Altcoin

Altcoin: Every Cryptocurrency That Isn’t Bitcoin

“Altcoin” literally means “alternative to Bitcoin.” Some are innovative improvements, others are marketing experiments, and many are outright scams.

An altcoin is any cryptocurrency other than Bitcoin. The term covers everything from Ethereum’s smart contract platform to obscure meme coins with dog themes.

How Altcoins Work

Each altcoin attempts to solve different problems or serve different markets. Some focus on faster transactions, others on privacy, smart contracts, or specific industries.

Most altcoins started by forking Bitcoin’s code and modifying it. Others built entirely new blockchain architectures from scratch.

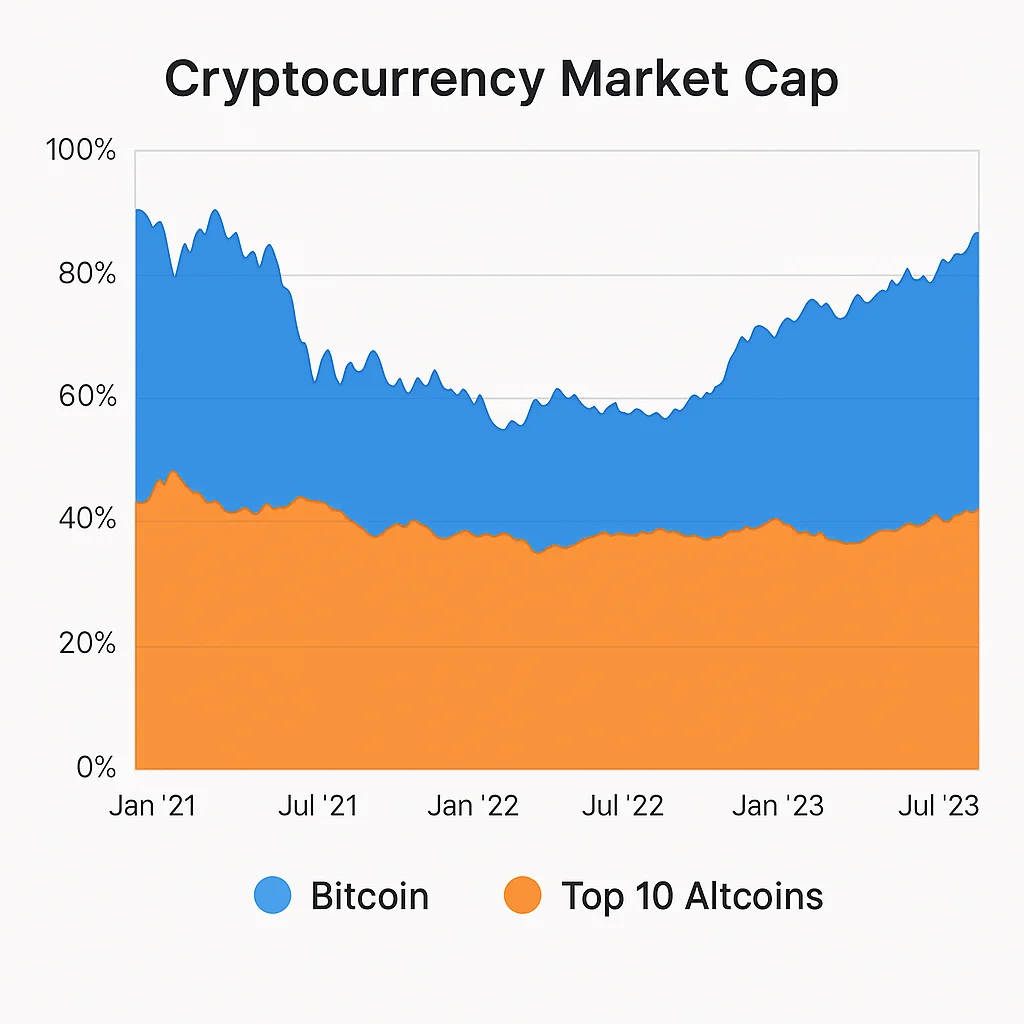

The altcoin market is highly speculative. While Bitcoin has proven staying power over 15 years, most altcoins from previous cycles have disappeared.

Real-World Examples

- Ethereum (ETH) – Smart contract platform powering DeFi and NFTs

- Litecoin (LTC) – “Silver to Bitcoin’s gold” with faster transactions

- Chainlink (LINK) – Connects blockchains to real-world data

Why Beginners Should Care

Altcoins offer opportunities for higher returns but carry significantly higher risks. Many promise revolutionary features but fail to deliver long-term value.

Smart investors typically start with Bitcoin to understand crypto fundamentals, then carefully research altcoins with real utility and strong development teams.

Related Terms: Bitcoin, Ethereum, Market Cap, Tokenomics