Paper Hands

Paper Hands: Quick to Sell, Quick to Regret

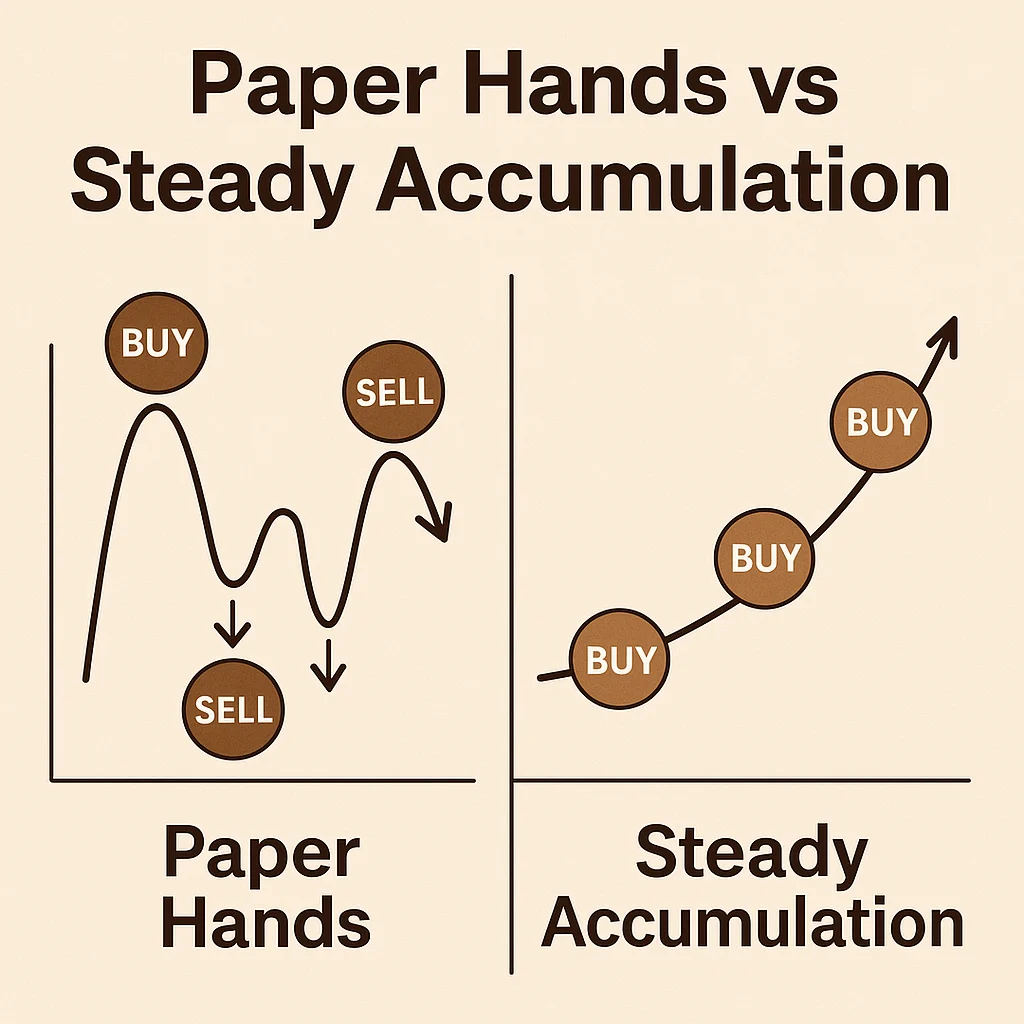

Paper hands describes investors who sell at the first sign of trouble or take profits too early. It’s crypto’s version of weak stomach syndrome.

Paper hands refers to investors who sell their cryptocurrency holdings quickly due to fear, panic, or impatience rather than holding through volatility. The term suggests hands too weak to grip investments during turbulent periods.

How Paper Hands Behavior Works

Loss aversion drives paper hands selling – the psychological pain of losing money feels worse than the pleasure of gaining equivalent amounts. First-time investors often sell during initial crashes.

FOMO and FUD cycles trigger paper hands behavior. Investors buy during euphoria (FOMO) then sell during fear campaigns (FUD), repeatedly buying high and selling low.

Lack of conviction in investment thesis makes it easy to abandon positions when prices move against expectations or negative news emerges.

Real-World Examples

- 2018 crypto crash saw many retail investors sell at losses, missing the 2020-2021 recovery

- COVID market crash triggered massive selling that reversed within months

- FTX collapse caused paper hands selling of quality assets due to contagion fears

Why Beginners Should Care

Paper hands behavior destroys wealth through poor timing decisions. Emotional reactions to volatility typically result in buying peaks and selling bottoms.

Education reduces paper hands tendencies. Understanding market cycles, volatility patterns, and fundamental analysis builds conviction needed for successful long-term investing.

Position sizing helps prevent paper hands by only investing amounts you can afford to lose completely, reducing emotional attachment to daily price movements.

Related Terms: Diamond Hands, FOMO, FUD, HODL