Cold Storage

Cold Storage: Maximum Security for Crypto Assets

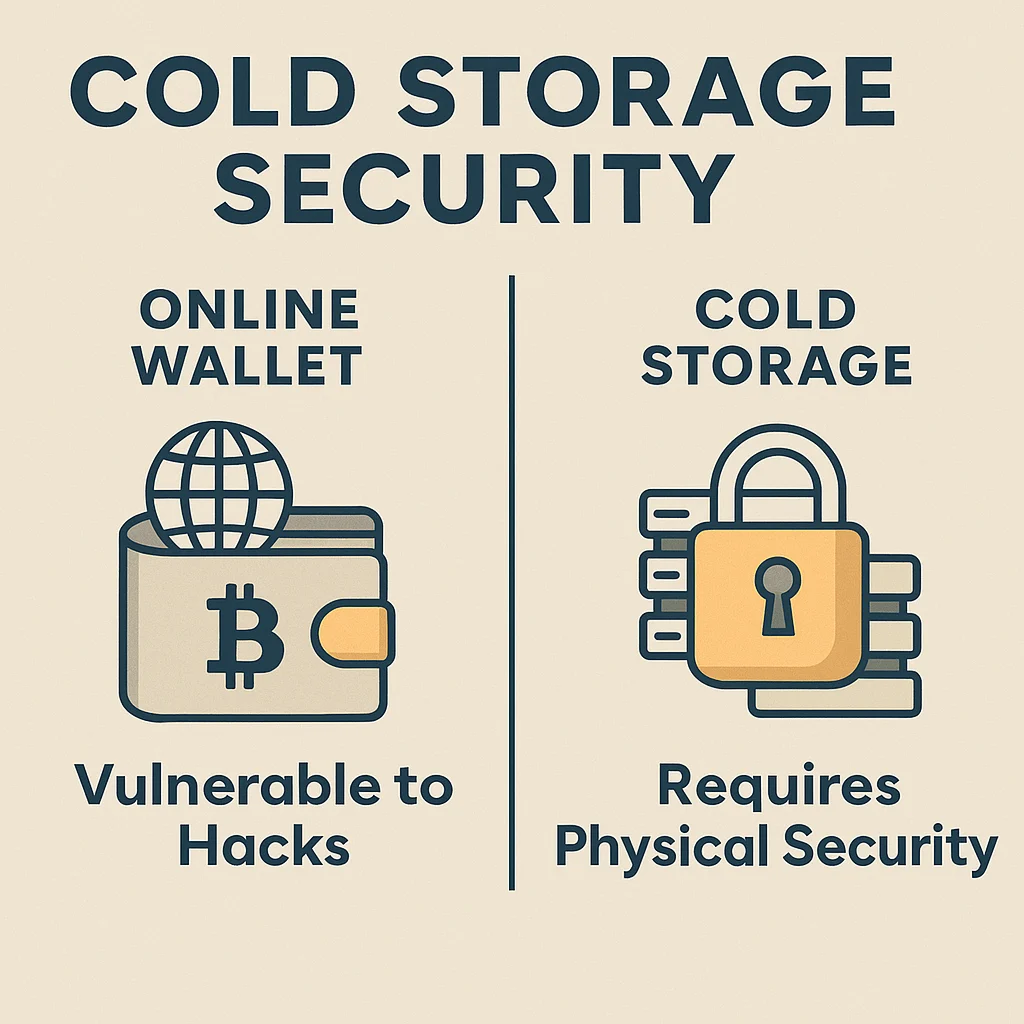

Cold storage keeps cryptocurrency private keys completely offline, away from any internet connection. It’s the digital equivalent of storing gold bars in a bank vault rather than your wallet.

Cold storage refers to keeping cryptocurrency private keys on devices or media that have never been connected to the internet. This creates an “air gap” that makes remote hacking impossible since attackers cannot access offline storage remotely.

How Cold Storage Works

Offline key generation creates private keys on devices that have never touched the internet, ensuring the keys cannot be intercepted during creation.

Physical security becomes paramount since attackers would need physical access to steal funds, shifting security from cybersecurity to traditional physical protection.

Transaction signing happens offline, with signed transactions transferred to online devices for broadcast without exposing private keys to internet-connected systems.

Real-World Examples

- Hardware wallets like Ledger and Trezor provide convenient cold storage for most users

- Paper wallets store private keys as printed QR codes or written text

- Steel backups engrave seed phrases on metal plates for fire and flood resistance

Why Beginners Should Care

Exchange hacks happen regularly, making cold storage essential for significant cryptocurrency holdings that you can’t afford to lose completely.

Insurance limitations mean most cold storage losses from user error or theft are not recoverable, making proper setup and backup procedures critical.

Convenience trade-offs exist since cold storage requires more steps for transactions compared to hot wallets, but security benefits usually justify the inconvenience.

Related Terms: Hardware Wallet, Hot Wallet, Private Key, Seed Phrase