Market Cap

Market Cap: How to Value Crypto Projects

Market cap tells you how much the entire crypto market values a project. It’s the most important number for comparing different cryptocurrencies.

Market capitalization is the total value of all coins in circulation, calculated by multiplying the current price by the circulating supply. It shows the relative size and importance of different crypto projects.

How Market Cap Works

Simple formula: Current Price × Circulating Supply = Market Cap

A $1 coin with 1 billion circulating supply has the same market cap ($1 billion) as a $1,000 coin with 1 million circulating supply. Price per coin is meaningless without considering supply.

Fully Diluted Market Cap includes all tokens that will ever exist, including those not yet released. This gives a more complete picture of potential future value dilution.

Real-World Examples

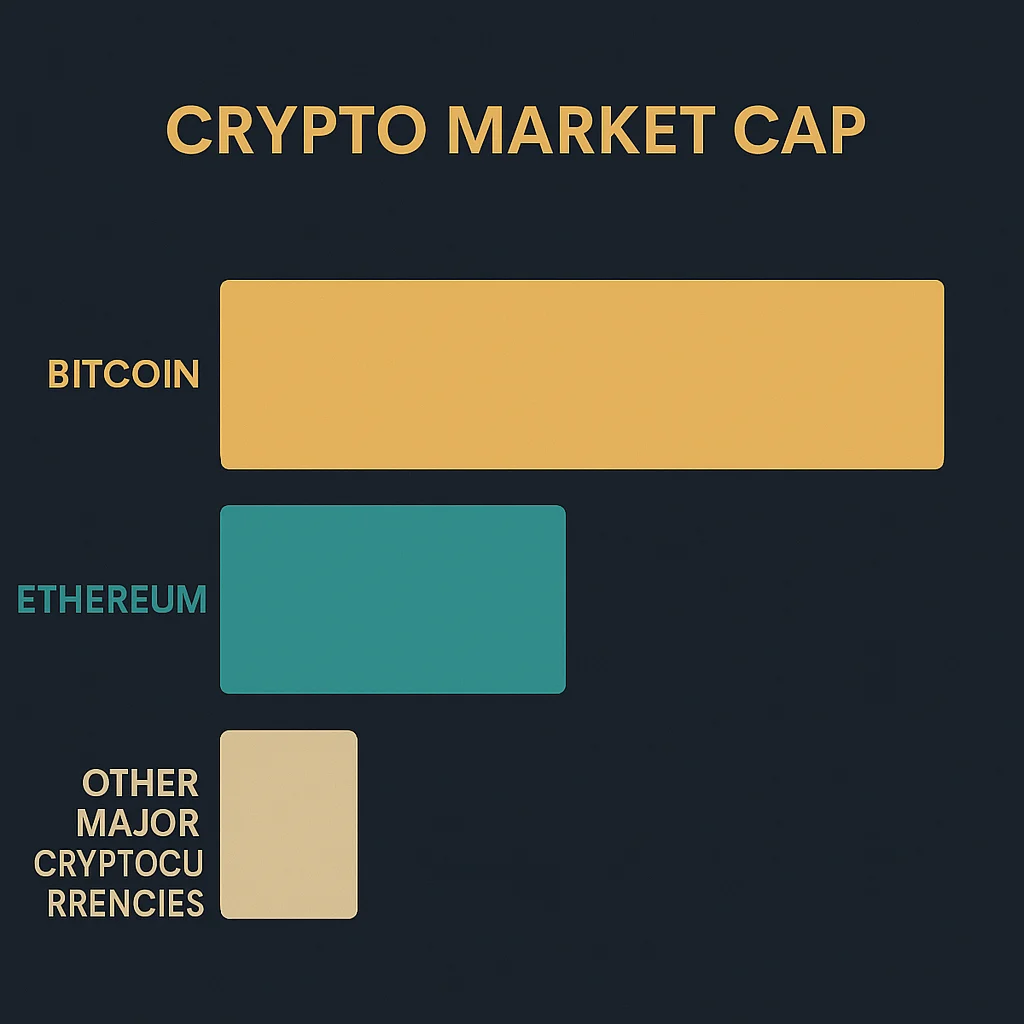

- Bitcoin – ~$600 billion market cap (19.7M BTC × ~$30K)

- Ethereum – ~$240 billion market cap (120M ETH × ~$2K)

- Shiba Inu – $6 billion market cap despite low price due to massive supply

Why Beginners Should Care

Market cap helps you understand realistic price potential. A coin with 100 billion tokens can’t reach $1,000+ per token without exceeding global GDP.

Compare similar projects by market cap, not price. Two DeFi tokens might have different prices, but market cap shows which the market values more highly.

Related Terms: Circulating Supply, Total Supply, Token Economics, Whale