Tokenization

Tokenization: Converting Assets into Digital Tokens

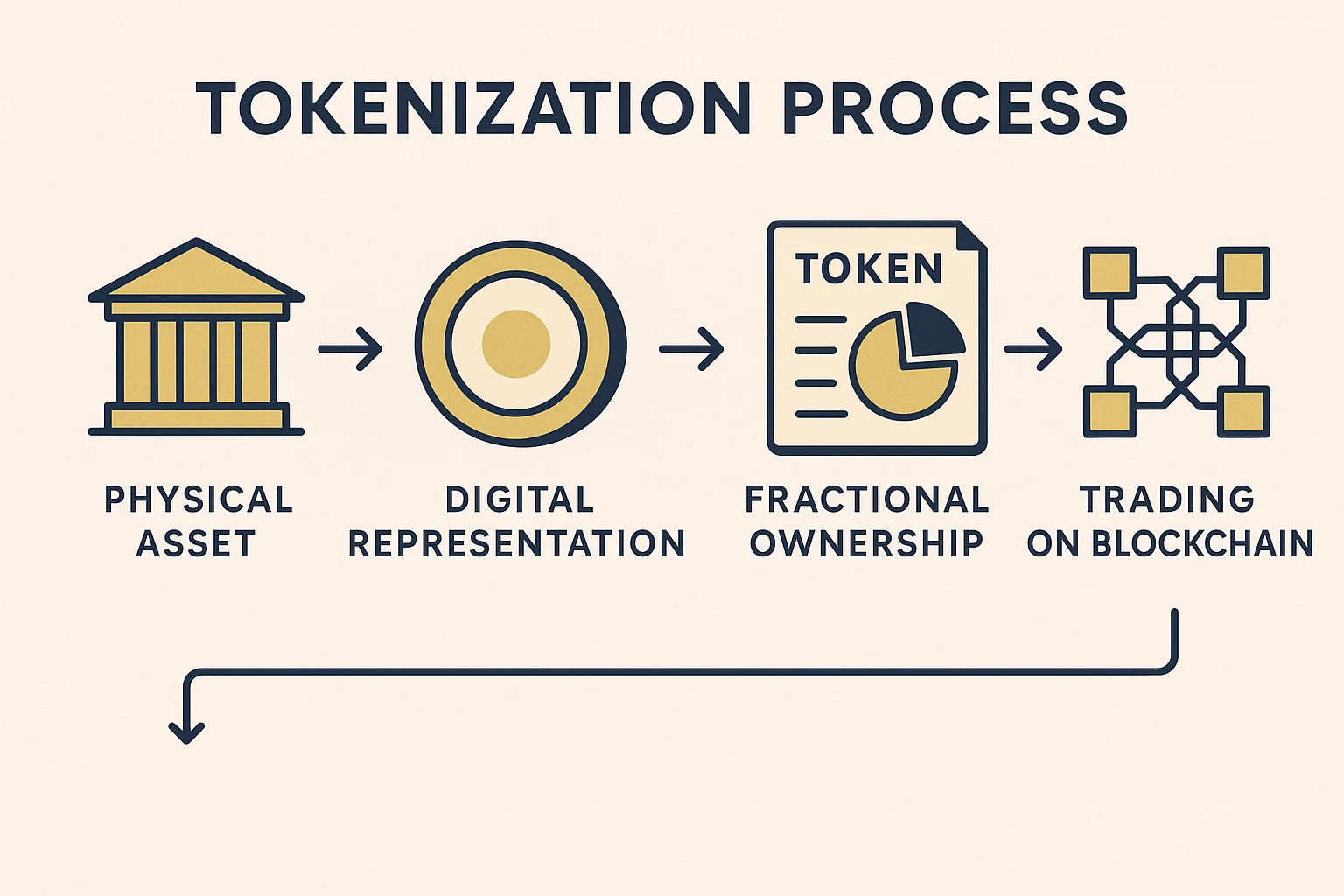

Tokenization transforms real-world assets into blockchain-based tokens that can be traded, divided, and managed digitally. It’s like turning everything into tradeable game pieces.

Tokenization is the process of converting ownership rights to assets into digital tokens on a blockchain. This enables fractional ownership, easier trading, and programmable functionality for traditionally illiquid or indivisible assets.

How Tokenization Works

Asset representation creates digital tokens that correspond to ownership stakes in physical assets, intellectual property, or financial instruments.

Fractional ownership enables dividing expensive assets like real estate or artwork into smaller, more affordable investment units.

Smart contract automation can handle distributions, voting rights, and other asset management functions through programmable code.

Real-World Examples

- Real estate tokens representing ownership shares in commercial or residential properties

- Art tokenization enabling fractional ownership of expensive paintings or collectibles

- Company equity tokens that provide ownership stakes and voting rights in businesses

Why Beginners Should Care

Access expansion to investment opportunities previously available only to wealthy individuals or institutions through fractional ownership.

Liquidity improvement for traditionally illiquid assets that can now be traded 24/7 on global markets.

Regulatory complexity as tokenized assets often fall under securities regulations that vary by jurisdiction and asset type.

Related Terms: Security Token, Fractional Ownership, Asset Backing, Digital Securities