Stable Yield

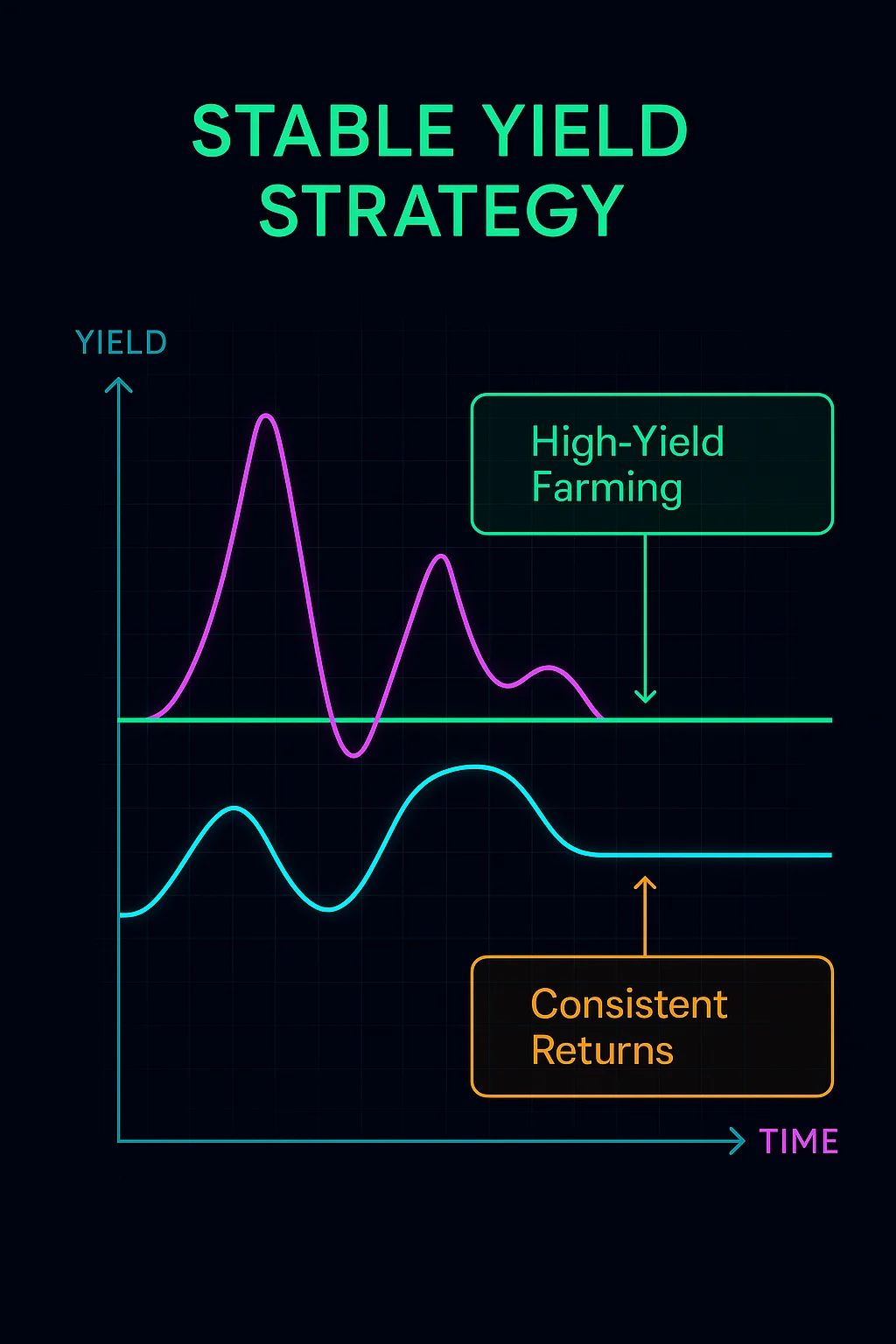

Stable Yield: Predictable DeFi Returns

Stable yield refers to DeFi strategies that provide consistent returns with lower volatility than traditional yield farming. It’s like finding the boring but reliable investment in a casino full of slot machines.

Stable yield strategies focus on generating consistent returns from DeFi protocols with lower risk and volatility than high-APY farming opportunities. These approaches prioritize capital preservation and predictable income over maximum yield extraction.

How Stable Yield Works

Stablecoin strategies use dollar-pegged assets to eliminate token price volatility while earning yield from lending, liquidity provision, or protocol rewards.

Blue-chip protocol focus concentrates on established, well-audited platforms with proven track records rather than experimental high-yield opportunities.

Risk management through diversification, position sizing, and avoiding leverage or complex strategies that could amplify losses.

Real-World Examples

- USDC lending on Aave or Compound for steady 3-5% returns without token price risk

- Curve stablecoin pools providing consistent yields from trading fees and CRV rewards

- Treasury bill protocols offering on-chain access to government bond yields

Why Beginners Should Care

Sustainable returns that don’t depend on unsustainable token emissions or speculative trading activity for yield generation.

Lower complexity compared to active yield farming strategies that require constant monitoring and position management.

Inflation hedge potential as stable yields often exceed traditional savings account rates while maintaining dollar exposure.

Related Terms: Yield Farming, Stablecoin, Risk Management, Capital Preservation