Bull Market

Bull Market: When Everything Goes Up

Bull markets are when crypto investors feel like geniuses. Prices rise, optimism soars, and everyone becomes a trading expert. Until they don’t.

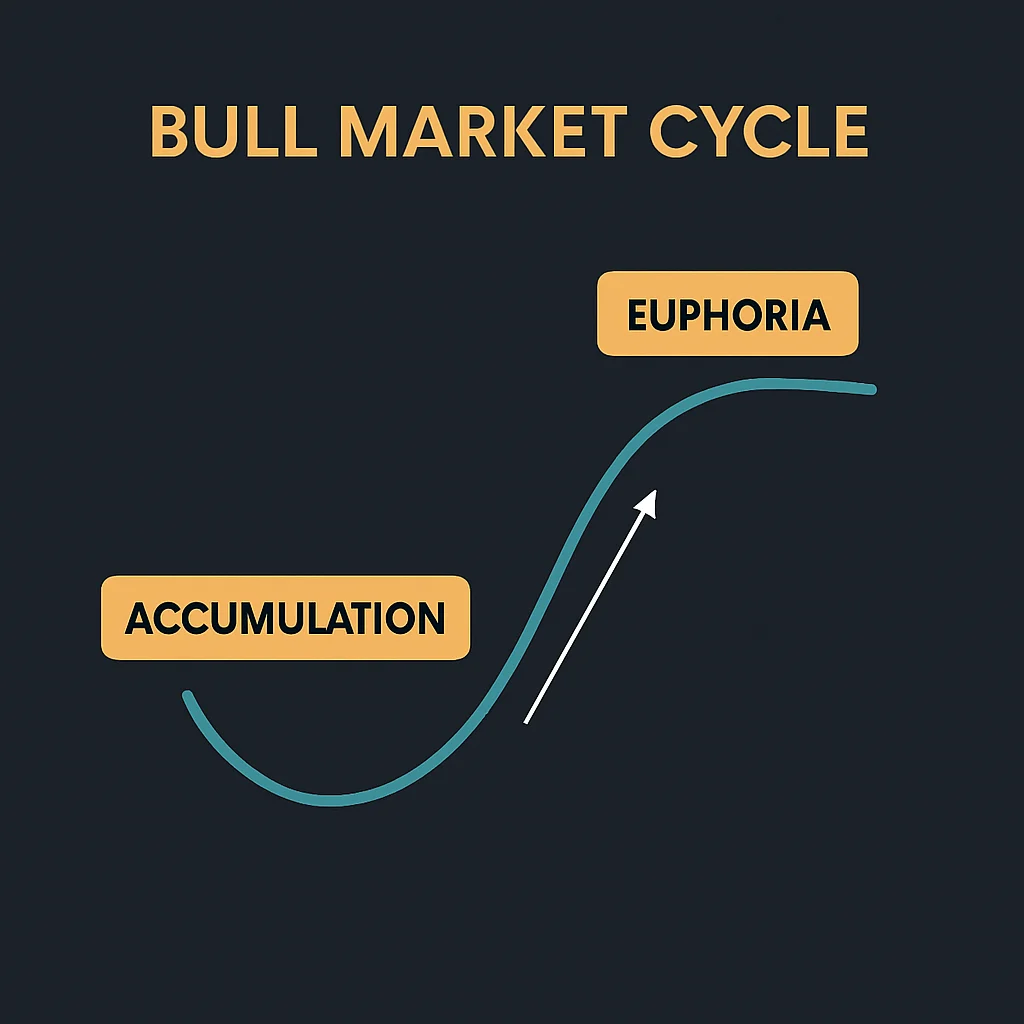

A bull market is a sustained period of rising cryptocurrency prices accompanied by widespread investor optimism. During bull runs, even terrible projects can see massive gains as speculation overtakes fundamentals.

How Bull Markets Work

Bull markets feed on themselves. Rising prices attract new investors, whose buying drives prices higher, attracting even more investors. This creates positive feedback loops that can last months or years.

Media attention amplifies bull markets. Mainstream coverage brings retail investors who have never owned crypto, providing new money to fuel further price increases.

“This time is different” becomes the prevailing sentiment. New investors believe prices will keep rising indefinitely, leading to increasingly risky behavior.

Real-World Examples

- 2017 Bull Run – Bitcoin went from $1,000 to $20,000 in one year

- 2021 Bull Run – Total crypto market cap reached $3 trillion

- DeFi Summer 2020 – Decentralized finance tokens gained 1000%+

Why Beginners Should Care

Bull markets create life-changing wealth but also devastating losses. The same psychological forces that drive prices up eventually reverse, often violently.

Smart strategies include taking profits systematically, avoiding leverage, and remembering that bull markets always end. The time to be greedy is when others are fearful, not when everyone’s celebrating.

Related Terms: Bear Market, FOMO, ATH, Market Cycle