Liquidity

Liquidity: How Easily You Can Buy or Sell

Liquidity determines whether you can actually trade your crypto at fair prices. High liquidity means smooth trading. Low liquidity means getting rekt by slippage.

Liquidity refers to how easily an asset can be bought or sold without significantly affecting its price. In crypto markets, liquidity comes from active buyers and sellers providing depth to order books or automated market makers.

How Liquidity Works

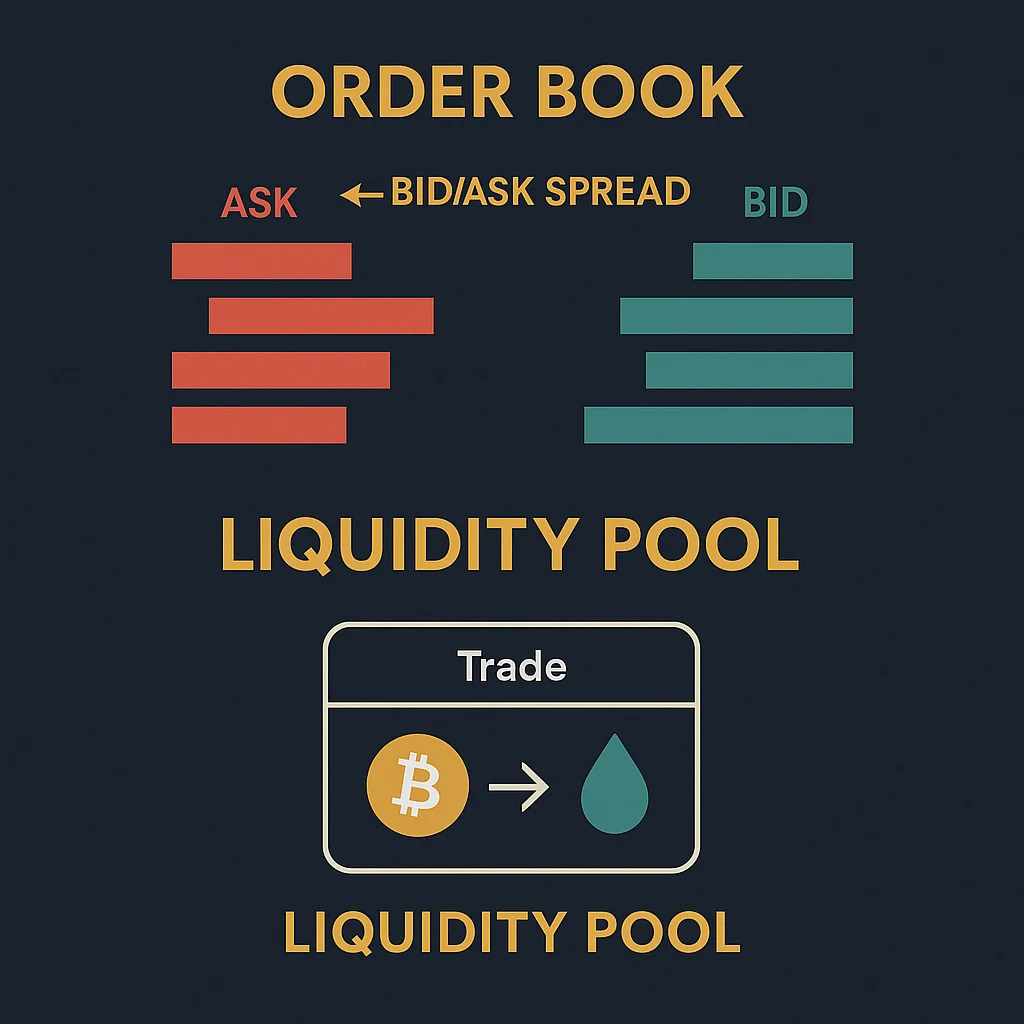

Order book depth shows how many buy and sell orders exist at different price levels. Deep order books allow large trades without major price impact.

Market makers provide liquidity by continuously offering to buy and sell at slightly different prices, earning the spread between bid and ask prices.

Liquidity pools in DeFi protocols replace traditional order books with algorithmic market making, allowing trades against pooled assets rather than specific counterparties.

Real-World Examples

- Bitcoin/USD pairs have deep liquidity on major exchanges with tight spreads

- Small altcoins often have wide spreads and high slippage on trades

- Uniswap pools provide 24/7 liquidity through automated market makers

Why Beginners Should Care

Poor liquidity means you can’t exit positions quickly without losing money to slippage. A 10% price move might cost you 15% if there’s insufficient liquidity to absorb your trade.

Check spreads before trading smaller coins. Wide bid-ask spreads indicate poor liquidity that will cost you money on every trade.

Major exchanges like Kraken typically offer better liquidity for popular trading pairs than smaller platforms.

Related Terms: Slippage, Market Maker, Order Book, Liquidity Pool