Diamond Hands

Diamond Hands: Unshakeable Conviction

Diamond hands represent the ultimate HODLer mentality – holding through extreme volatility without selling. It’s a badge of honor in crypto communities.

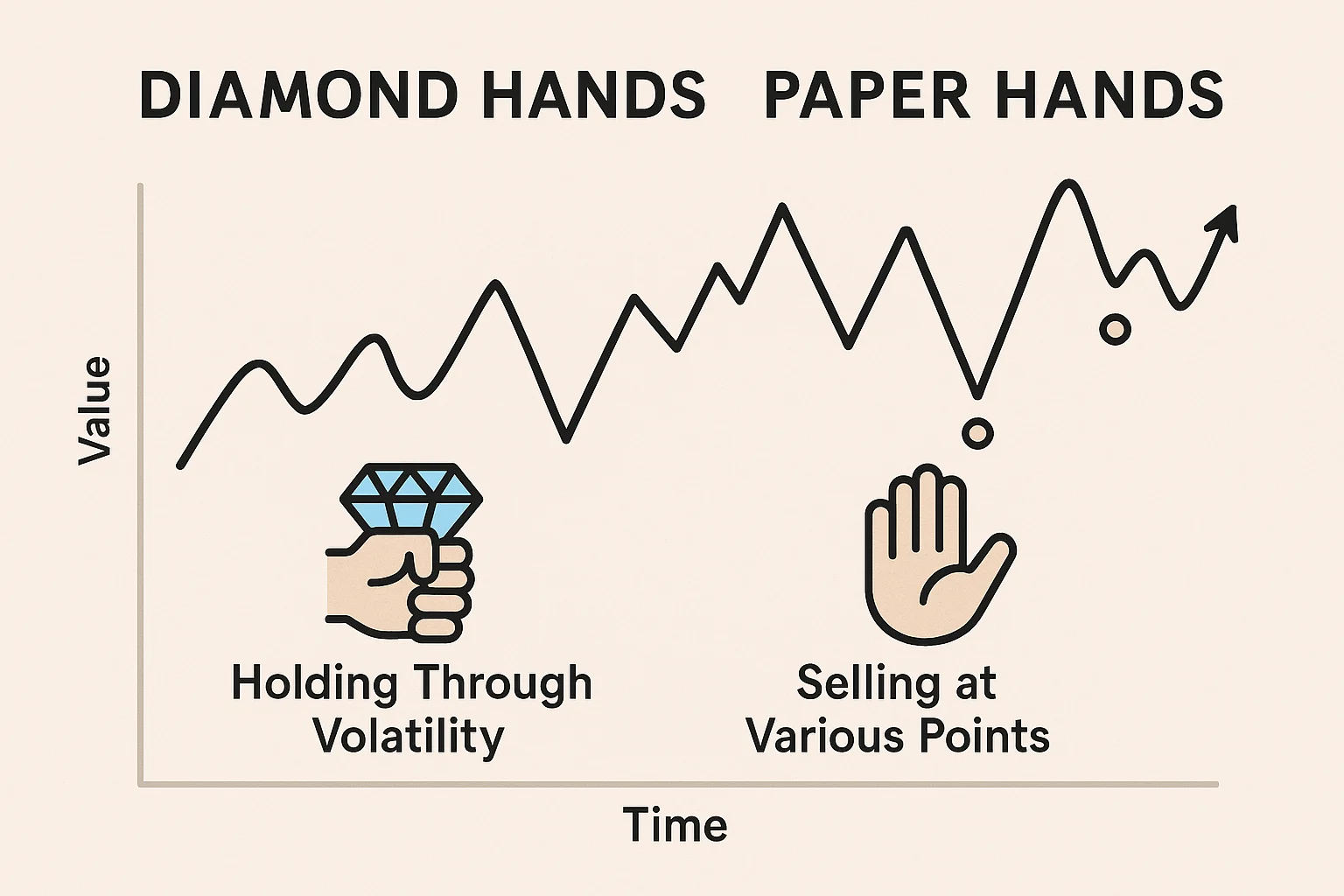

Diamond hands refers to the unwavering determination to hold cryptocurrency positions through significant price volatility and market stress. It celebrates investors who resist selling during crashes or euphoric peaks.

How Diamond Hands Mentality Works

Conviction-based investing focuses on long-term fundamental value rather than short-term price movements. Diamond hands holders believe temporary volatility is noise compared to long-term trends.

Community reinforcement through social media and forums encourages holding behavior. “Diamond hands” posts during crashes provide mutual support and discourage panic selling.

Opportunity cost acceptance means choosing potential long-term gains over guaranteed short-term profits. Diamond hands holders often watch massive unrealized gains disappear without selling.

Real-World Examples

- Tesla shareholders who held through Elon Musk’s Twitter polls about selling stock

- GameStop holders during the 2021 squeeze who refused to sell at $400+

- Bitcoin maximalists who held through multiple 80% bear market crashes

Why Beginners Should Care

Diamond hands can create wealth but also prevent taking profits during euphoric peaks. The strategy works best with assets you genuinely believe have long-term value.

Emotional preparation is crucial. Diamond hands requires accepting that your portfolio might lose 50-90% of value temporarily without changing your investment thesis.

Risk management still matters. Having diamond hands on 100% of your portfolio can prevent necessary rebalancing or profit-taking for life expenses.

Related Terms: HODL, Paper Hands, Bull Market, Bear Market