DeFi Insurance

DeFi Insurance: Protecting Against Smart Contract Risk

DeFi insurance provides coverage against smart contract failures, hacks, and protocol exploits. It’s like buying fire insurance for your digital assets in experimental financial protocols.

DeFi insurance offers protection against losses from smart contract bugs, hacks, oracle failures, and other technical risks in decentralized finance protocols. Users pay premiums to receive coverage for specific risks and amounts.

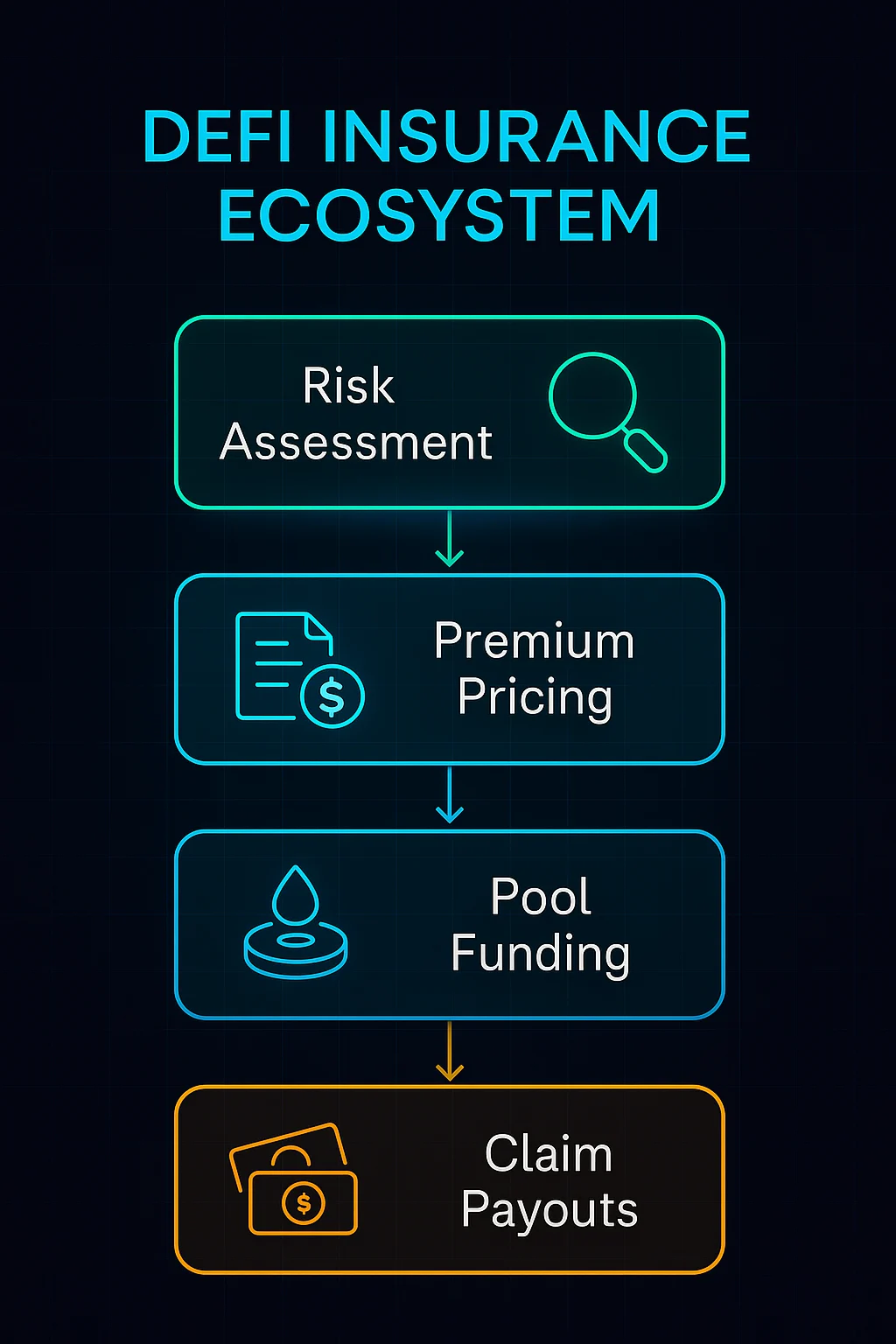

How DeFi Insurance Works

Risk assessment by insurance protocols evaluates smart contract security, team reputation, and historical performance to price coverage appropriately.

Premium payments fund insurance pools that pay out claims when covered events occur, with pricing based on perceived risk levels.

Claim verification often involves community governance or expert assessment to determine whether losses qualify for insurance payouts.

Real-World Examples

- Nexus Mutual provides community-driven smart contract insurance coverage

- Cover Protocol offers decentralized insurance markets for DeFi risks

- Unslashed Finance creates insurance pools for various crypto risks

Why Beginners Should Care

Risk mitigation for experimental DeFi protocols that may have undiscovered vulnerabilities or face sophisticated attacks.

Cost considerations as insurance premiums can be expensive, sometimes offsetting potential yield gains from high-risk protocols.

Coverage limitations since insurance typically doesn’t cover market risks, impermanent loss, or user errors – only technical failures.

Related Terms: Smart Contract Risk, Protocol Security, Risk Management, Premium