FOMO (Fear of Missing Out)

FOMO: The Psychology That Drives Crypto Markets

FOMO (Fear of Missing Out) is responsible for more bad crypto decisions than any technical analysis could prevent. It’s the emotional trap that turns rational people into panic buyers.

FOMO is the anxiety that others are experiencing rewarding experiences from which one is absent. In crypto, it manifests as the urgent need to buy tokens that are rapidly increasing in price, often at the worst possible moment.

How FOMO Works in Crypto

Social media amplifies FOMO dramatically. Seeing others post gains from tokens you don’t own creates psychological pressure to join the party, regardless of fundamentals.

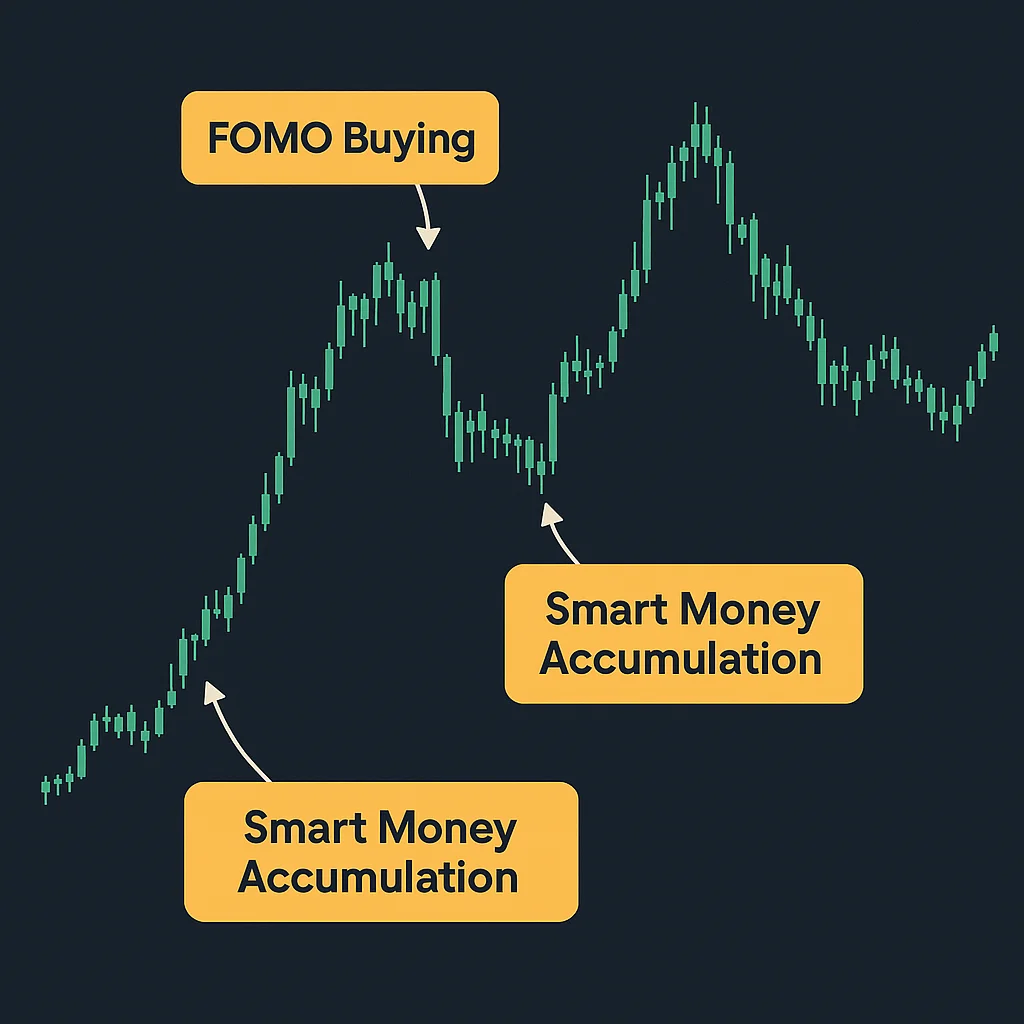

FOMO buying typically happens at peaks. When everyone’s talking about a coin and prices are parabolic, that’s usually when retail investors feel the strongest urge to buy.

This emotion-driven buying often coincides with smart money selling, creating the classic “buy high, sell low” pattern that destroys retail wealth.

Real-World Examples

- GameStop/Dogecoin 2021 – Retail FOMO drove massive price spikes followed by crashes

- NFT mania – People buying expensive JPEGs at peaks due to social pressure

- Altcoin season – Rotating FOMO between different “hot” tokens

Why Beginners Should Care

FOMO is your enemy in crypto markets. The time to buy is when nobody’s talking about crypto, not when your barber is giving you trading advice.

Develop systems to counter FOMO – dollar cost averaging, predetermined buy levels, and taking profits systematically. Emotional decisions in volatile markets typically lose money.

Related Terms: FUD, Bull Market, Pump and Dump, Diamond Hands