Total Value Locked (TVL)

Total Value Locked (TVL): DeFi’s Scorecard

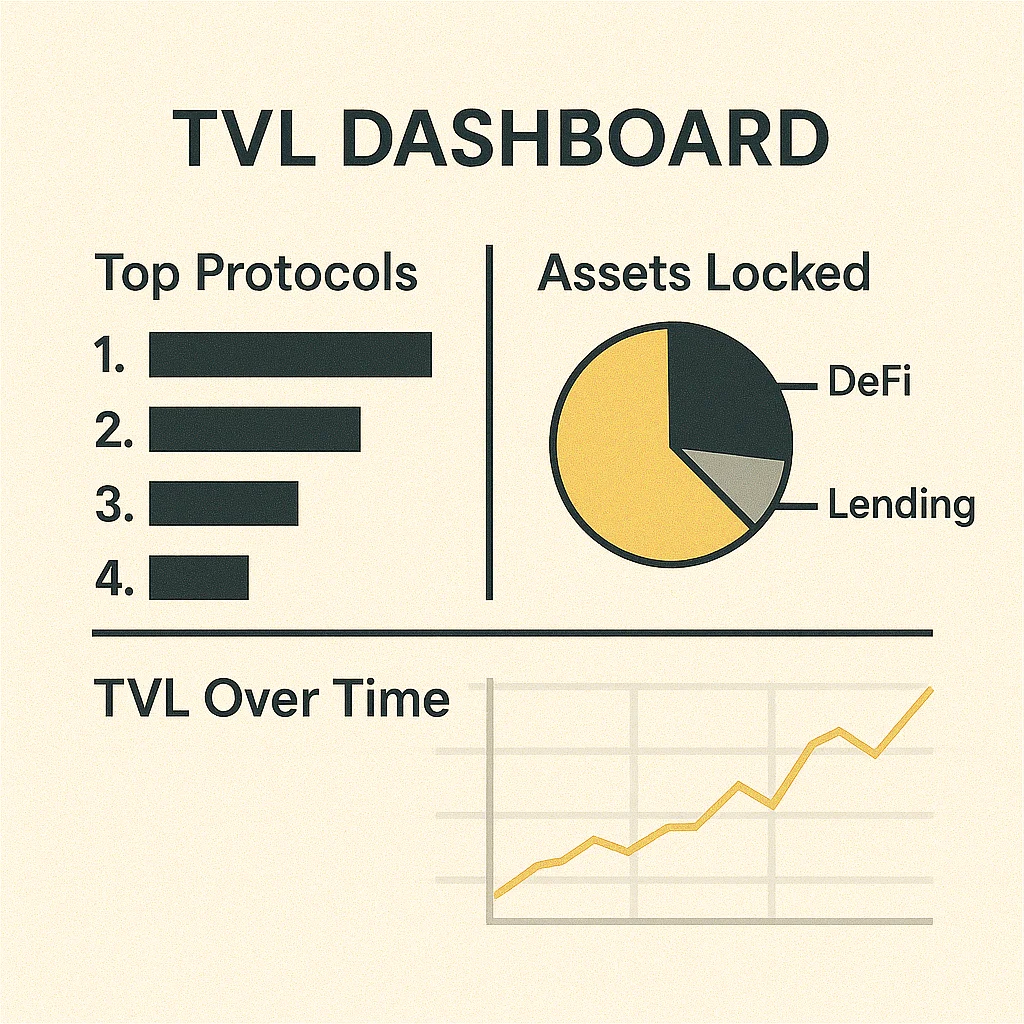

TVL measures how much money is deposited in DeFi protocols. It’s like measuring the size of a bank by its total deposits – bigger usually means more trust and activity.

Total Value Locked (TVL) is the aggregate value of all assets deposited in a DeFi protocol or across the entire DeFi ecosystem. It represents how much capital users have entrusted to smart contracts for lending, trading, or yield farming.

How TVL Works

Asset valuation uses current market prices to calculate the dollar value of all deposited tokens. A protocol holding 1000 ETH at $2000 per ETH has $2 million TVL.

Double counting can inflate numbers when protocols build on each other. If Protocol A deposits funds into Protocol B, both might count the same assets toward their TVL.

TVL growth indicates increasing user confidence and adoption. Protocols with growing TVL typically offer competitive yields or innovative features attracting more deposits.

Real-World Examples

- Aave – Leading lending protocol with $10+ billion TVL across multiple chains

- Uniswap – Largest DEX with $4+ billion in liquidity pools

- Total DeFi TVL peaked at $180+ billion in 2021, currently around $50 billion

Why Beginners Should Care

TVL indicates protocol maturity and user trust. Protocols with higher TVL have more battle-tested smart contracts and established user bases.

Yield dilution often accompanies TVL growth. Early adopters earn higher yields that decrease as more users deposit funds and compete for the same rewards.

TVL crashes during bear markets or protocol exploits can signal fundamental problems or broader market stress affecting the entire DeFi ecosystem.

Related Terms: DeFi, Liquidity Pool, Yield Farming, Smart Contract