Decentralization

Decentralization: Power to the People

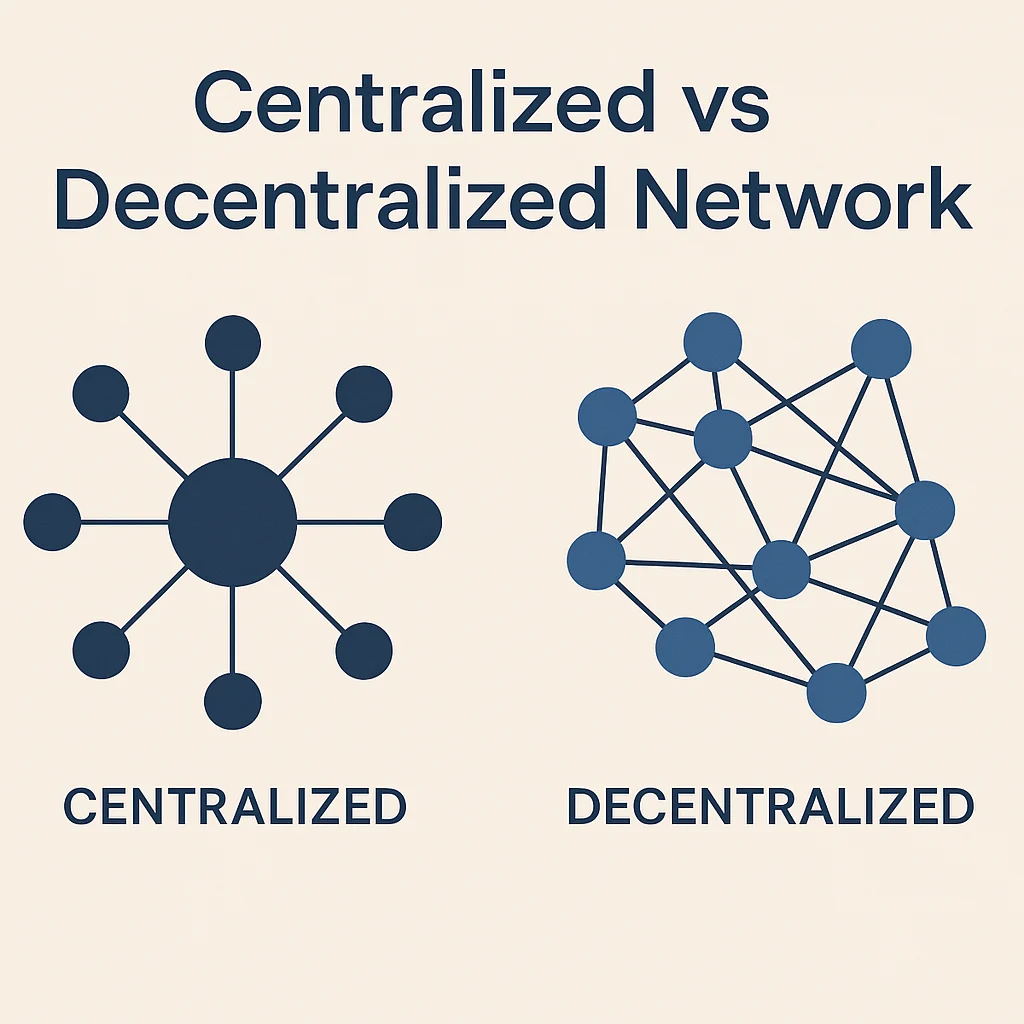

Decentralization distributes control away from single authorities across many independent participants. It’s the difference between having one king versus a thousand voters making decisions.

Decentralization refers to the distribution of power, control, and decision-making away from central authorities to a network of independent participants. In blockchain systems, this means no single entity controls the network, transactions, or governance decisions.

How Decentralization Works

Distributed control spreads network operations across thousands of independent nodes, miners, or validators who collectively maintain system integrity without central coordination.

Consensus mechanisms enable distributed networks to agree on valid transactions and network state without requiring trust in central authorities or intermediaries.

Resistance benefits make decentralized systems harder to shut down, censor, or manipulate since attackers would need to compromise many independent participants simultaneously.

Real-World Examples

- Bitcoin network operates through thousands of independent miners and nodes worldwide

- Ethereum validators secure the network through distributed proof-of-stake consensus

- Traditional internet vs decentralized protocols like IPFS for file storage

Why Beginners Should Care

Censorship resistance means decentralized networks can operate even when governments or corporations try to shut them down or restrict access.

Reduced single points of failure create more robust systems that continue operating even when some participants go offline or become unreliable.

Trade-off awareness as decentralization often means slower decision-making and coordination compared to centralized systems, but with greater resilience and fairness.

Related Terms: Consensus Mechanism, Node, Peer-to-Peer, Governance