What is Cryptocurrency: A Complete Guide for Absolute Beginners

Here’s the truth about cryptocurrency that nobody wants to tell you upfront: it’s not magic internet money, and it’s not a get-rich-quick scheme.

It’s a new form of digital money that runs on technology so secure, even banks are scrambling to figure out how to use it. And if you’re completely new to this world, you’re about to discover why millions of people are ditching traditional banking for something that puts them in complete control of their money.

What Exactly Is Cryptocurrency?

Cryptocurrency is digital money that exists only in computer code. No physical coins. No paper bills. Just secure, encrypted data that represents value and can be sent anywhere in the world instantly.

Think of it like this: remember when we used to carry around physical photos, and now everything’s digital on your phone? Cryptocurrency did the same thing to money.

But here’s where it gets interesting.

Unlike the digital money in your bank account (which your bank controls), cryptocurrency is controlled by mathematical rules and computer networks. No single person, company, or government can print more of it, freeze your account, or tell you how to spend it.

The Three Things That Make Crypto Different From Regular Money

- Decentralization: No central authority controls it

- Encryption: Military-grade security protects every transaction

- Transparency: Every transaction is recorded on a public ledger

This isn’t just fancy tech talk. These differences solve real problems that cost you money every day.

How Does Cryptocurrency Actually Work?

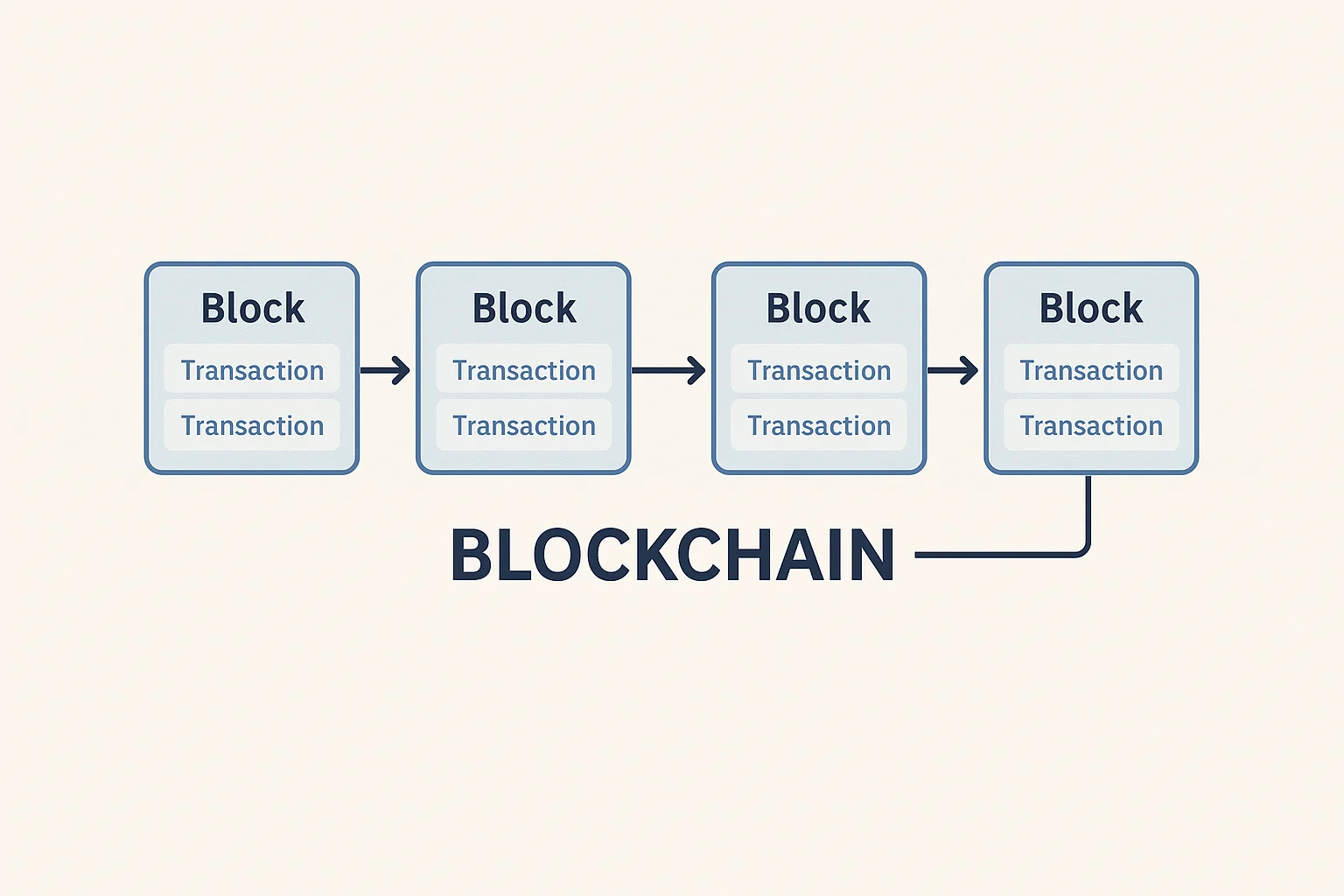

Understanding how cryptocurrency works starts with grasping one core concept: the blockchain.

Imagine a notebook that tracks every dollar that changes hands in your town. Now imagine that notebook is copied and stored by hundreds of people, and every time someone spends money, all the copies get updated simultaneously.

That’s essentially how cryptocurrency works, except the “notebook” is digital, the “people” are computers around the world, and the system is so secure that it’s virtually impossible to hack or fake.

The Step-by-Step Process

Here’s exactly what happens when you send cryptocurrency:

- You initiate a transaction using your digital wallet

- The transaction gets broadcast to the network

- Computers verify you have the funds to send

- The transaction gets bundled with others into a “block”

- The network confirms the block through complex math

- Your transaction is complete and recorded forever

This entire process of cryptocurrency transactions typically takes minutes, not days like traditional banking.

Want to see this in action? Start trading on one of the world’s most secure exchanges

Why Cryptocurrency Was Created (And Why It Matters to You)

Cryptocurrency wasn’t created by accident. It was born from frustration.

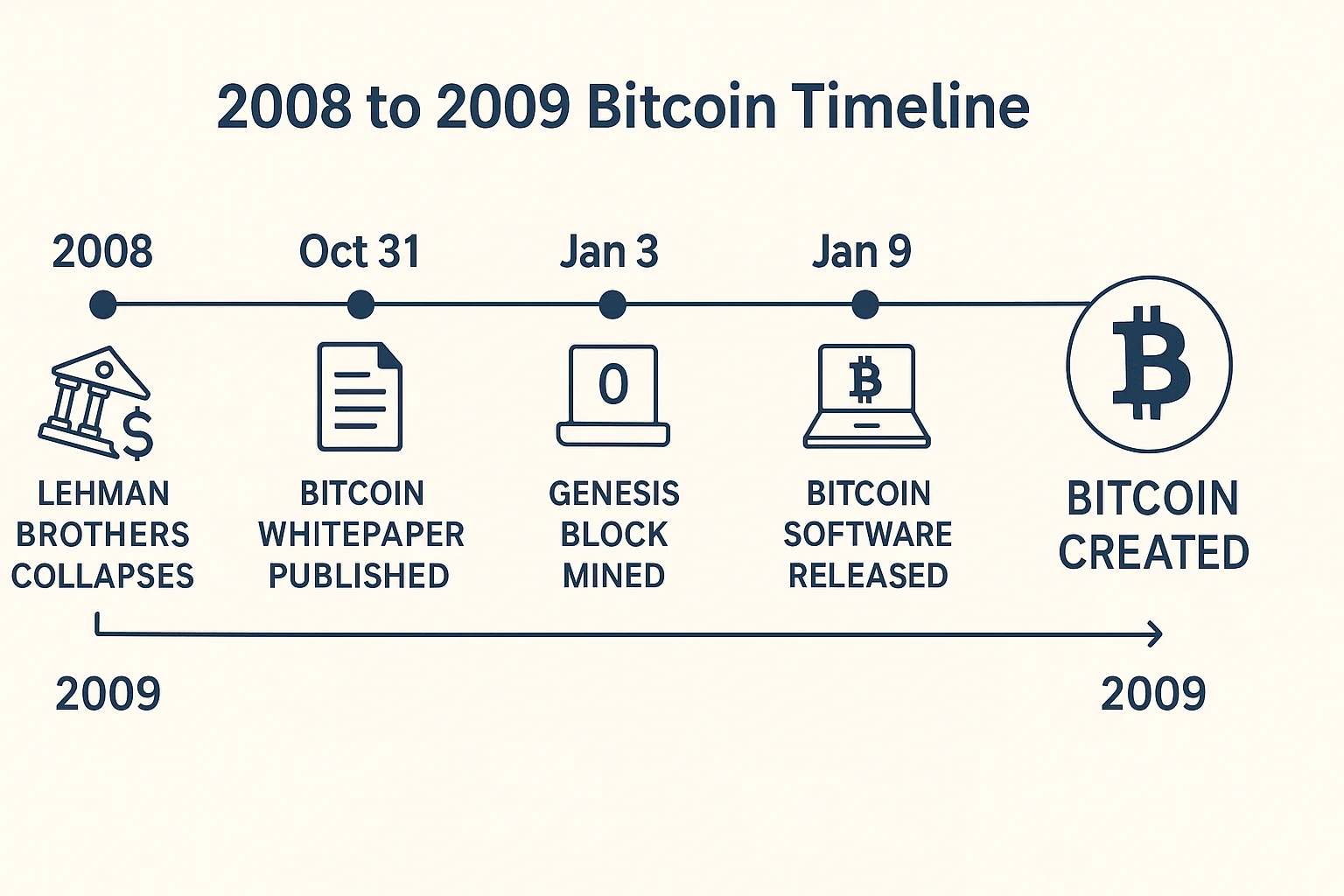

In 2008, while banks were collapsing and getting bailed out with taxpayer money, an anonymous person (or group) called Satoshi Nakamoto published a solution: digital money that couldn’t be controlled by banks or governments.

The complete cryptocurrency history reveals a pattern of innovation driven by the need for financial freedom.

Problems Cryptocurrency Solves Right Now

High Transfer Fees: Banks charge $15-50 for international transfers. Crypto? Often less than $1.

Slow Transactions: Bank transfers take 3-5 business days. Crypto? Minutes.

Limited Access: 1.7 billion people worldwide don’t have bank accounts. They can use crypto with just a smartphone.

Inflation Protection: When governments print more money, your savings lose value. Most cryptocurrencies have limited supplies.

Privacy: Banks track and report your spending. Many cryptocurrencies offer enhanced privacy.

These cryptocurrency benefits aren’t theoretical – they’re helping real people right now.

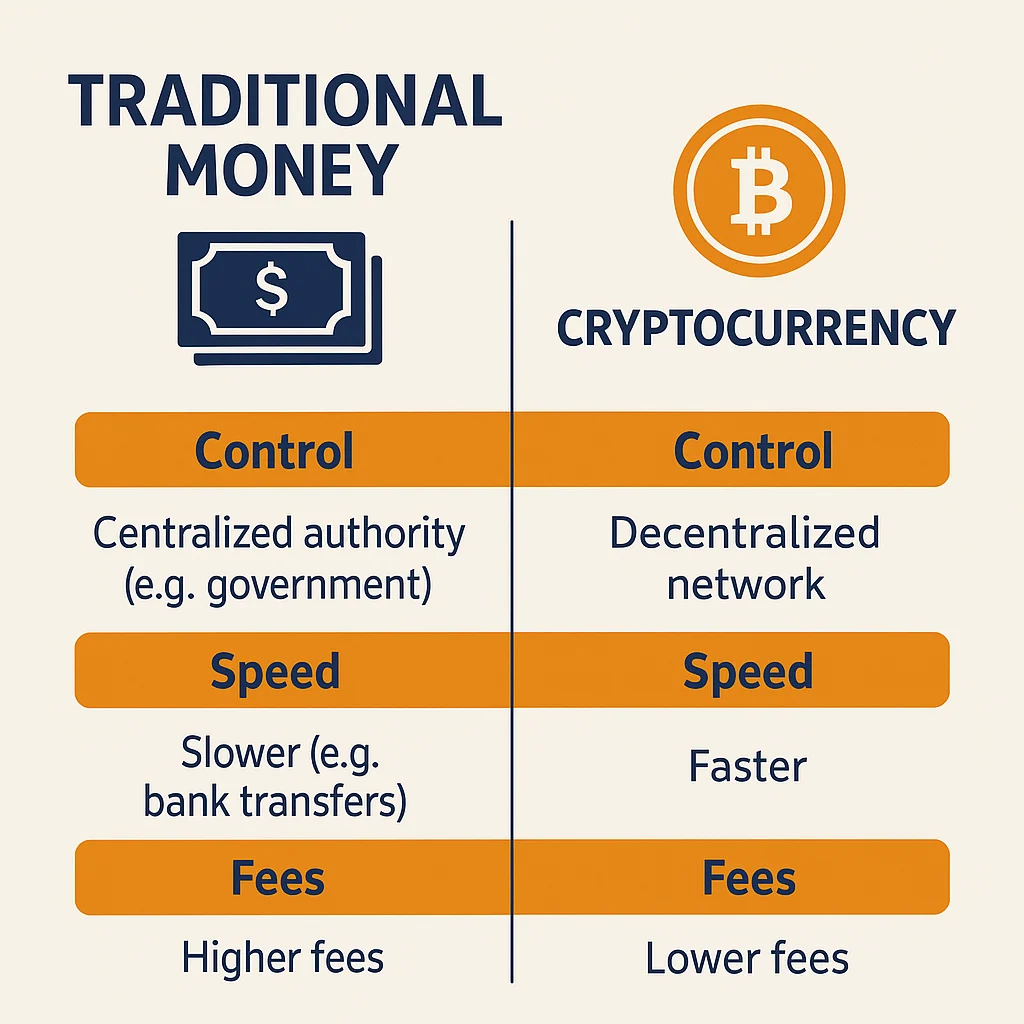

Cryptocurrency vs Traditional Money: The Real Differences

The differences between cryptocurrency vs traditional money go deeper than just “digital vs physical.”

| Traditional Money | Cryptocurrency |

|---|---|

| Controlled by banks/governments | Controlled by mathematical rules |

| Can be printed infinitely | Most have limited supplies |

| Transactions monitored | Can be private |

| Slow international transfers | Fast global transfers |

| High fees for sending money | Low fees |

| Banks can freeze accounts | You control your funds |

Here’s what this means for your wallet:

When you send $1,000 internationally through a bank, you’ll pay $25-50 in fees and wait 3-5 days. With cryptocurrency, you’ll pay under $5 and wait 10 minutes.

Types of Cryptocurrency: Understanding Your Options

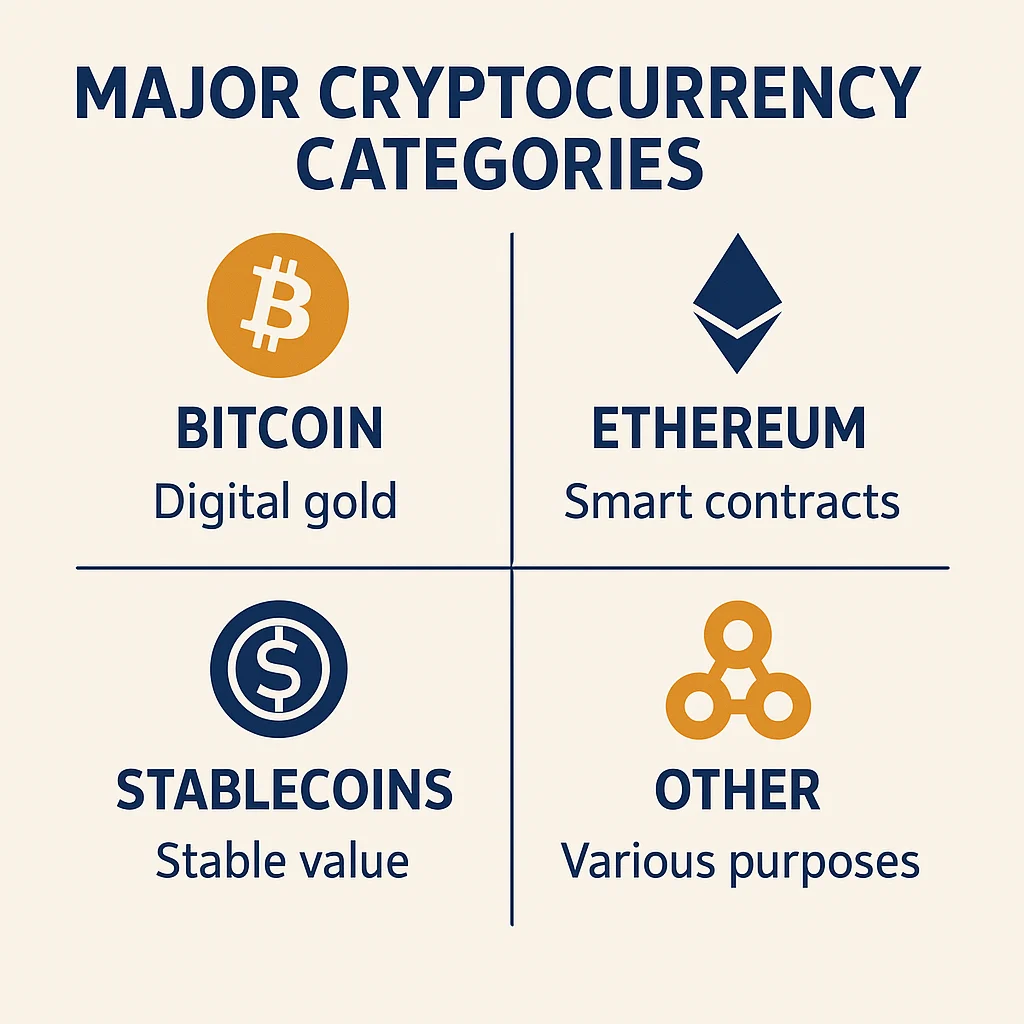

Not all cryptocurrencies are created equal. Different types of cryptocurrency serve different purposes.

The Big Three Categories

1. Digital Currency (Bitcoin)

- Purpose: Store of value and medium of exchange

- Think: Digital gold that you can actually spend

2. Smart Contract Platforms (Ethereum)

- Purpose: Run applications and create other cryptocurrencies

- Think: Digital computer that executes agreements automatically

3. Stablecoins (USDC, Tether)

- Purpose: Stable value pegged to dollars

- Think: Digital dollars that move at crypto speed

Learn more about the best cryptocurrency for beginners and which ones make sense for new investors.

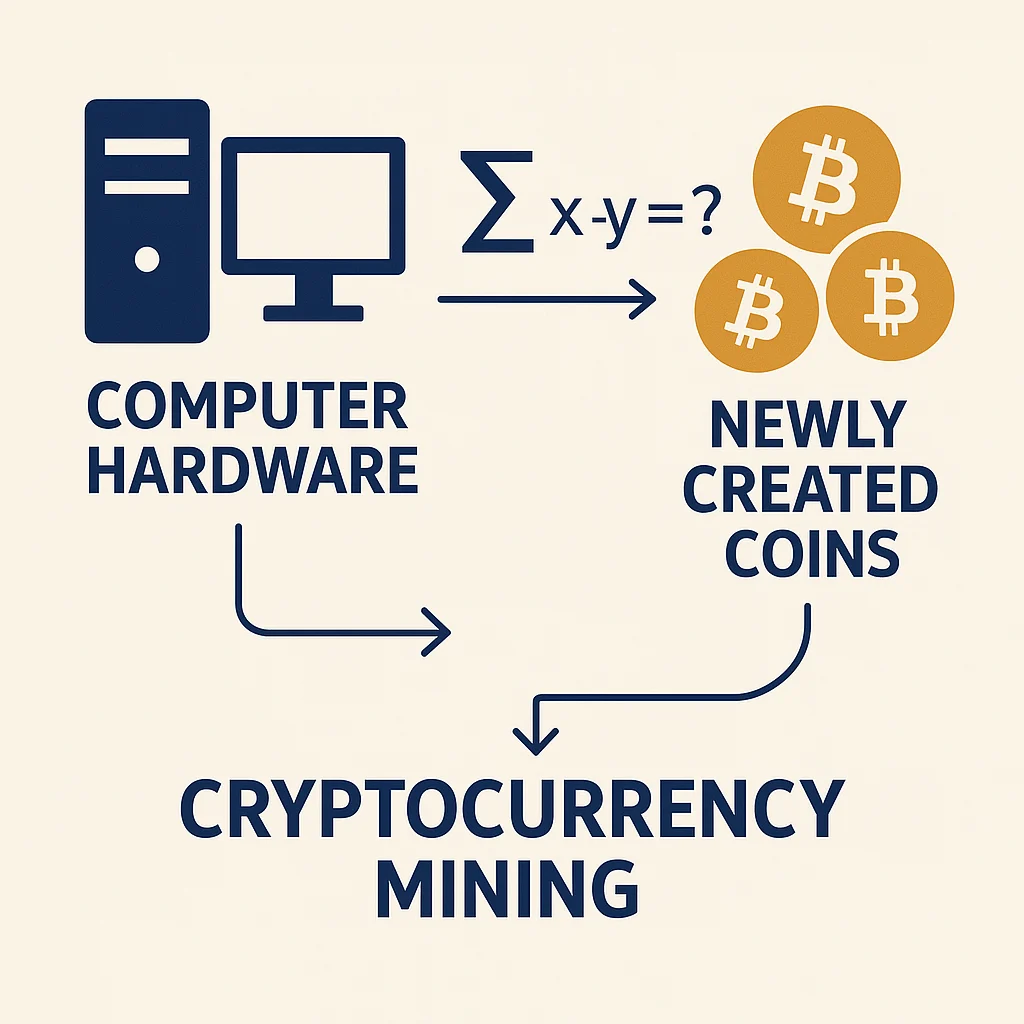

How Cryptocurrency Is Created: Mining and Validation

Understanding how cryptocurrency is created helps you grasp why it has value.

Two Main Methods:

Mining (Bitcoin, Ethereum): Computers solve complex math problems to validate transactions and earn new coins as rewards.

Staking (Newer cryptocurrencies): People “stake” their existing coins to help validate transactions and earn rewards.

Think of miners and stakers as security guards who check every transaction. In return for their work, they get paid in new cryptocurrency.

This is why cryptocurrency has value: it costs real money (electricity, computer hardware, time) to create and maintain the network.

Is Cryptocurrency Legal? What You Need to Know

The question “is cryptocurrency legal” has different answers depending on where you live.

In the United States: Completely legal. The IRS treats it as property for tax purposes.

In Most Developed Countries: Legal and increasingly regulated.

Some Countries: Restricted or banned (China, India has complex rules).

Bottom line: If you’re in the US, Canada, Europe, or most developed nations, you’re good to go. Just pay your taxes on any gains.

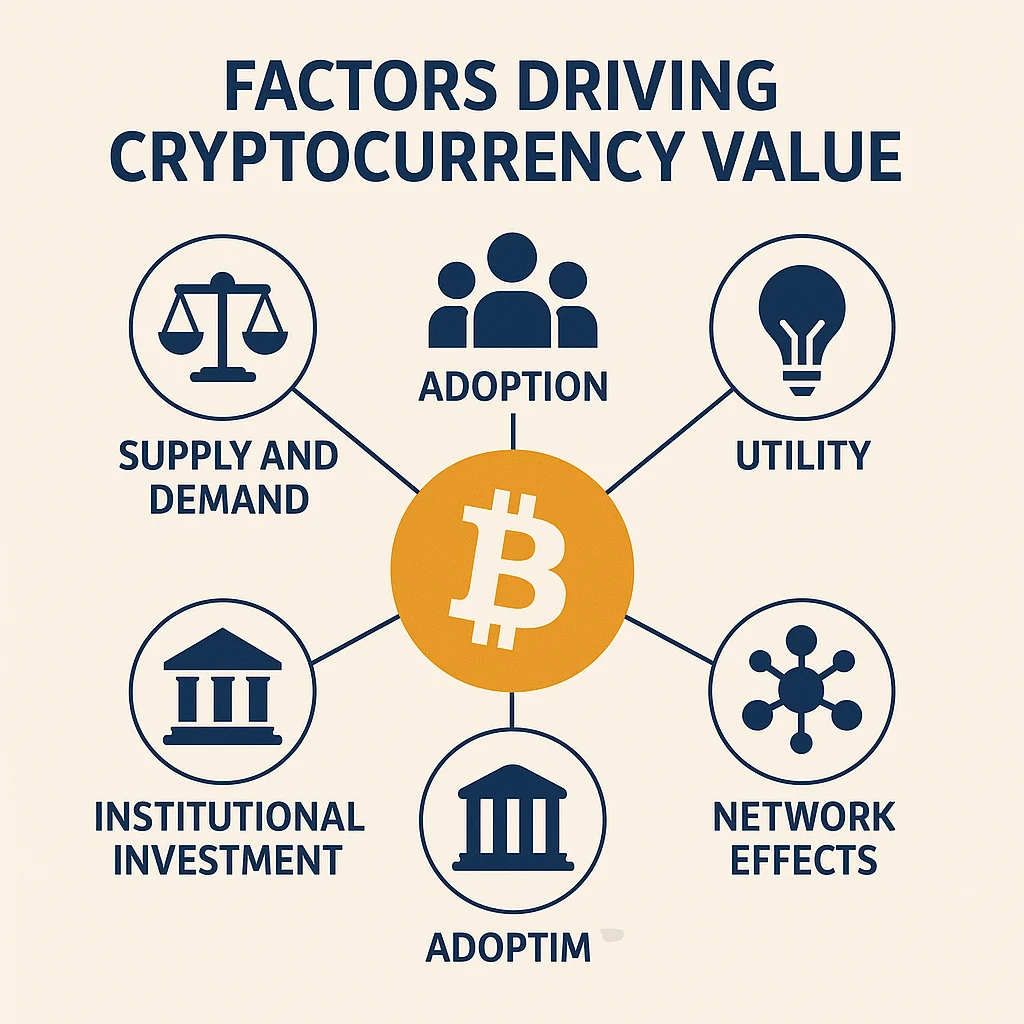

What Makes Cryptocurrency Valuable?

The question of cryptocurrency value confuses many beginners.

Five Key Factors Drive Value:

- Limited Supply: Most cryptocurrencies have caps on total supply

- Demand: More people wanting to buy than sell drives prices up

- Utility: What the cryptocurrency actually does or solves

- Network Effects: More users make the network more valuable

- Institutional Adoption: Banks and corporations buying in

Real Example: Bitcoin has a hard cap of 21 million coins. Ever. As more people want Bitcoin but the supply stays fixed, price tends to rise.

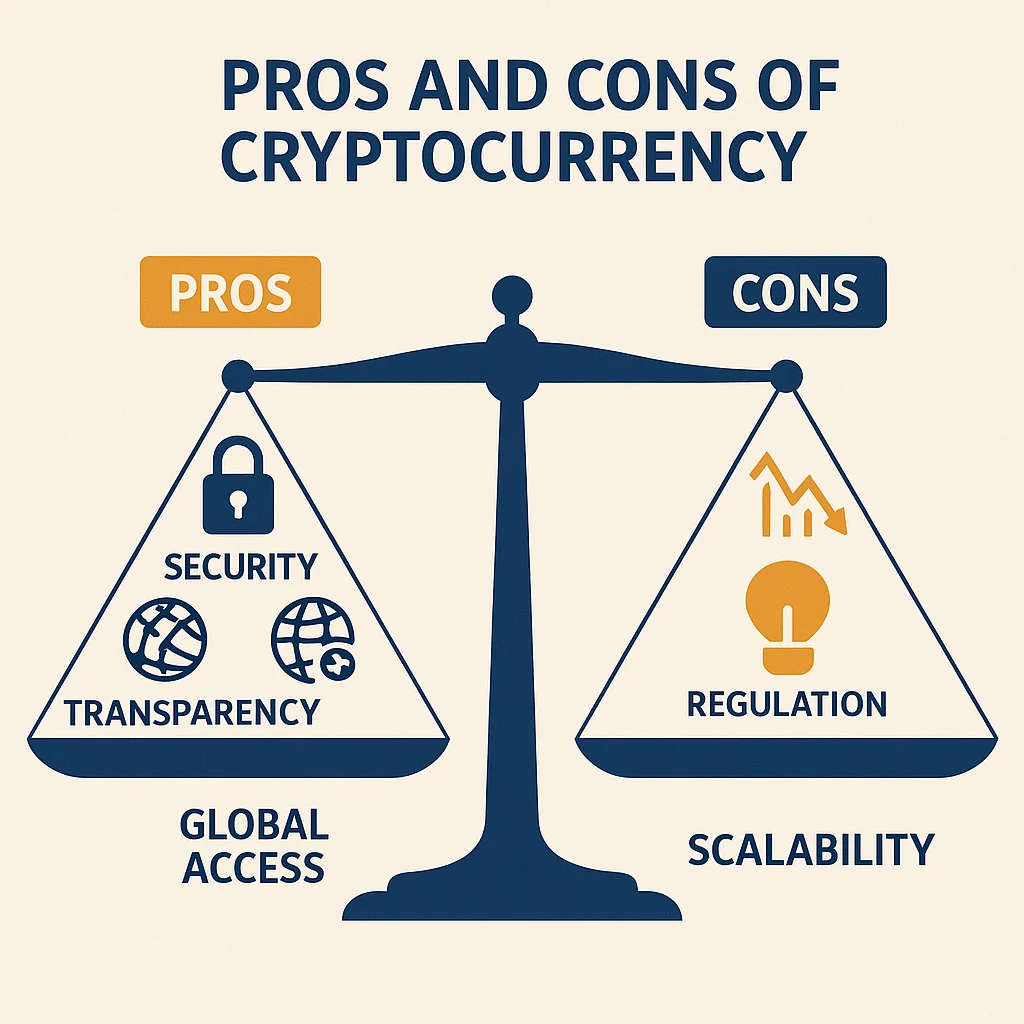

Cryptocurrency Advantages and Disadvantages: The Honest Truth

Every new investor should understand the cryptocurrency advantages and disadvantages before diving in.

The Advantages (Why People Love Crypto)

✅ Complete Control: You own your money, not a bank

✅ Lower Fees: Especially for international transfers

✅ 24/7 Access: No bank hours or holidays

✅ Fast Transfers: Minutes instead of days

✅ Investment Potential: Some have seen massive gains

✅ Privacy Options: More private than traditional banking

✅ Global Access: Works anywhere with internet

The Disadvantages (The Risks Are Real)

❌ Price Volatility: Values can swing wildly

❌ Learning Curve: More complex than traditional banking

❌ Limited Acceptance: Not every store accepts crypto yet

❌ Irreversible Transactions: Send to wrong address? Gone forever

❌ Regulatory Uncertainty: Rules are still being written

❌ Security Responsibility: You’re your own bank (good and bad)

Understanding these cryptocurrency risks is crucial before investing a single dollar.

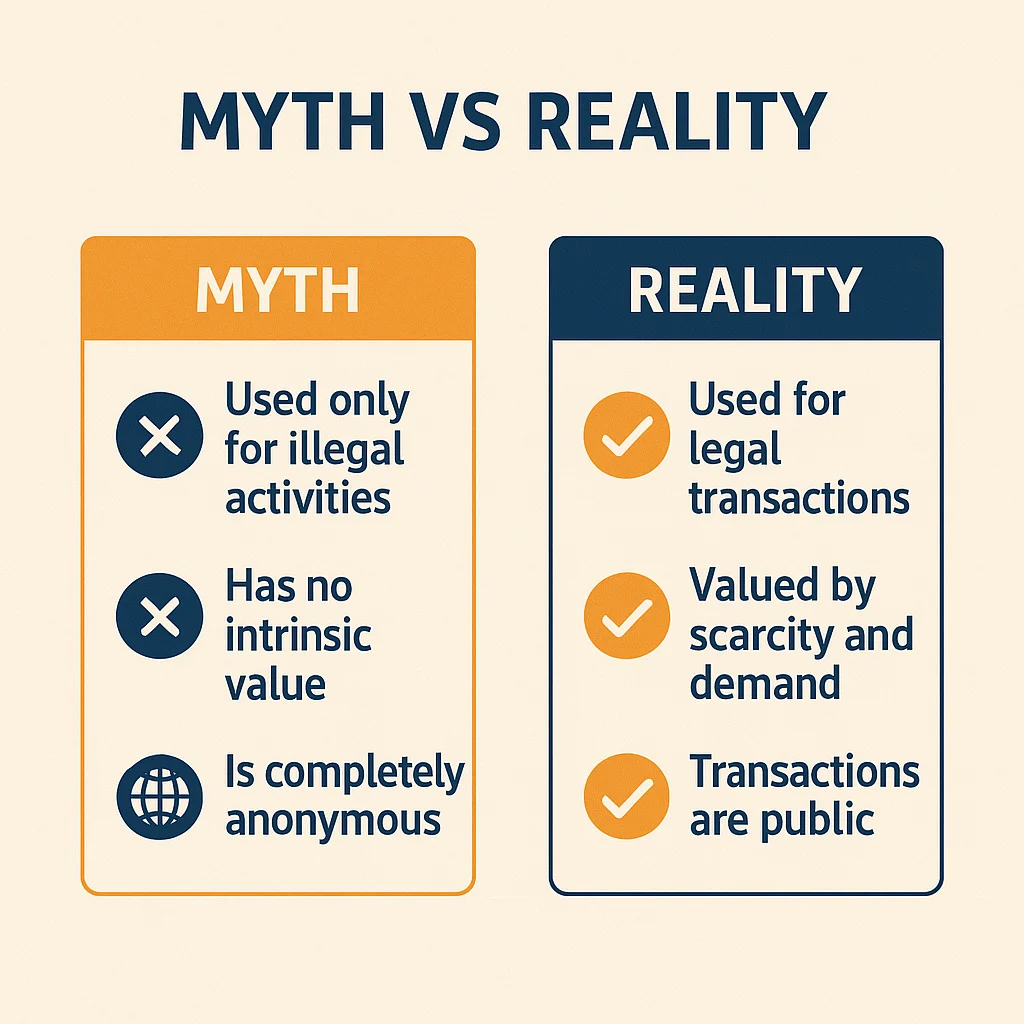

Common Cryptocurrency Myths (And the Reality)

Let’s destroy some cryptocurrency myths that keep people from understanding the truth.

Myth: “Cryptocurrency is only used by criminals”

Reality: Less than 1% of crypto transactions involve illegal activity. Compare that to cash.

Myth: “It’s too late to get involved”

Reality: We’re still in the early stages. Most people don’t own any cryptocurrency yet.

Myth: “You need to buy whole coins”

Reality: You can buy $10 worth of Bitcoin. You don’t need $50,000 for a whole coin.

Myth: “It’s too complicated for regular people”

Reality: Modern crypto apps are as easy to use as Venmo or PayPal.

Myth: “It’s not backed by anything”

Reality: It’s backed by mathematics, energy, and network effects. What backs the dollar?

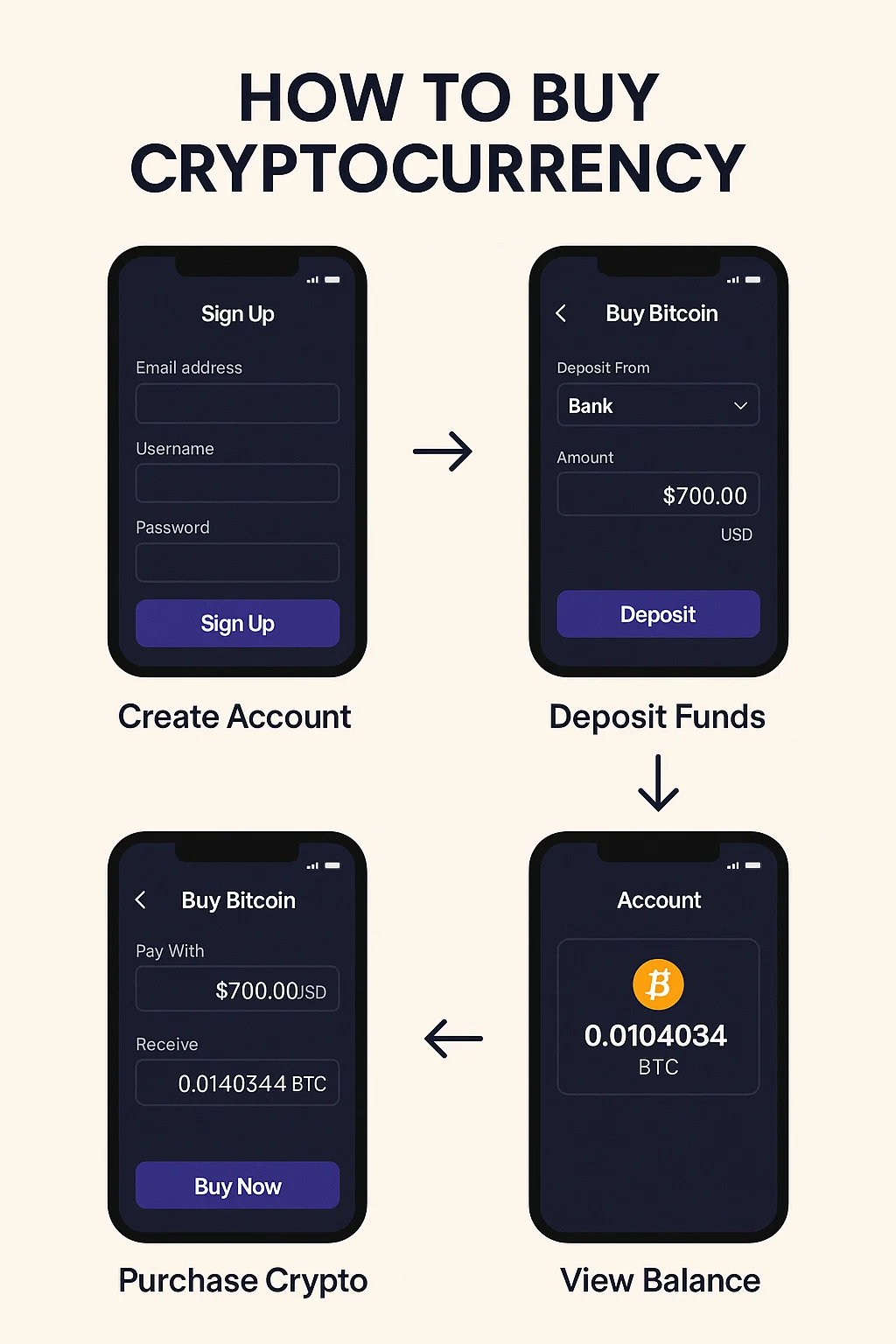

What Happens When You Buy Cryptocurrency?

Here’s exactly what happens when you buy cryptocurrency for the first time.

The Complete Process

- Create an account on a cryptocurrency exchange

- Verify your identity (required by law in most countries)

- Link your bank account or debit card

- Deposit funds into your exchange account

- Place a buy order for the cryptocurrency you want

- Own cryptocurrency in your exchange wallet

The whole process takes about 15 minutes if you have your documents ready.

Most beginners start with $50-100 to test the waters. Smart move.

Learn about the best cryptocurrency apps for beginners to make this process even easier.

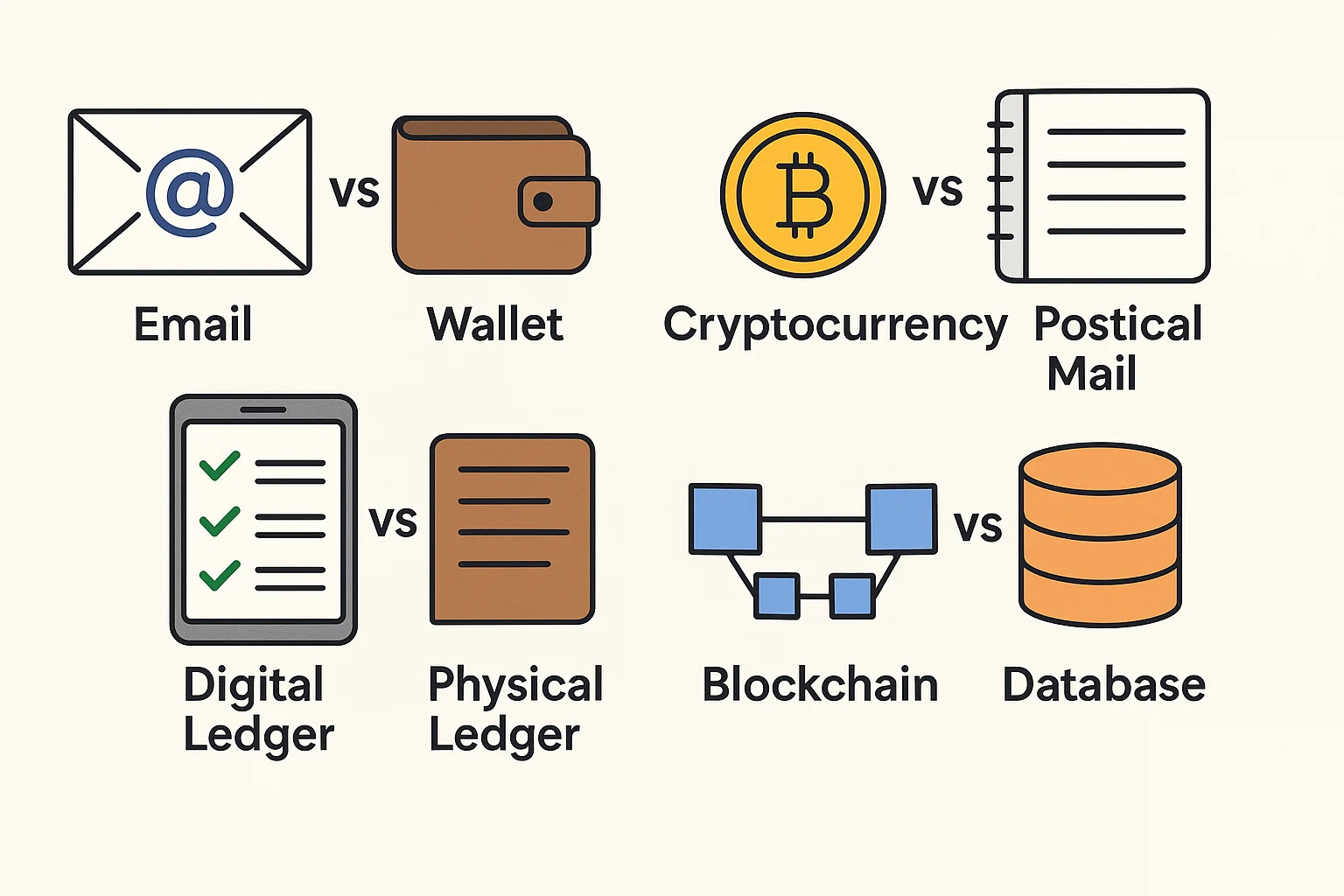

How to Explain Cryptocurrency Simply (To Anyone)

Need to explain cryptocurrency simply to friends or family?

Use These Analogies:

Email vs Postal Mail: Cryptocurrency is like email for money. Instead of going through the post office (bank), it goes directly from person to person over the internet.

Digital Gold: Bitcoin is like gold that lives in your computer. Limited supply, valuable, but easier to store and transfer.

Arcade Tokens: Just like arcade tokens only work in that arcade, each cryptocurrency works in its specific network. But instead of games, you’re using financial services.

Getting Started: Your First Steps

Ready to start? Here’s your action plan:

Step 1: Educate Yourself

Continue learning with our best cryptocurrency books for beginners and top online courses.

Step 2: Start Small

Invest only what you can afford to lose completely. $50-100 is plenty to start.

Step 3: Choose a Beginner-Friendly Platform

Check out our guide to the best cryptocurrency apps designed for newcomers.

Step 4: Focus on Security

Step 5: Stay Informed

Follow our recommendations for the best cryptocurrency podcasts to stay updated.

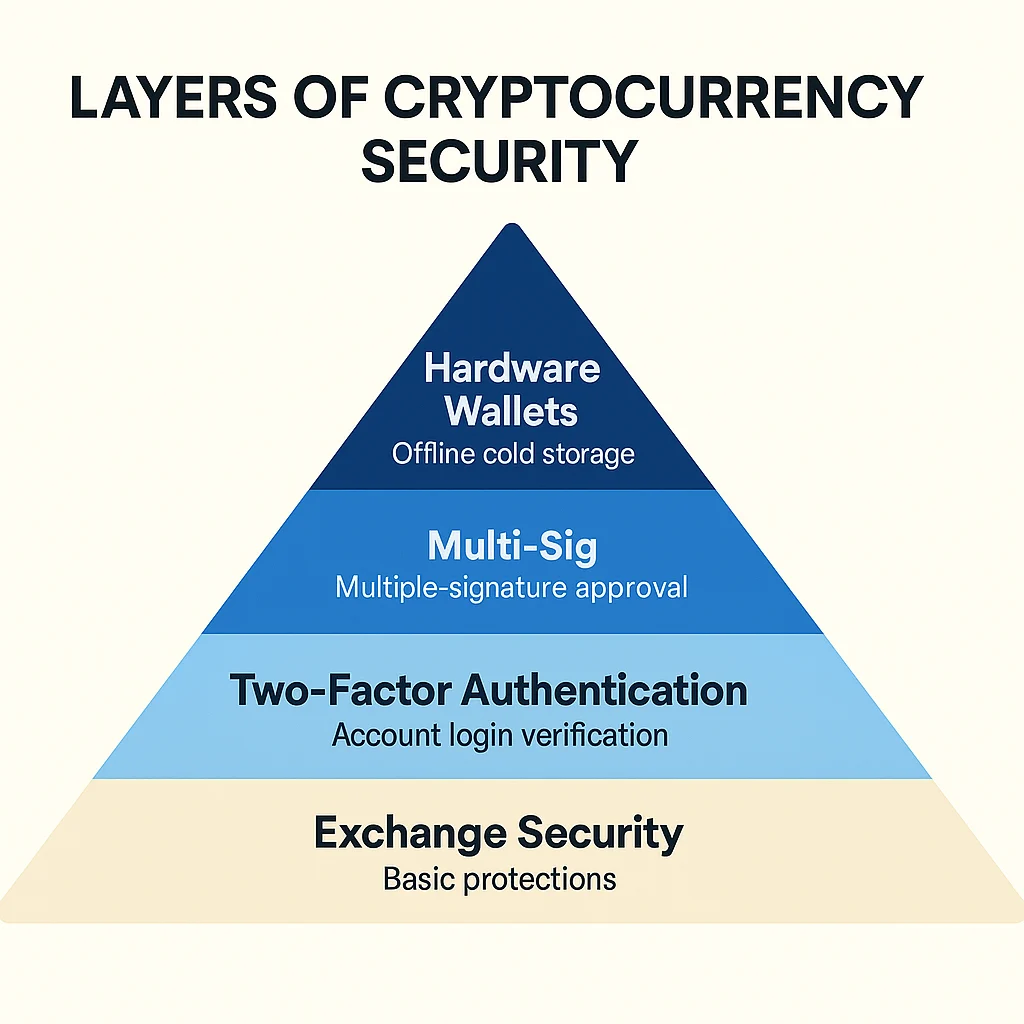

Security: Protecting Your Digital Assets

The #1 rule of cryptocurrency: You are your own bank. This means you’re responsible for security.

Essential Security Practices

For Beginners:

- Use reputable exchanges only

- Enable two-factor authentication everywhere

- Never share your private keys or seed phrases

- Start with small amounts while learning

For Serious Investors:

- Use hardware wallets for long-term storage

- Consider multi-signature wallets for large amounts

- Keep multiple backups of recovery phrases

- Use VPNs and hardware authentication like YubiKey

Get the complete breakdown of cryptocurrency security risks every beginner should know.

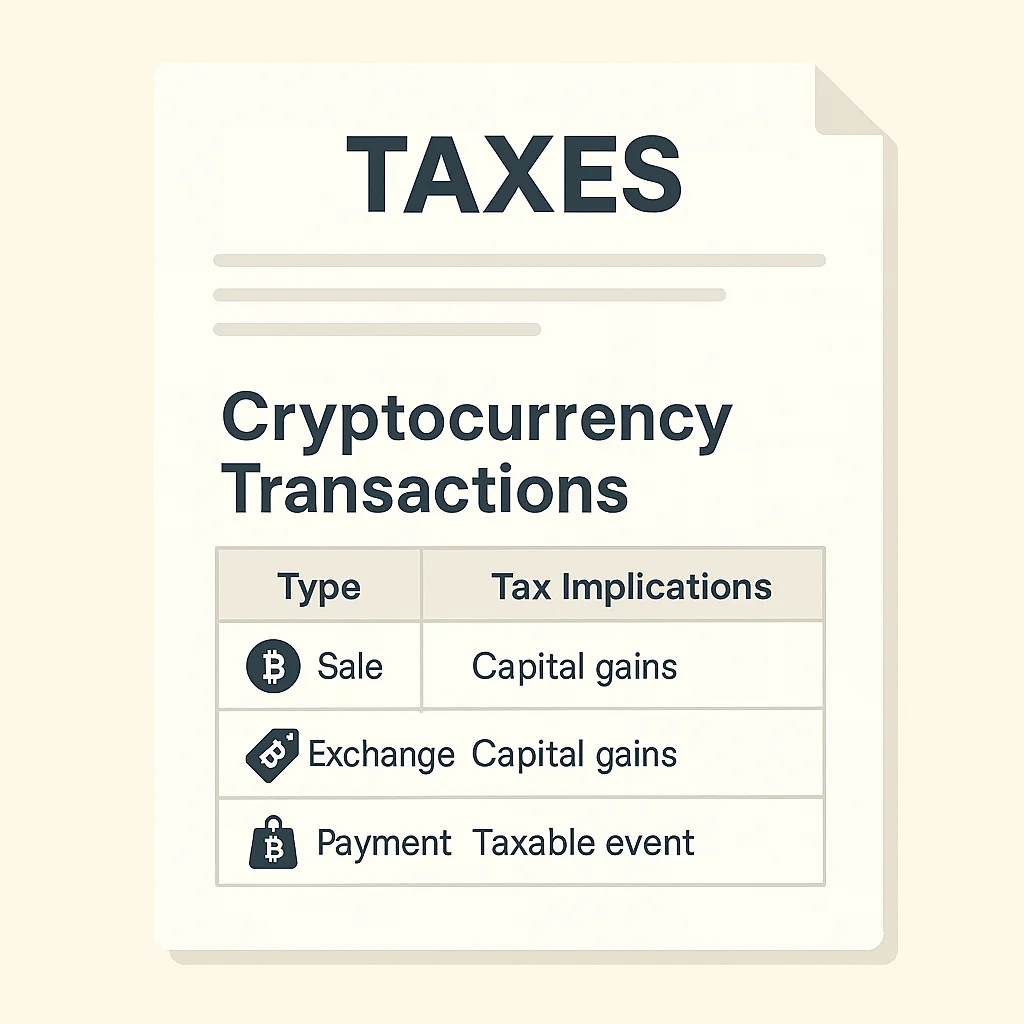

Tax Implications: What the IRS Wants You to Know

In the United States, cryptocurrency is treated as property for tax purposes.

This means:

- Buying crypto with dollars: Not taxable

- Trading one crypto for another: Taxable event

- Selling crypto for dollars: Taxable event

- Using crypto to buy goods: Taxable event

Keep detailed records of all transactions. The IRS is getting serious about crypto compliance.

The Future of Cryptocurrency

Where is this all heading?

Major trends shaping the future:

- Central bank digital currencies (government-issued crypto)

- Integration with traditional banking

- Mainstream adoption by corporations

- Improved user interfaces making crypto as easy as email

- Environmental improvements making crypto more sustainable

The writing is on the wall: Digital money isn’t going away. The question is whether you’ll be early to the party or fashionably late.

Common Beginner Questions Answered

Q: How much money do I need to start?

A: You can start with as little as $10. Most experts recommend starting with $50-100.

Q: Which cryptocurrency should I buy first?

A: Most beginners start with Bitcoin or Ethereum. Our guide to the best cryptocurrency for beginners has detailed recommendations.

Q: Is it too late to invest in cryptocurrency?

A: We’re still in the early stages. Less than 5% of the global population owns cryptocurrency.

Q: Can I lose all my money?

A: Yes, cryptocurrency is volatile and risky. Never invest more than you can afford to lose completely.

Q: Do I need to buy whole coins?

A: No! You can buy fractions of coins. You can own $50 worth of Bitcoin without buying a whole coin.

Resources for Continued Learning

Your cryptocurrency education doesn’t stop here.

Essential Resources:

- Best cryptocurrency books for beginners – comprehensive reading list

- Top online cryptocurrency courses for structured learning

- Best cryptocurrency podcasts to follow for daily updates

- Expert-led courses designed for serious learners, Take your crypto knowledge to the next level with Crypto Crew University

Final Thoughts: Your Next Move

Cryptocurrency isn’t just about making money (though that’s certainly possible). It’s about taking control of your financial future.

You now understand:

- What cryptocurrency actually is and how it works

- Why it was created and what problems it solves

- The real advantages and honest disadvantages

- How to get started safely and securely

The next step is yours.

You can stay on the sidelines and watch this financial revolution happen to other people. Or you can start small, learn as you go, and position yourself for whatever comes next.

Most people will wait until cryptocurrency is completely mainstream and safe. By then, the biggest opportunities will be gone.

The future of money is digital. The question isn’t whether cryptocurrency will succeed – it’s whether you’ll be part of it.

Remember: This guide provides educational information only. Cryptocurrency investments are risky and volatile. Never invest more than you can afford to lose completely. Always do your own research and consider consulting with a financial advisor.