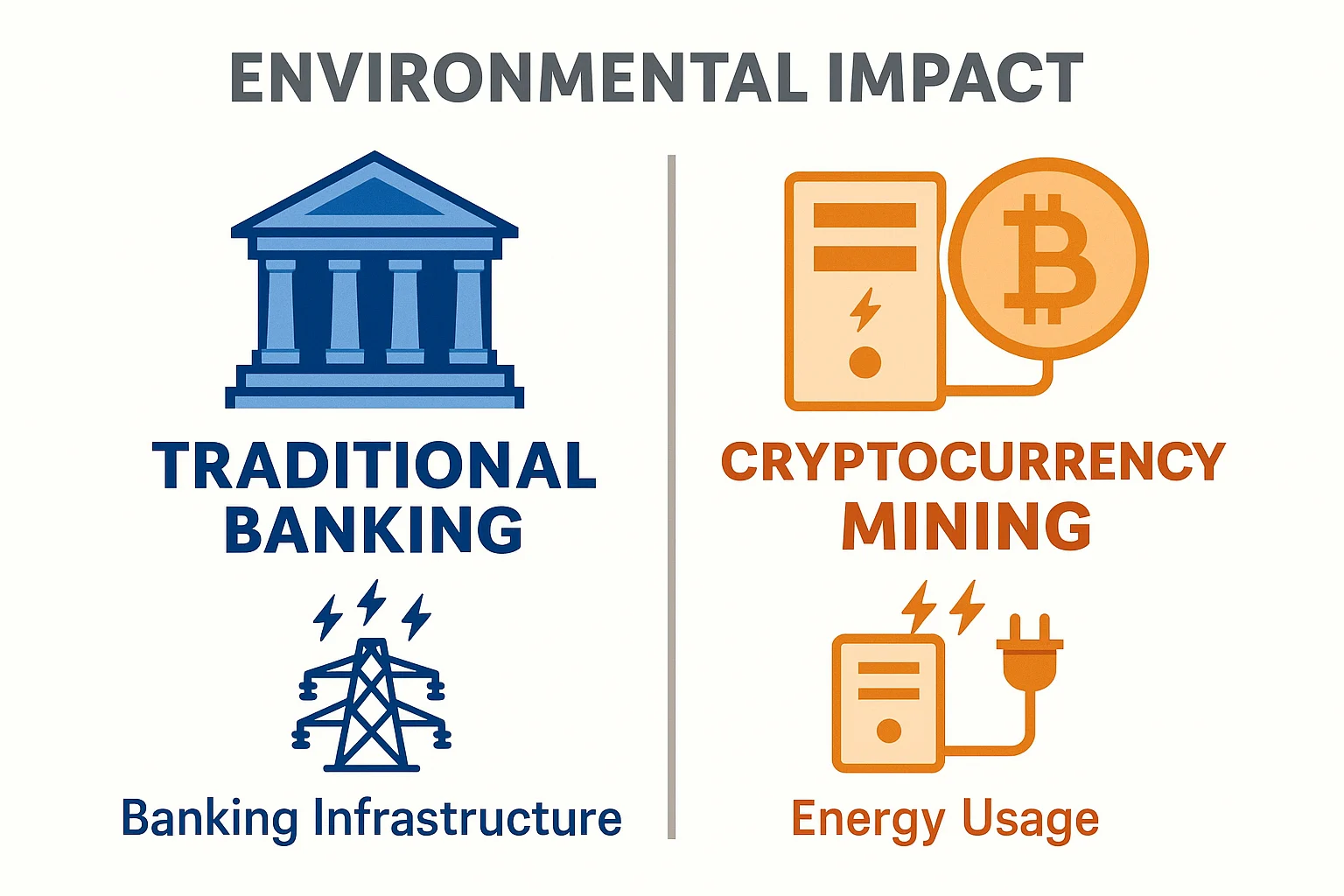

Energy and Environmental Impact

Traditional Money Environmental Impact

Physical infrastructure: Bank branches, ATMs, data centers worldwide Transportation: Armored trucks moving cash, employee commuting Paper and metal: Printing cash, minting coins Legacy systems: Old, inefficient computer systems Estimated consumption: Traditional banking uses significant energy but isn’t precisely measured

Cryptocurrency Environmental Impact

Mining energy: Bitcoin mining consumes substantial electricity Renewable trends: Mining increasingly uses renewable energy sources Efficiency improvements: Newer cryptocurrencies use far less energy No physical infrastructure: No bank branches or transportation needs Transparent measurement: Energy usage is public and verifiable

Recent developments: Ethereum moved to proof-of-stake, reducing energy use by 99.9%.

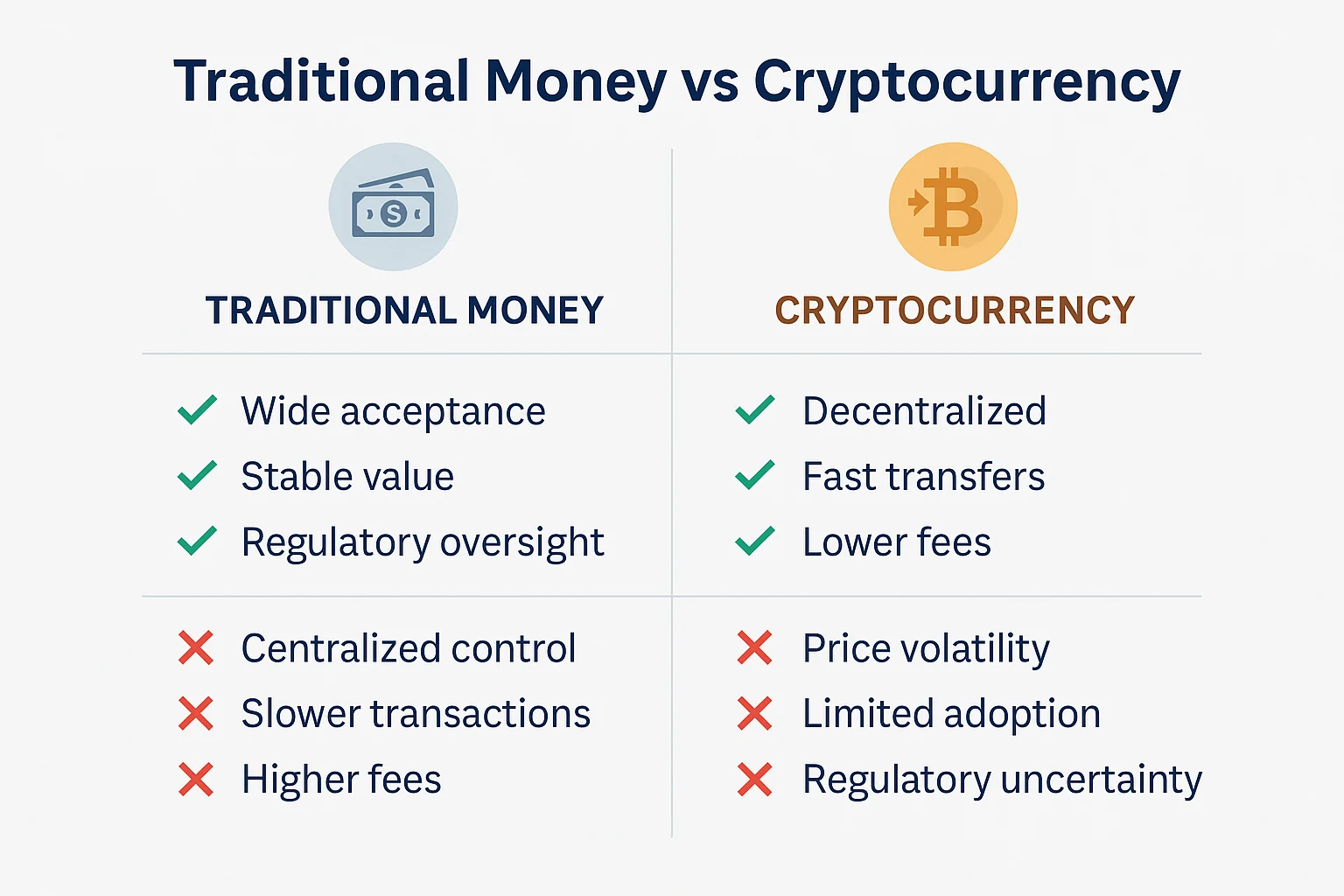

The Advantages and Disadvantages: Honest Comparison

Traditional Money Advantages

✅ Stability: Less volatile, predictable value

✅ Consumer protection: Insurance, fraud protection, dispute resolution

✅ Widespread acceptance: Accepted everywhere

✅ Professional management: Banks handle security and compliance

✅ Mature regulations: Clear legal framework

✅ Easy to use: Familiar interfaces and processes

Traditional Money Disadvantages

❌ Centralized control: Banks and governments control access

❌ Inflation risk: Value erodes over time

❌ High fees: Expensive international transfers

❌ Limited hours: Bank holidays and business hours

❌ Privacy concerns: All transactions monitored

❌ Exclusion: 1.7 billion people lack bank access

Cryptocurrency Advantages

✅ Decentralized: No single point of control or failure

✅ 24/7 availability: Works anytime, anywhere

✅ Lower fees: Especially for international transfers

✅ Inflation protection: Many have limited supplies

✅ Programmable: Smart contracts enable automation

✅ Global access: Anyone with internet can participate

Cryptocurrency Disadvantages

❌ Volatility: Prices can swing dramatically

❌ Complexity: Steeper learning curve

❌ Irreversibility: No chargebacks or dispute resolution

❌ Regulatory uncertainty: Laws still evolving

❌ User responsibility: You’re your own bank

❌ Limited acceptance: Not accepted everywhere yet

Understanding these cryptocurrency pros and cons helps you make informed decisions.

Real-World Use Cases: When to Use Each

When Traditional Money Works Better

Daily purchases: Grocery stores, gas stations, local businesses Large purchases with protection needs: Houses, cars, expensive electronics Employer payments: Payroll systems integrate with traditional banking Government interactions: Taxes, social security, official transactions Emergency situations: When you need immediate dispute resolution

When Cryptocurrency Works Better

International transfers: Sending money across borders quickly and cheaply Inflation hedging: Protecting wealth in unstable economies 24/7 trading: Buying and selling assets outside traditional market hours Programmable payments: Automated transactions based on conditions Financial privacy: Transactions you prefer not to be monitored Unbanked populations: Financial services without bank accounts

The Hybrid Approach

Most successful users combine both systems:

- Traditional money for daily expenses and emergencies

- Cryptocurrency for savings, international transfers, and investment

- Gradual transition as acceptance and infrastructure improve

Ready to start using both systems? Open a Kraken account to bridge traditional and crypto finance.

The Future: Convergence vs Competition

Traditional Finance Adopting Crypto

Bank crypto services: Major banks offering cryptocurrency custody Central Bank Digital Currencies (CBDCs): Government-issued digital money Payment integration: Credit cards and apps adding crypto support Institutional adoption: Corporations holding cryptocurrency as treasury assets

Cryptocurrency Becoming More Traditional

Regulatory compliance: Crypto companies following banking regulations Insurance products: FDIC-style insurance for cryptocurrency deposits User-friendly interfaces: Apps as easy as traditional banking Stability mechanisms: Stablecoins that track traditional currency values

Likely Outcome

Coexistence and integration rather than winner-take-all competition:

- Traditional money for stability and consumer protection

- Cryptocurrency for innovation and global access

- Hybrid products combining benefits of both systems

Making the Choice: Which System for You?

Start with Traditional Money If:

- You’re new to financial technology

- You need maximum stability and consumer protection

- You’re making large purchases requiring dispute resolution

- You’re not comfortable with personal security responsibility

Add Cryptocurrency If:

- You make international transfers regularly

- You’re concerned about inflation and currency debasuation

- You want 24/7 access to financial services

- You’re interested in emerging financial technologies

Your Action Plan

Phase 1: Master traditional money management

Phase 2: Learn about cryptocurrency basics

Phase 3: Start small with cryptocurrency experimentation

Phase 4: Develop hybrid approach using both systems

Begin your cryptocurrency education with understanding the fundamentals.

Learn about the best cryptocurrency options for beginners when you’re ready to start.

Find the best cryptocurrency apps to make the transition easier.

Common Questions About the Transition

Q: Do I have to choose one or the other? A: No! Most people use both systems for different purposes. Start by adding cryptocurrency to your existing financial toolkit.

Q: Is cryptocurrency trying to replace traditional money? A: Some cryptocurrencies aim to be alternatives, others are designed to complement existing systems. The market will decide what works best.

Q: Which system is safer? A: Both have different types of safety. Traditional money has institutional protection; cryptocurrency has cryptographic security. Choose based on your risk tolerance.

Q: Will governments ban cryptocurrency? A: Most developed countries are regulating rather than banning cryptocurrency. Current legal status varies by country.

Q: How much cryptocurrency should I own? A: Financial experts typically recommend 5-10% of investment portfolio in cryptocurrency, but this depends on your risk tolerance and financial goals.

Educational Resources for Both Systems

Traditional Finance Education

- Personal finance books and courses

- Bank financial literacy programs

- Government consumer protection resources

- Financial advisor consultations

Cryptocurrency Education

Best cryptocurrency books for comprehensive learning

Top cryptocurrency courses for structured education

Best cryptocurrency podcasts for ongoing updates

Get expert-level cryptocurrency education with Crypto Crew University

The Bottom Line: Understanding Both Systems

The cryptocurrency vs traditional money debate isn’t really about picking sides. It’s about understanding two different approaches to solving the same problem: how to store and transfer value efficiently and securely.

Traditional money offers:

- Stability and consumer protection

- Widespread acceptance and familiar interfaces

- Mature regulatory framework and institutional support

Cryptocurrency offers:

- 24/7 global access and programmable features

- Protection against inflation and institutional control

- Innovation in financial services and inclusion

The smartest approach is understanding both systems and using each where it works best. Traditional money for stability and daily transactions. Cryptocurrency for innovation and global access.

Your financial future likely includes both systems working together, not one replacing the other.

The question isn’t whether cryptocurrency will replace traditional money. The question is how quickly you’ll learn to use both systems effectively.

Start building your knowledge foundation with cryptocurrency basics.

This comparison provides educational information about monetary systems. Consider your personal financial situation and risk tolerance before making investment decisions. Consult with financial professionals for personalized advice.