Whale

Whale: The Big Players Who Move Markets

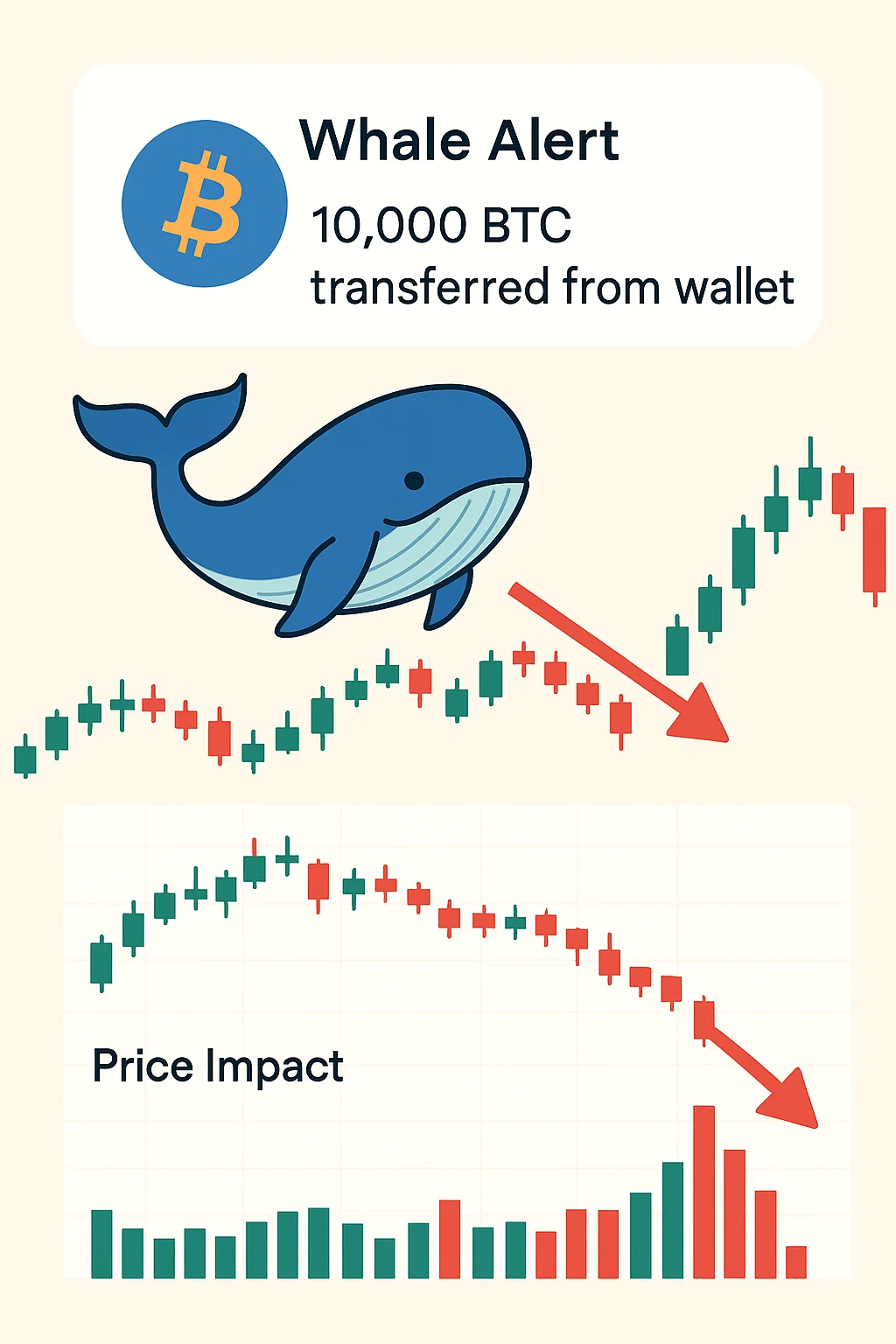

In crypto, whales are individuals or entities holding massive amounts of cryptocurrency. When whales move, markets tremble.

A whale is someone who holds enough cryptocurrency to significantly influence market prices through their trading decisions. For Bitcoin, this typically means holding 1,000+ BTC (worth $30+ million at current prices).

How Whales Impact Markets

Large trades by whales can cause dramatic price movements. A single whale selling 5,000 Bitcoin can crash the price by 10%+ in minutes, especially during low-liquidity periods.

Whale watching has become an industry. Blockchain analysis firms track large wallet movements and alert traders when whales start moving funds, often signaling major price changes.

Some whales coordinate their actions, creating unofficial cartels that can manipulate smaller cryptocurrency markets through coordinated buying or selling.

Real-World Examples

- Michael Saylor/MicroStrategy – Holds over 190,000 Bitcoin

- Ethereum Foundation – Large ETH holder that occasionally sells for funding

- Early adopters – Bitcoin addresses from 2009-2011 containing thousands of coins

Why Beginners Should Care

Understanding whale behavior helps explain seemingly random price movements. When Bitcoin suddenly drops 15% with no news, check if major whale wallets moved coins to exchanges.

Whale movements often precede major market shifts. Whales accumulating during bear markets or distributing during bull markets can signal trend changes before retail investors notice.

Follow whale alert services to get early warnings about potential market-moving events.

Related Terms: Market Cap, Liquidity, Pump and Dump, Market Manipulation