Single-Sided Staking

Single-Sided Staking: Simplified Yield Farming

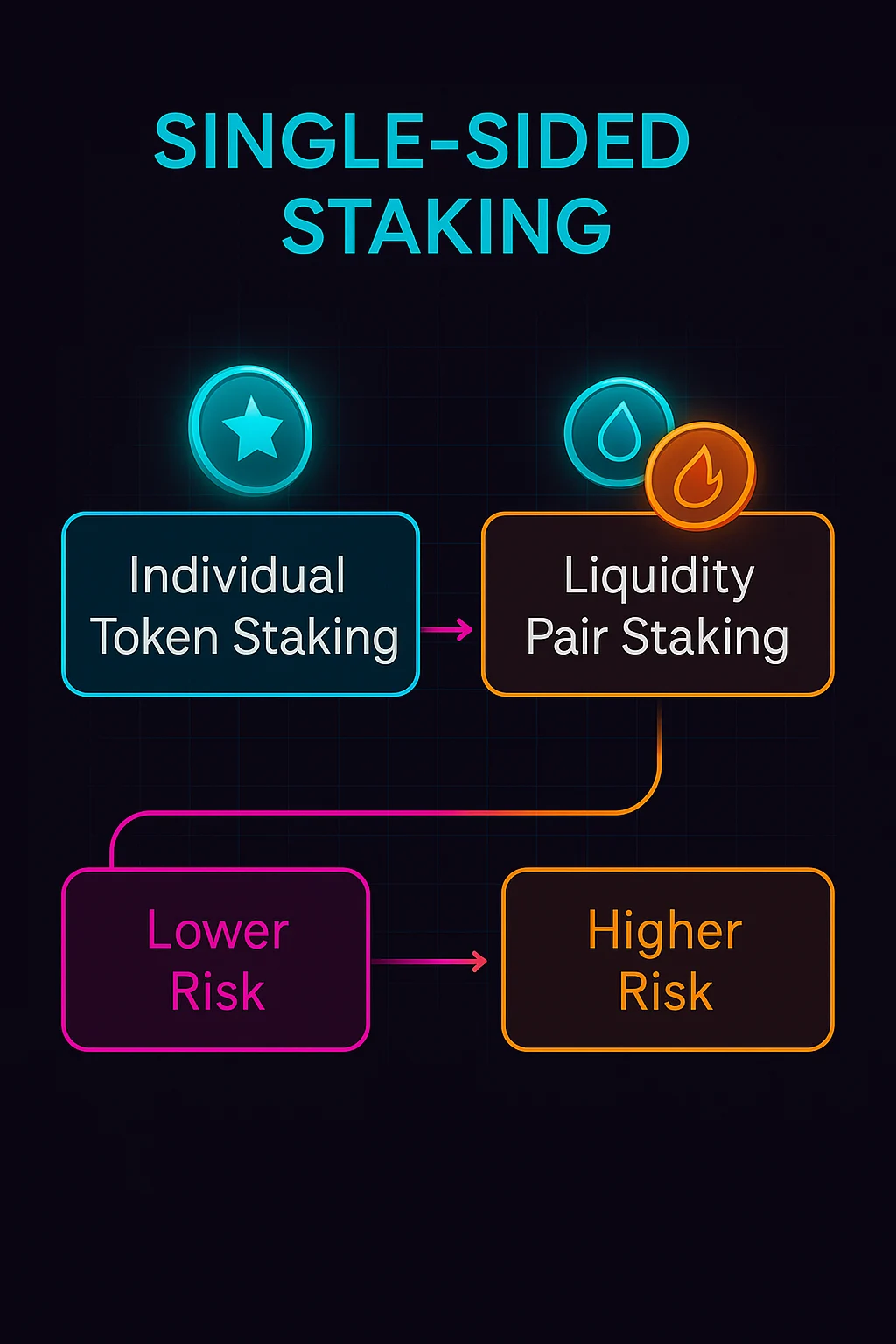

Single-sided staking lets you earn yield on individual tokens without providing liquidity pairs or facing impermanent loss. It’s like earning interest on a savings account without loan risk.

Single-sided staking allows users to stake individual tokens to earn rewards without needing to provide paired assets or manage liquidity pool positions. This eliminates impermanent loss while still generating yield from token holdings.

How Single-Sided Staking Works

Protocol rewards come from token emissions, revenue sharing, or other sources that don’t require users to provide trading liquidity.

No pairing requirements mean users can stake popular tokens like ETH or BTC without needing to acquire and manage secondary tokens for liquidity provision.

Simplified risk eliminates impermanent loss concerns since users maintain exposure to only their chosen token rather than token pairs.

Real-World Examples

- Ethereum 2.0 staking provides ~6% APY for holding ETH without impermanent loss risks

- Lido liquid staking enables ETH staking with tradeable stETH tokens

- Rocket Pool offers decentralized ETH staking with rETH liquid staking tokens

Why Beginners Should Care

Lower complexity makes single-sided staking more accessible than complex DeFi strategies requiring multiple tokens and risk management.

Predictable exposure maintains your chosen token allocation without the price ratio risks inherent in liquidity pool strategies.

Generally lower yields compared to liquidity mining since protocols don’t need to incentivize users to provide trading infrastructure.

Related Terms: Staking, Liquid Staking, Impermanent Loss, Yield Farming