HODL

HODL: The Art of Doing Nothing

HODL started as a typo but became crypto’s most important investment strategy. Sometimes the best move is not moving at all.

HODL means holding cryptocurrency long-term regardless of short-term price volatility, derived from a misspelled “hold” in a 2013 Bitcoin forum post. It represents the strategy of buying and holding rather than actively trading.

How HODL Works

Time arbitrage leverages crypto’s long-term growth trends while avoiding the stress and fees of constant trading. HODLers believe in underlying technology adoption over short-term price movements.

Emotional discipline prevents panic selling during crashes and FOMO buying during peaks. HODLing removes timing decisions that most retail traders get wrong.

Dollar cost averaging often accompanies HODL strategies – consistently buying fixed dollar amounts regardless of price to smooth out volatility over time.

Real-World Examples

- Early Bitcoin adopters who held through multiple 80%+ crashes are now wealthy

- Ethereum holders from 2016 experienced massive gains despite severe volatility

- “Bitcoin pizza guy” spent 10,000 BTC on pizza in 2010 – worth $300+ million today

Why Beginners Should Care

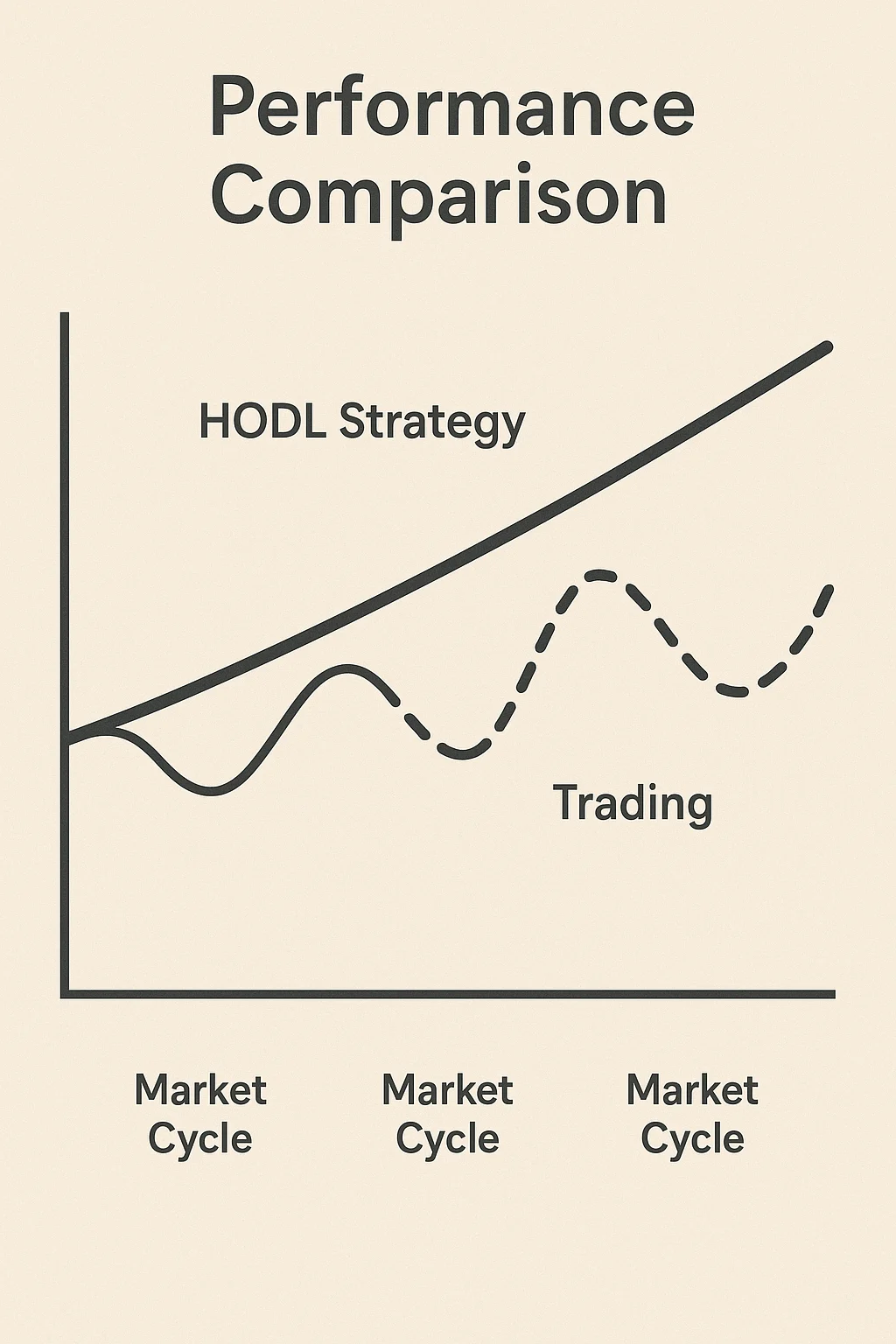

HODLing beats trading for most people. Studies show active traders typically underperform simple buy-and-hold strategies after accounting for fees and taxes.

Psychological benefits include reduced stress from daily price watching and elimination of complex timing decisions that even professionals struggle with.

Tax advantages in many jurisdictions favor long-term holding over short-term trading, reducing overall tax burden on crypto gains.

Related Terms: Diamond Hands, DCA, Bull Market, Bear Market