Floor Price

Floor Price: The Cheapest Entry Point

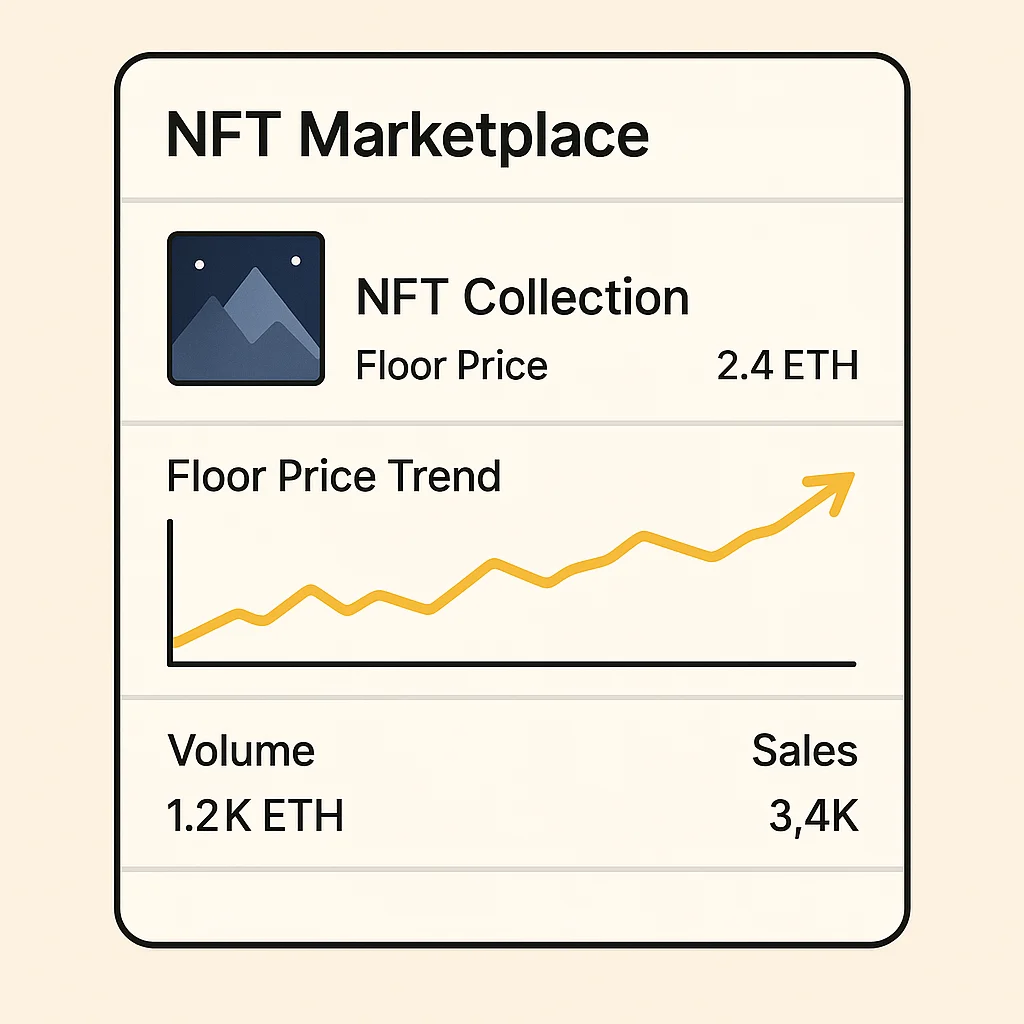

Floor price is the lowest price you can buy into an NFT collection. It’s the most watched metric in NFT trading and often determines a project’s perceived value.

Floor price is the lowest listed price for any NFT in a collection on marketplaces. It represents the minimum cost to own any piece from that collection, regardless of traits or rarity.

How Floor Price Works

Market sentiment drives floor prices up and down. Positive news, celebrity endorsements, or utility announcements can spike floors. Negative events or broader market downturns crash them.

Supply and demand fundamentals apply. Collections with strong holder communities and low listing rates maintain higher floors than projects where everyone’s trying to sell.

Trait rarity creates price tiers above floor. While floor represents the cheapest NFTs, rare traits can sell for 10x-100x floor price.

Real-World Examples

- Bored Apes floor price peaked at 150+ ETH, now trades around 30-40 ETH

- CryptoPunks maintain high floors due to historical significance and scarcity

- Newer collections often see 90%+ floor price declines from mint price

Why Beginners Should Care

Floor price reflects market confidence in a project’s long-term value. Consistently declining floors usually signal community abandonment and project failure.

Don’t chase floors during rapid increases – you’re often buying near temporary peaks. Similarly, rapidly crashing floors rarely indicate good buying opportunities.

Focus on collections with strong communities, real utility, and active development rather than purely speculative floor price movements.

Related Terms: NFT, Marketplace, Rarity, Collection