Pump and Dump

Pump and Dump: Coordinated Market Manipulation

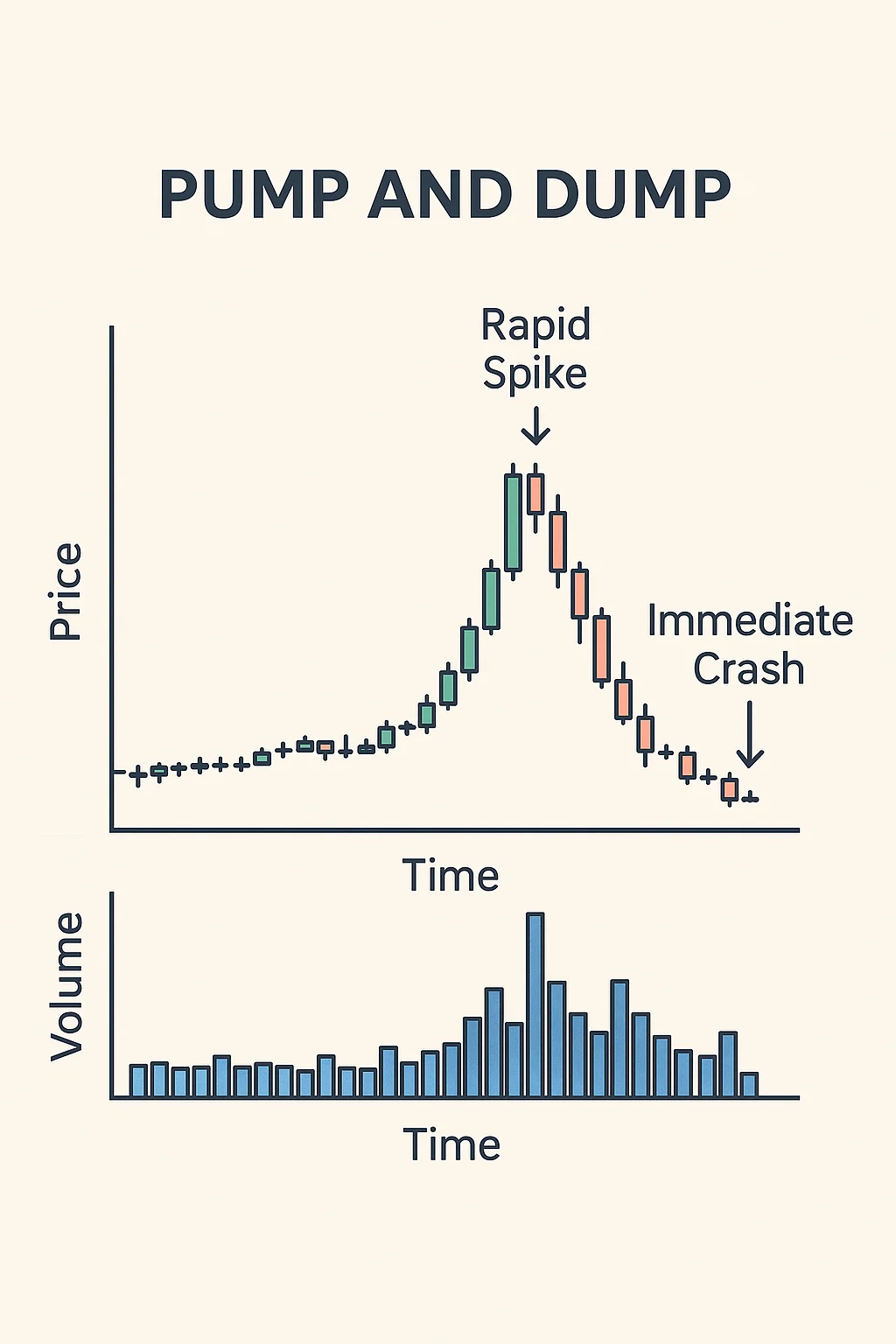

Pump and dump schemes are crypto’s version of old-school stock manipulation. Coordinated groups artificially inflate prices, then dump on unsuspecting victims.

A pump and dump is a form of market manipulation where a group artificially inflates an asset’s price through coordinated buying and false promotion, then sells at peak prices while others lose money. It’s illegal in traditional markets but common in unregulated crypto spaces.

How Pump and Dumps Work

Coordination happens through private Telegram groups, Discord servers, or social media. Organizers choose low-cap tokens that are easy to manipulate with relatively small amounts of capital.

The pump phase involves simultaneous buying to rapidly increase price while spreading hype through social media. FOMO kicks in as external buyers see the rapid price increase.

The dump phase sees coordinated selling by insiders while continuing to promote the token publicly. Late buyers are left holding worthless tokens as organizers cash out.

Real-World Examples

- Telegram pump groups targeting small-cap altcoins with coordinated buy signals

- Celebrity endorsements of meme coins followed by immediate selling

- Social media campaigns using bots to create artificial buzz around chosen tokens

Why Beginners Should Care

Pump and dumps prey on FOMO and inexperienced traders. If you see sudden 500%+ price increases with no fundamental news, it’s likely manipulation.

Red flags include anonymous teams, no real utility, sudden social media buzz, and promises of guaranteed returns. Legitimate projects build value gradually through development and adoption.

Never chase parabolic price movements or join groups promising coordinated buying. You’re more likely to be the exit liquidity than the profiteer.

Related Terms: FOMO, Market Manipulation, Whale, Rug Pull