Token Lockup

Token Lockup: Preventing Early Selling

Token lockups prevent allocated tokens from being sold or transferred for specific time periods. It’s like putting your poker winnings in a time-locked safe to prevent impulse spending.

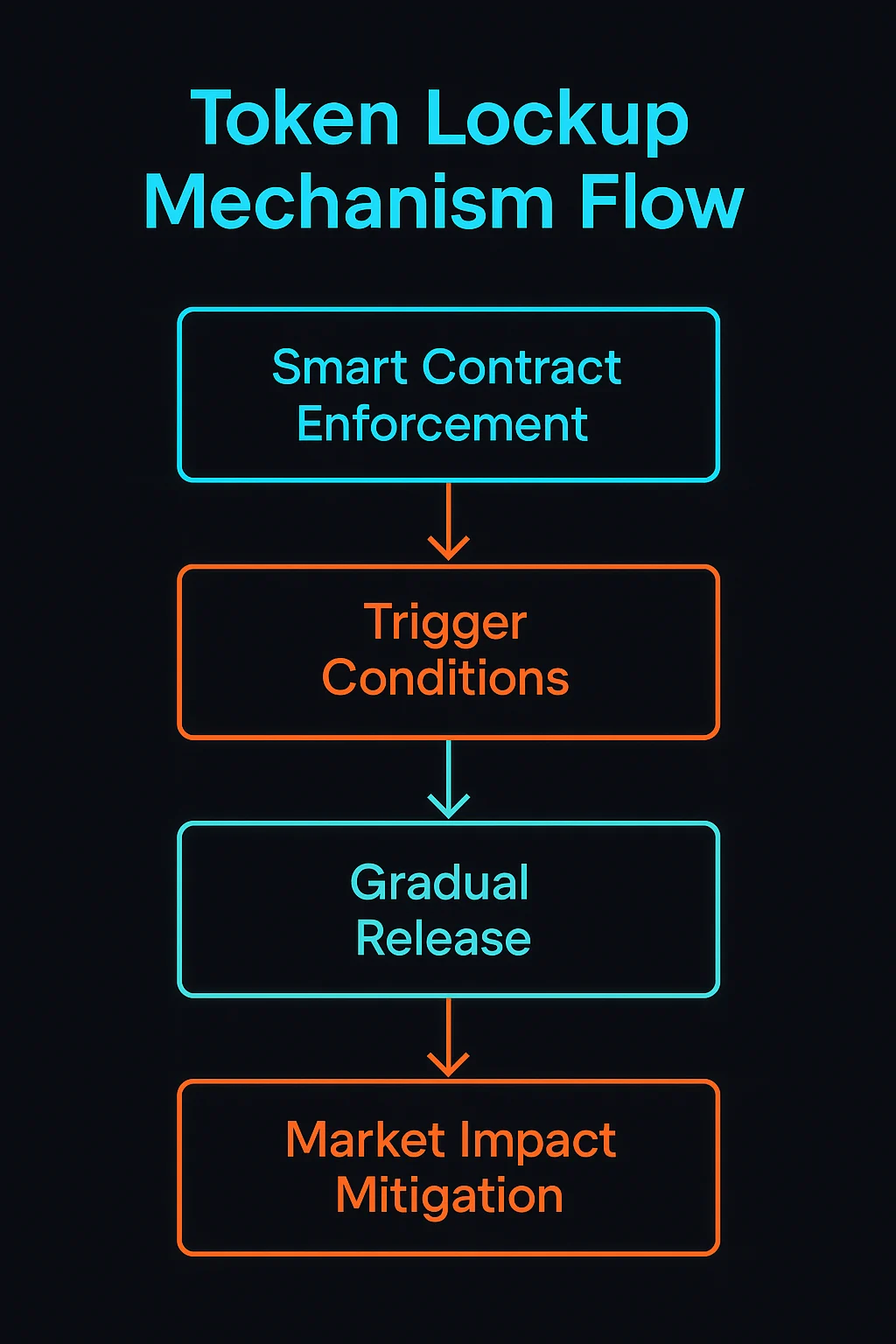

Token lockup is a mechanism that prevents token holders from selling, transferring, or accessing their tokens until predetermined conditions are met. Lockups typically use smart contracts to enforce restrictions automatically.

How Token Lockups Work

Smart contract enforcement makes lockup periods technically immutable, preventing even token holders from accessing funds before unlock conditions are satisfied.

Various trigger types include time-based unlocks, milestone achievements, governance votes, or other on-chain events that automatically release tokens.

Gradual release options may unlock tokens in tranches rather than all at once, smoothing potential market impact from large sales.

Real-World Examples

- Team token lockups prevent founders from immediately selling allocations after public token launches

- Liquidity provider rewards often have lockup periods to ensure continued platform participation

- Investor protections through lockups that prevent early whale dumping on retail buyers

Why Beginners Should Care

Price stability benefits from lockups that prevent large holders from immediately dumping tokens and crashing prices after launches.

Commitment signaling as teams and investors willing to accept lockups demonstrate confidence in long-term project success.

Unlock events create predictable supply increases that may pressure prices, requiring investors to monitor lockup expiration schedules.

Related Terms: Vesting Schedule, Smart Contract, Supply Shock, Market Stability