Real Yield

Real Yield: Sustainable Revenue-Based Returns

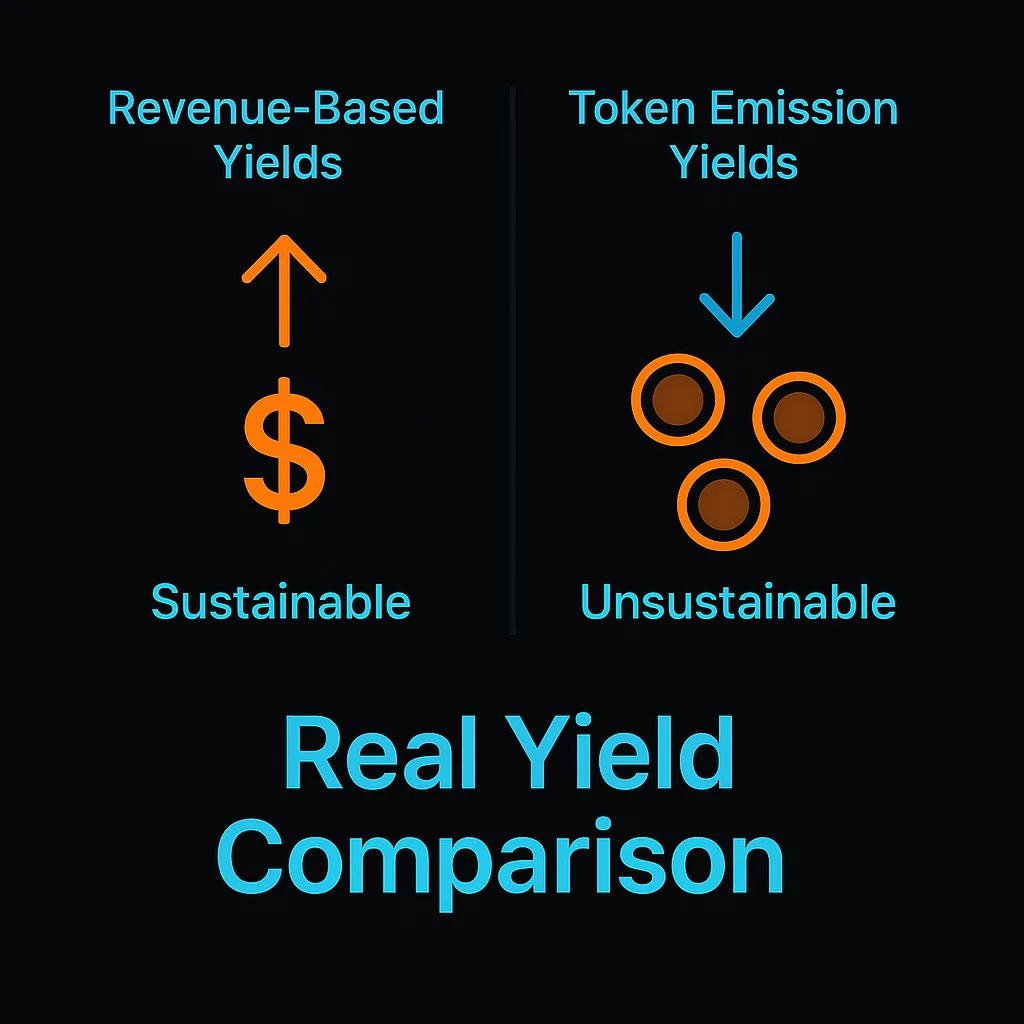

Real yield comes from actual protocol revenue rather than token emissions or inflationary rewards. It’s the difference between earning from productive business activity versus printing more money.

Real yield refers to returns generated from genuine protocol revenue, fees, or value creation rather than token inflation or emissions. These yields can theoretically continue indefinitely since they’re backed by actual economic activity.

How Real Yield Works

Revenue generation from protocol fees, transaction costs, or service charges creates income that gets distributed to token holders or stakers.

Fee sharing mechanisms redirect a portion of protocol revenue to participants who provide value like liquidity, governance, or security services.

Sustainable economics enable long-term yield generation without depending on new money entering the system to pay existing participants.

Real-World Examples

- GMX distributes trading fees to token stakers from actual platform revenue

- Synthetix shares trading fees from synthetic asset exchanges with SNX stakers

- MakerDAO distributes stability fees from DAI borrowing to MKR holders

Why Beginners Should Care

Sustainability assessment helps distinguish between temporary incentive programs and genuinely profitable protocols that can maintain yields long-term.

Lower but stable returns compared to high-emission farming programs that typically decrease as token prices fall or incentives end.

Business model validation as real yield demonstrates that protocols create genuine value worth paying for rather than existing purely for speculation.

Related Terms: Protocol Revenue, Fee Sharing, Sustainable Yield, Token Emissions