REKT

REKT: When Trades Go Wrong

REKT is what happens when your confident trade turns into a financial disaster. It’s crypto slang for getting completely wrecked by bad investment decisions.

REKT is slang for “wrecked” – suffering severe financial losses from cryptocurrency trading or investing. It describes the aftermath of leveraged positions gone wrong, rug pulls, exchange collapses, or any situation where someone loses most or all of their crypto.

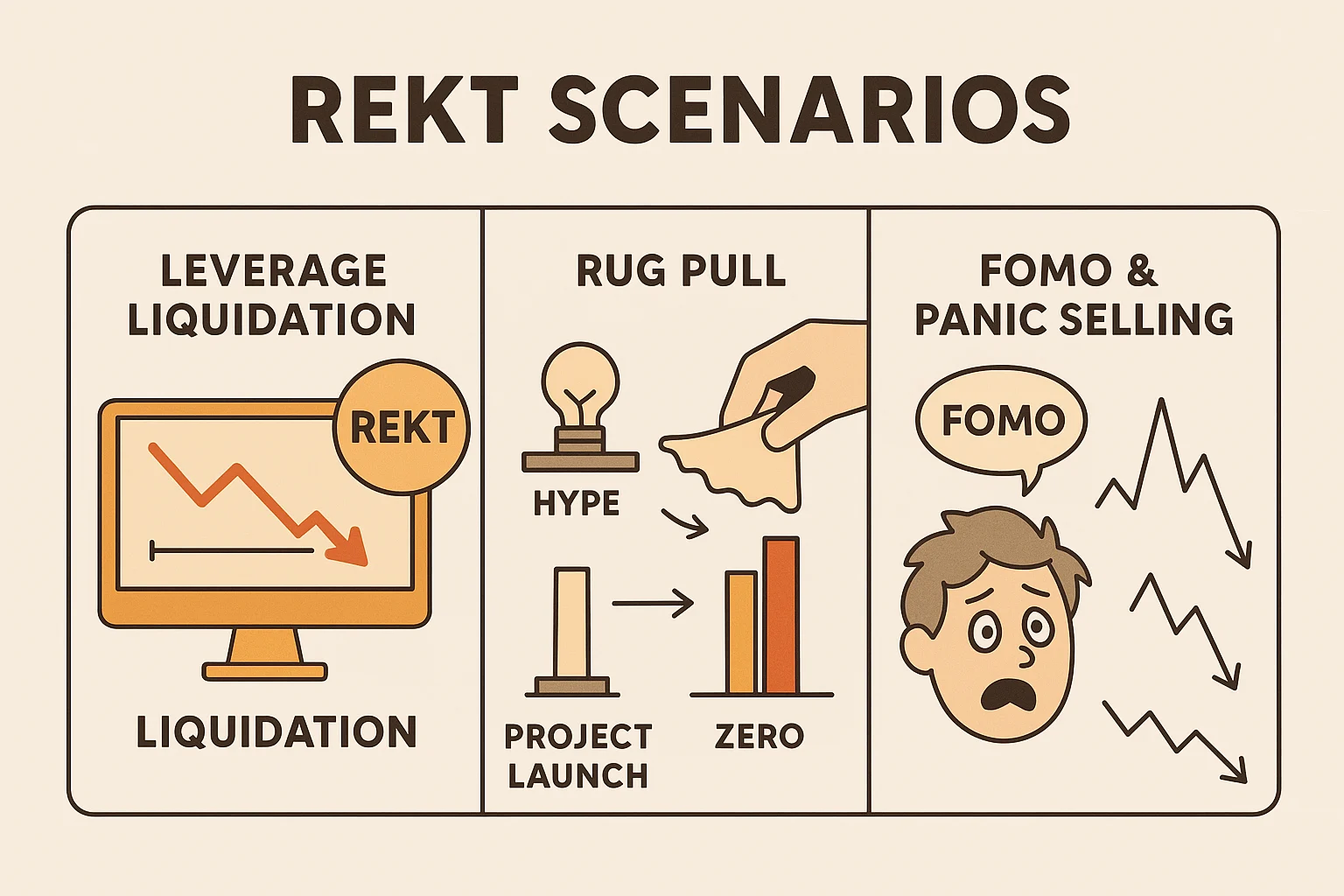

How People Get REKT

Leverage trading amplifies both gains and losses. A 10x leveraged position can liquidate your entire account with just a 10% price move in the wrong direction.

FOMO buying at market tops followed by panic selling at bottoms creates the classic “buy high, sell low” pattern that destroys retail wealth systematically.

Scam projects including rug pulls, fake DeFi protocols, and worthless tokens promoted by influencers can completely wipe out investments overnight.

Real-World Examples

- Terra Luna collapse – Investors lost 99.9% as LUNA went from $85 to essentially zero

- FTX bankruptcy – Users with funds on exchange lost billions when platform collapsed

- Leverage liquidations during flash crashes wipe out millions in minutes

Why Beginners Should Care

Getting REKT is educational but expensive. Learning from others’ mistakes costs less than experiencing them personally through poor risk management.

Position sizing prevents total REKT scenarios. Never invest more than you can afford to lose completely, especially in high-risk plays.

Emotional preparation for potential losses helps prevent panic decisions that turn temporary drawdowns into permanent REKT situations.

Related Terms: Liquidation, Leverage, Rug Pull, FOMO