FUD (Fear, Uncertainty, Doubt)

FUD: Fear, Uncertainty, and Doubt

FUD is FOMO’s evil twin. While FOMO makes you buy at peaks, FUD makes you sell at bottoms. Understanding FUD helps you think clearly when markets panic.

FUD stands for Fear, Uncertainty, and Doubt – negative sentiment spread to influence crypto prices downward. Sometimes it’s legitimate concerns, often it’s manufactured panic designed to shake out weak hands.

How FUD Works

Legitimate FUD includes real threats like regulatory crackdowns, exchange hacks, or technical vulnerabilities. Smart investors pay attention to genuine risks.

Manufactured FUD comes from competitors, short sellers, or media seeking clicks. They amplify minor issues or spread misleading information to trigger panic selling.

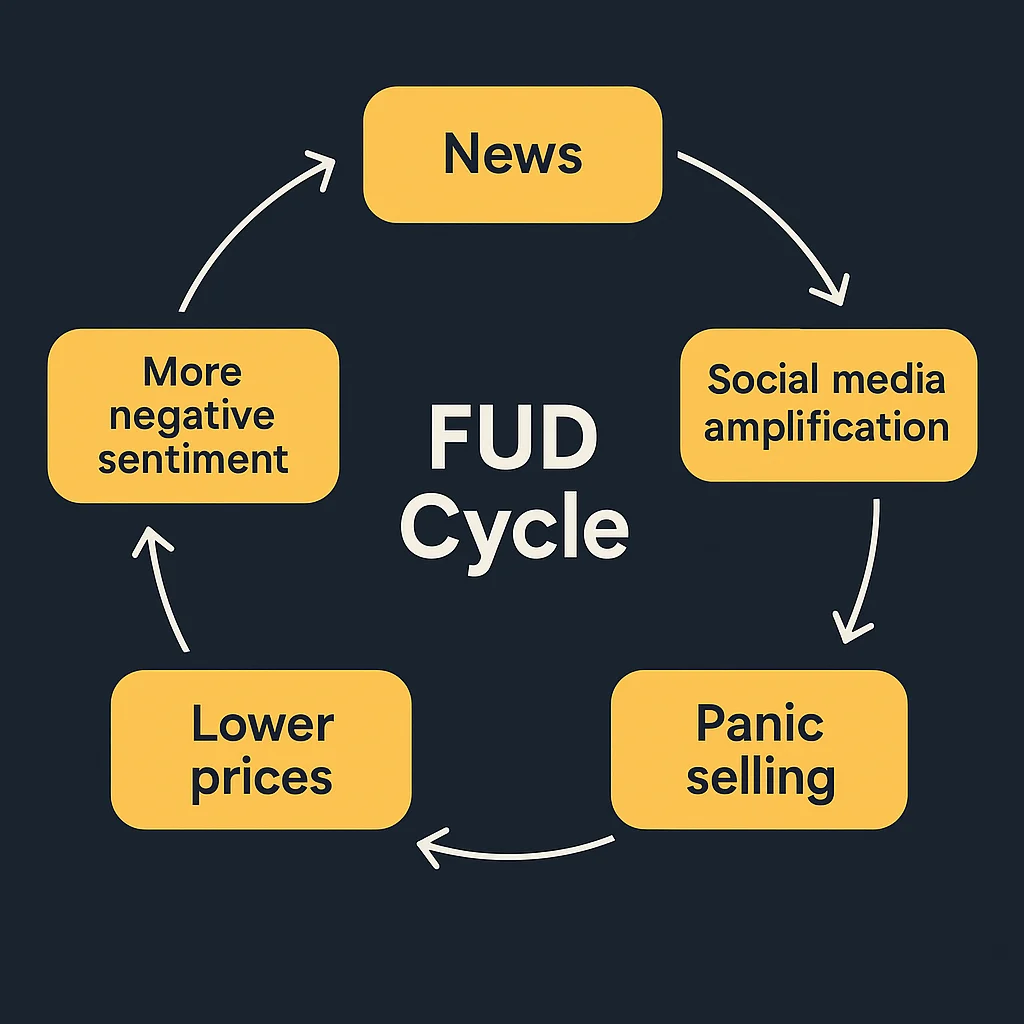

Social media echo chambers amplify both types of FUD. One negative headline becomes a thousand panicked posts, creating self-reinforcing fear cycles.

Real-World Examples

- China ban news – Recycled every few months, causes temporary price drops

- Tether collapse fears – Persistent despite ongoing operations

- Environmental concerns – Bitcoin mining energy usage criticism

Why Beginners Should Care

Learning to distinguish between legitimate concerns and manufactured FUD is crucial for long-term success. Markets overreact to both positive and negative news.

Real risks deserve attention – regulatory changes, technical vulnerabilities, and macroeconomic factors matter. But temporary news cycles often create buying opportunities for patient investors.

Related Terms: FOMO, Bear Market, Paper Hands, Market Manipulation