Launchpad

Launchpad: The Crypto Startup Accelerator

Launchpads are platforms that help new crypto projects raise funds and launch tokens. They’re like Kickstarter for cryptocurrencies, but with more speculation and less product delivery.

A launchpad is a platform that facilitates fundraising and token launches for new cryptocurrency projects. They provide infrastructure, marketing, and community access to help projects raise capital and distribute tokens to early supporters.

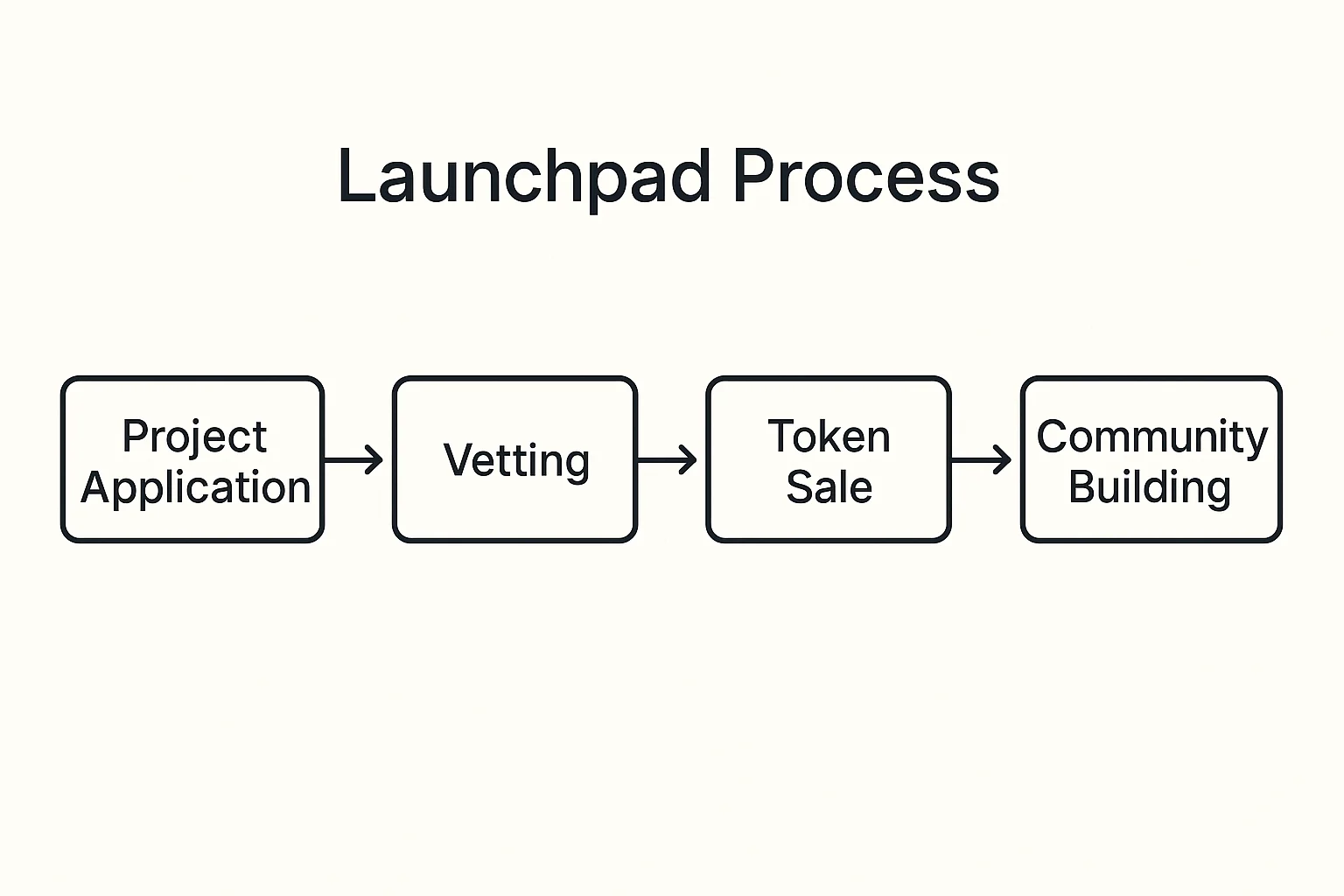

How Launchpads Work

Project vetting screens potential launches for legitimacy, though quality varies significantly between different launchpad platforms and market conditions.

Token sales occur through various mechanisms like fixed prices, bonding curves, or Dutch auctions, often with whitelisting requirements or lottery systems for popular projects.

Community building helps projects gain exposure to existing investor communities who are actively seeking new investment opportunities in early-stage crypto projects.

Real-World Examples

- Binance Launchpad has launched major projects like Polygon (MATIC) and Sandbox (SAND)

- Polkastarter focuses on cross-chain token launches and DeFi projects

- DAO Maker combines launchpad services with community-driven project incubation

Why Beginners Should Care

Early access to new projects can provide significant returns, but most launchpad projects fail or lose value after initial hype subsides.

High risk exists since many projects are experimental or lack working products, making launchpad investing closer to speculation than traditional investment.

FOMO marketing creates artificial urgency around launches, often leading to poor investment decisions based on fear of missing out rather than fundamental analysis.

Related Terms: Token Sale, ICO, Whitelist, Project Vetting