Bonding Curve

Bonding Curve: Algorithmic Token Pricing

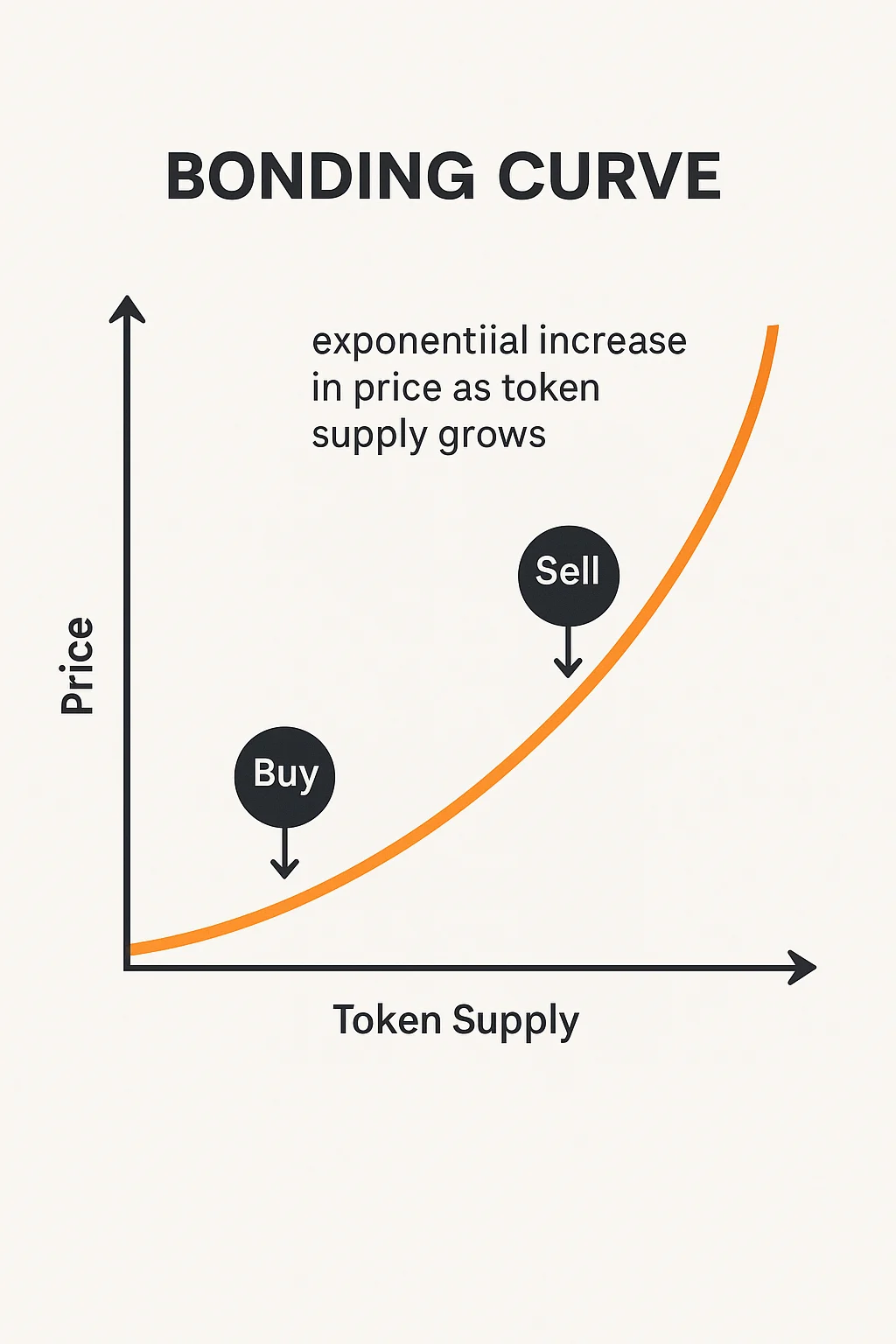

Bonding curves use mathematical formulas to automatically price tokens based on supply. As more tokens get bought, prices increase predictably according to the curve’s formula.

A bonding curve is an algorithmic pricing mechanism that determines token price based on token supply through a mathematical function. Prices increase as supply grows and decrease as supply shrinks, creating automatic market making without human intervention.

How Bonding Curves Work

Mathematical formulas like y = x² create predictable price relationships where each additional token costs more than the previous one, generating exponential price growth.

Continuous liquidity exists since the curve itself acts as a market maker, always willing to buy or sell tokens at the current curve price without requiring counterparties.

Price discovery happens algorithmically rather than through order book matching, ensuring tokens always have deterministic prices based on current supply levels.

Real-World Examples

- Bancor protocol pioneered bonding curve AMMs for continuous token liquidity

- Curation markets use bonding curves to price shares in content or prediction markets

- Social tokens often launch with bonding curves to bootstrap initial liquidity and price discovery

Why Beginners Should Care

Front-runner advantages exist since early buyers get lower prices while later buyers pay increasingly higher amounts, creating wealth concentration among early adopters.

No liquidity shortages occur with bonding curves since the algorithm always provides liquidity, eliminating concerns about market makers withdrawing support.

Price volatility can be extreme with steep bonding curves where small buy or sell orders create large price movements, especially at low supply levels.

Related Terms: AMM, Price Discovery, Algorithmic Trading, Token Launch